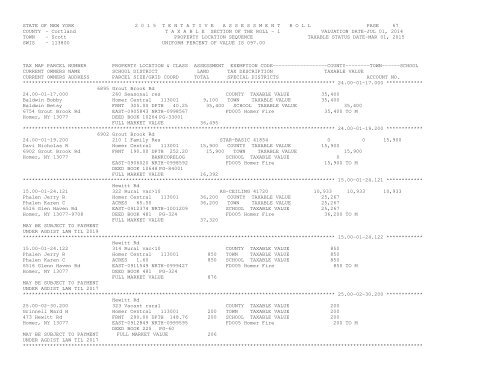

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 67COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 24.00-01-17.000 ************6895 Grout Brook Rd24.00-01-17.000 260 Seasonal res COUNTY TAXABLE VALUE 35,400Baldwin Bobby Homer Central 113001 9,100 TOWN TAXABLE VALUE 35,400Baldwin Betsy FRNT 305.00 DPTH 40.25 35,400 SCHOOL TAXABLE VALUE 35,4006754 Grout Brook Rd EAST-0905843 NRTH-0998567 FD005 Homer Fire 35,400 TO MHomer, NY 13077 DEED BOOK 10264 PG-33001FULL MARKET VALUE 36,495******************************************************************************************************* 24.00-01-19.200 ************6902 Grout Brook Rd24.00-01-19.200 210 1 Family Res STAR-BASIC 41854 0 0 15,900Davi Nicholas R Homer Central 113001 15,900 COUNTY TAXABLE VALUE 15,9006902 Grout Brook Rd FRNT 190.00 DPTH 252.20 15,900 TOWN TAXABLE VALUE 15,900Homer, NY 13077 BANKCORELOG SCHOOL TAXABLE VALUE 0EAST-0906020 NRTH-0998592 FD005 Homer Fire 15,900 TO MDEED BOOK 10648 PG-84001FULL MARKET VALUE 16,392******************************************************************************************************* 15.00-01-24.121 ************Hewitt Rd15.00-01-24.121 322 Rural vac>10 AG-CEILING 41720 10,933 10,933 10,933Phalen Jerry R Homer Central 113001 36,200 COUNTY TAXABLE VALUE 25,267Phalen Karen C ACRES 65.50 36,200 TOWN TAXABLE VALUE 25,2676516 Glen Haven Rd EAST-0912374 NRTH-1001209 SCHOOL TAXABLE VALUE 25,267Homer, NY 13077-9708 DEED BOOK 481 PG-324 FD005 Homer Fire 36,200 TO MFULL MARKET VALUE 37,320MAY BE SUBJECT TO PAYMENTUNDER AGDIST LAW TIL 2019******************************************************************************************************* 15.00-01-24.122 ************Hewitt Rd15.00-01-24.122 314 Rural vac

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 68COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 25.01-01-09.000 ************455 Hewitt Rd25.01-01-09.000 210 1 Family Res STAR - SR 41834 0 0 65,300St Peter Betty K (LU) Homer Central 113001 19,100 COUNTY TAXABLE VALUE 66,700St Peter Linda ACRES 1.10 66,700 TOWN TAXABLE VALUE 66,700455 Hewitt Rd EAST-0911270 NRTH-0999401 SCHOOL TAXABLE VALUE 1,400Homer, NY 13077-9722 DEED BOOK 2012 PG-5494 FD005 Homer Fire 66,700 TO MFULL MARKET VALUE 68,763******************************************************************************************************* 25.01-01-11.000 ************456 Hewitt Rd25.01-01-11.000 210 1 Family Res AGED C 41802 25,350 0 0Lee Elizabeth M Homer Central 113001 9,200 AGED T&S 41806 0 12,675 12,675456 Hewitt Rd FRNT 104.00 DPTH 142.50 50,700 STAR - SR 41834 0 0 38,025Homer, NY 13077-9722 ACRES 0.31 COUNTY TAXABLE VALUE 25,350EAST-0911259 NRTH-0999167 TOWN TAXABLE VALUE 38,025DEED BOOK 1999 PG-4825 SCHOOL TAXABLE VALUE 0FULL MARKET VALUE 52,268 FD005 Homer Fire 50,700 TO M******************************************************************************************************* 25.01-01-14.100 ************460 Hewitt Rd25.01-01-14.100 270 Mfg housing STAR-BASIC 41854 0 0 30,000Weeks Raymond E Homer Central 113001 21,000 COUNTY TAXABLE VALUE 43,300460 Hewitt Rd ACRES 2.24 BANK WELLS 43,300 TOWN TAXABLE VALUE 43,300Homer, NY 13077-9722 EAST-0911368 NRTH-0999022 SCHOOL TAXABLE VALUE 13,300DEED BOOK 1997 PG-4238 FD005 Homer Fire 43,300 TO MFULL MARKET VALUE 44,639******************************************************************************************************* 25.01-01-14.200 ************468 Hewitt Rd25.01-01-14.200 210 1 Family Res VET WAR CT 41121 6,000 6,000 0Connell Mark Homer Central 113001 20,000 STAR-BASIC 41854 0 0 30,000Ernhout Karen ACRES 1.64 BANKCORELOG 82,400 COUNTY TAXABLE VALUE 76,400468 Hewitt Rd EAST-0911560 NRTH-0999027 TOWN TAXABLE VALUE 76,400Homer, NY 13077-9722 DEED BOOK 2002 PG-6670 SCHOOL TAXABLE VALUE 52,400FULL MARKET VALUE 84,948 FD005 Homer Fire 82,400 TO M******************************************************************************************************* 25.00-02-29.000 ************472 Hewitt Rd 54 PCT OF VALUE USED FOR EXEMPTION PURPOSES25.00-02-29.000 240 Rural res AGED C 41802 30,294 0 0Wilson Vivien Homer Central 113001 69,700 AGED T&S 41806 0 18,176 18,176472 Hewitt Rd ACRES 79.70 BANKCORELOG 112,200 STAR - SR 41834 0 0 65,300Homer, NY 13077-9722 EAST-0912651 NRTH-0998978 COUNTY TAXABLE VALUE 81,906DEED BOOK 2009 PG-2204 TOWN TAXABLE VALUE 94,024FULL MARKET VALUE 115,670 SCHOOL TAXABLE VALUE 28,724FD005 Homer Fire 112,200 TO M************************************************************************************************************************************