March - CI Investments

March - CI Investments

March - CI Investments

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

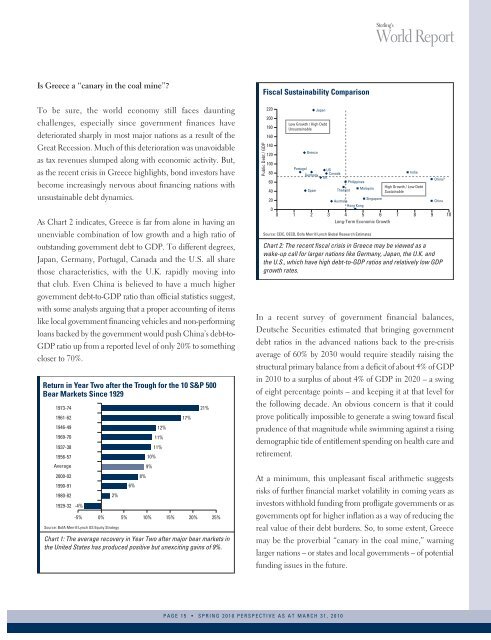

Sterling’sWorld ReportIs Greece a “canary in the coal mine”?To be sure, the world economy still faces dauntingchallenges, especially since government finances havedeteriorated sharply in most major nations as a result of theGreat Recession. Much of this deterioration was unavoidableas tax revenues slumped along with economic activity. But,as the recent crisis in Greece highlights, bond investors havebecome increasingly nervous about financing nations withunsustainable debt dynamics.As Chart 2 indicates, Greece is far from alone in having anunenviable combination of low growth and a high ratio ofoutstanding government debt to GDP. To different degrees,Japan, Germany, Portugal, Canada and the U.S. all sharethose characteristics, with the U.K. rapidly moving intothat club. Even China is believed to have a much highergovernment debt-to-GDP ratio than official statistics suggest,with some analysts arguing that a proper accounting of itemslike local government financing vehicles and non-performingloans backed by the government would push China’s debt-to-GDP ratio up from a reported level of only 20% to somethingcloser to 70%.Return in Year Two after the Trough for the 10 S&P 500Bear Markets Since 19291973-741961-621946-491969-701937-381956-57Average2000-021990-911980-821929-32 -4%2%Source: BofA Merrill Lynch US Equity Strategy6%8%10%9%12%11%11%17%21%-5% 0% 5% 10% 15% 20% 25%Chart 1: The average recovery in Year Two after major bear markets inthe United States has produced positive but unexciting gains of 9%.Public Debt / GDPFiscal Sustainability Comparison220Japan200180Low Growth / High DebtUnsustainable160140120Greece100PortugalUS80Germany CanadaIndiaUKChina?60Philippines40SpainThailandMalaysia High Growth / Low DebtSustainable20AustraliaHong KongSingaporeChina00 1 2 3 4 5 6 7 8 9 10Long-Term Economic GrowthSource: CEIC, OECD, Bofa Merrill Lynch Global Research EstimatesChart 2: The recent fiscal crisis in Greece may be viewed as awake-up call for larger nations like Germany, Japan, the U.K. andthe U.S., which have high debt-to-GDP ratios and relatively low GDPgrowth rates.In a recent survey of government financial balances,Deutsche Securities estimated that bringing governmentdebt ratios in the advanced nations back to the pre-crisisaverage of 60% by 2030 would require steadily raising thestructural primary balance from a deficit of about 4% of GDPin 2010 to a surplus of about 4% of GDP in 2020 – a swingof eight percentage points – and keeping it at that level forthe following decade. An obvious concern is that it couldprove politically impossible to generate a swing toward fiscalprudence of that magnitude while swimming against a risingdemographic tide of entitlement spending on health care andretirement.At a minimum, this unpleasant fiscal arithmetic suggestsrisks of further financial market volatility in coming years asinvestors withhold funding from profligate governments or asgovernments opt for higher inflation as a way of reducing thereal value of their debt burdens. So, to some extent, Greecemay be the proverbial “canary in the coal mine,” warninglarger nations – or states and local governments – of potentialfunding issues in the future.PAGE 15 • SPRING 2010 PERSPECTIVE AS AT MARCH 31, 2010