You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

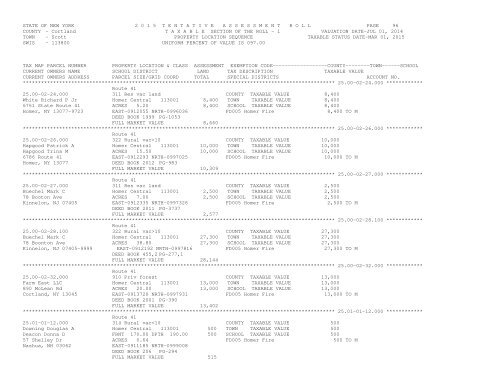

STATE OF NEW YORK 2 0 1 5 T E N T A T I V E A S S E S S M E N T R O L L PAGE 96COUNTY - <strong>Cortland</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2014TOWN - <strong>Scott</strong> PROPERTY LOCATION SEQUENCE TAXABLE STATUS DATE-MAR 01, 2015SWIS - 113800 UNIFORM PERCENT OF VALUE IS 097.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 25.00-02-24.000 ************Route 4125.00-02-24.000 311 Res vac land COUNTY TAXABLE VALUE 8,400White Richard P Jr Homer Central 113001 8,400 TOWN TAXABLE VALUE 8,4006761 State Route 41 ACRES 5.20 8,400 SCHOOL TAXABLE VALUE 8,400Homer, NY 13077-9723 EAST-0912055 NRTH-0996036 FD005 Homer Fire 8,400 TO MDEED BOOK 1999 PG-1053FULL MARKET VALUE 8,660******************************************************************************************************* 25.00-02-26.000 ************Route 4125.00-02-26.000 322 Rural vac>10 COUNTY TAXABLE VALUE 10,000Hapgood Patrick A Homer Central 113001 10,000 TOWN TAXABLE VALUE 10,000Hapgood Trina M ACRES 15.50 10,000 SCHOOL TAXABLE VALUE 10,0006786 Route 41 EAST-0912293 NRTH-0997025 FD005 Homer Fire 10,000 TO MHomer, NY 13077 DEED BOOK 2012 PG-983FULL MARKET VALUE 10,309******************************************************************************************************* 25.00-02-27.000 ************Route 4125.00-02-27.000 311 Res vac land COUNTY TAXABLE VALUE 2,500Buechel Mark C Homer Central 113001 2,500 TOWN TAXABLE VALUE 2,50078 Booton Ave ACRES 7.00 2,500 SCHOOL TAXABLE VALUE 2,500Kinnelon, NJ 07405 EAST-0912335 NRTH-0997326 FD005 Homer Fire 2,500 TO MDEED BOOK 2011 PG-3737FULL MARKET VALUE 2,577******************************************************************************************************* 25.00-02-28.100 ************Route 4125.00-02-28.100 322 Rural vac>10 COUNTY TAXABLE VALUE 27,300Buechel Mark C Homer Central 113001 27,300 TOWN TAXABLE VALUE 27,30078 Boonton Ave ACRES 38.80 27,300 SCHOOL TAXABLE VALUE 27,300Kinnelon, NJ 07405-9999 EAST-0912192 NRTH-0997816 FD005 Homer Fire 27,300 TO MDEED BOOK 455,2 PG-277,1FULL MARKET VALUE 28,144******************************************************************************************************* 25.00-02-32.000 ************Route 4125.00-02-32.000 910 Priv forest COUNTY TAXABLE VALUE 13,000Farm East LLC Homer Central 113001 13,000 TOWN TAXABLE VALUE 13,000890 McLean Rd ACRES 20.00 13,000 SCHOOL TAXABLE VALUE 13,000<strong>Cortland</strong>, NY 13045 EAST-0913720 NRTH-0997931 FD005 Homer Fire 13,000 TO MDEED BOOK 2001 PG-390FULL MARKET VALUE 13,402******************************************************************************************************* 25.01-01-12.000 ************Route 4125.01-01-12.000 314 Rural vac