Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

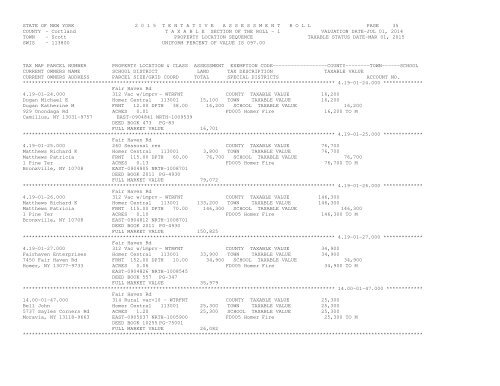

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 35COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 4.19-01-24.000 *************Fair Haven Rd4.19-01-24.000 312 Vac w/imprv - WTRFNT COUNTY TAXABLE VALUE 16,200Dugan Michael E Homer Central 113001 15,100 TOWN TAXABLE VALUE 16,200Dugan Katherine M FRNT 12.00 DPTH 38.00 16,200 SCHOOL TAXABLE VALUE 16,200929 Onondaga Rd ACRES 0.01 FD005 Homer Fire 16,200 TO MCamillus, NY 13031-9757 EAST-0904841 NRTH-1009539DEED BOOK 473 PG-83FULL MARKET VALUE 16,701******************************************************************************************************* 4.19-01-25.000 *************Fair Haven Rd4.19-01-25.000 260 Seasonal res COUNTY TAXABLE VALUE 76,700Matthews Richard K Homer Central 113001 3,800 TOWN TAXABLE VALUE 76,700Matthews Patricia FRNT 115.00 DPTH 60.00 76,700 SCHOOL TAXABLE VALUE 76,7001 Pine Ter ACRES 0.13 FD005 Homer Fire 76,700 TO MBronxville, NY 10708 EAST-0904905 NRTH-1008701DEED BOOK 2011 PG-4930FULL MARKET VALUE 79,072******************************************************************************************************* 4.19-01-26.000 *************Fair Haven Rd4.19-01-26.000 312 Vac w/imprv - WTRFNT COUNTY TAXABLE VALUE 146,300Matthews Richard K Homer Central 113001 133,200 TOWN TAXABLE VALUE 146,300Matthews Patricia FRNT 115.00 DPTH 70.00 146,300 SCHOOL TAXABLE VALUE 146,3001 Pine Ter ACRES 0.10 FD005 Homer Fire 146,300 TO MBronxville, NY 10708 EAST-0904812 NRTH-1008701DEED BOOK 2011 PG-4930FULL MARKET VALUE 150,825******************************************************************************************************* 4.19-01-27.000 *************Fair Haven Rd4.19-01-27.000 312 Vac w/imprv - WTRFNT COUNTY TAXABLE VALUE 34,900Fairhaven Enterprises Homer Central 113001 33,900 TOWN TAXABLE VALUE 34,9007450 Fair Haven Rd FRNT 152.00 DPTH 10.00 34,900 SCHOOL TAXABLE VALUE 34,900Homer, NY 13077-9733 ACRES 0.06 FD005 Homer Fire 34,900 TO MEAST-0904826 NRTH-1008545DEED BOOK 557 PG-347FULL MARKET VALUE 35,979******************************************************************************************************* 14.00-01-47.000 ************Fair Haven Rd14.00-01-47.000 314 Rural vac