Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

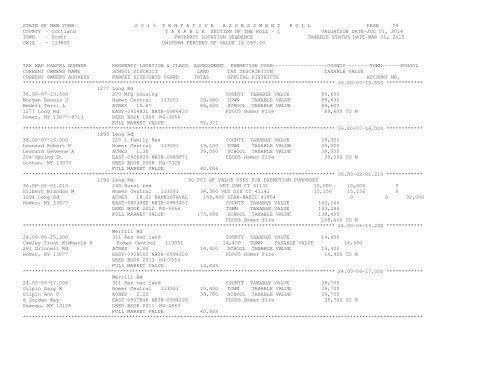

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 79COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 36.00-07-13.000 ************1277 Long Rd36.00-07-13.000 270 Mfg housing COUNTY TAXABLE VALUE 89,600Morgan Dennis J Homer Central 113001 29,600 TOWN TAXABLE VALUE 89,600Bedell Terri L ACRES 10.87 89,600 SCHOOL TAXABLE VALUE 89,6001277 Long Rd EAST-0924831 NRTH-0986433 FD005 Homer Fire 89,600 TO MHomer, NY 13077-9713 DEED BOOK 1999 PG-3856FULL MARKET VALUE 92,371******************************************************************************************************* 36.00-07-16.000 ************1293 Long Rd36.00-07-16.000 210 1 Family Res COUNTY TAXABLE VALUE 39,000Leonard Robert P Homer Central 113001 19,100 TOWN TAXABLE VALUE 39,000Leonard Geneene A ACRES 1.30 39,000 SCHOOL TAXABLE VALUE 39,000204 Spring St EAST-0925939 NRTH-0985871 FD005 Homer Fire 39,000 TO MGroton, NY 13073 DEED BOOK 2008 PG-7325FULL MARKET VALUE 40,206******************************************************************************************************* 36.00-02-01.210 ************1294 Long Rd 90 PCT OF VALUE USED FOR EXEMPTION PURPOSES36.00-02-01.210 240 Rural res VET COM CT 41131 10,000 10,000 0Gilbert Brandon M Homer Central 113001 34,300 VET DIS CT 41141 15,156 15,156 01294 Long Rd ACRES 18.01 BANK1STAVAL 168,400 STAR-BASIC 41854 0 0 30,000Homer, NY 13077 EAST-0924982 NRTH-0985451 COUNTY TAXABLE VALUE 143,244DEED BOOK 2012 PG-5464 TOWN TAXABLE VALUE 143,244FULL MARKET VALUE 173,608 SCHOOL TAXABLE VALUE 138,400FD005 Homer Fire 168,400 TO M******************************************************************************************************* 24.00-06-15.200 ************Merrill Rd24.00-06-15.200 311 Res vac land COUNTY TAXABLE VALUE 14,400Cawley Trust Kimberly H Homer Central 113001 14,400 TOWN TAXABLE VALUE 14,400281 Grinnell Rd ACRES 6.00 14,400 SCHOOL TAXABLE VALUE 14,400Homer, NY 13077 EAST-0908102 NRTH-0994220 FD005 Homer Fire 14,400 TO MDEED BOOK 2013 PG-7554FULL MARKET VALUE 14,845******************************************************************************************************* 24.00-06-17.000 ************Merrill Rd24.00-06-17.000 311 Res vac land COUNTY TAXABLE VALUE 39,700Gilpin Gary W Homer Central 113001 19,400 TOWN TAXABLE VALUE 39,700Gilpin Ann C ACRES 2.22 39,700 SCHOOL TAXABLE VALUE 39,7006 Jordan Way EAST-0907848 NRTH-0994293 FD005 Homer Fire 39,700 TO MOswego, NY 13126 DEED BOOK 2011 PG-4863FULL MARKET VALUE 40,928************************************************************************************************************************************