March - CI Investments

March - CI Investments

March - CI Investments

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

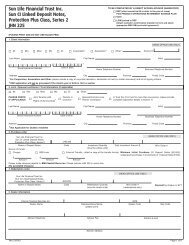

Fund Factsas at <strong>March</strong> 31, 2010Fund CodesISCDSCLSCClass A<strong>CI</strong>G2602<strong>CI</strong>G3602<strong>CI</strong>G1602Portfolio Series Growth FundAlso available: Class F, I & TManaged Solutions(Class A)Managed By: <strong>CI</strong> <strong>Investments</strong> Inc.Advisors: <strong>CI</strong> Investment ConsultingAssets Under Management: $496.0 millionPortfolio Manager: Multi−managerAsset Class: Asset AllocationInception Date: December 2001NAV: $11.14Min. Initial Investment: $500Subsequent Purchase(s): $50Min. PAC Investment: $50Management Expense Ratio: 2.35%Top Holdingsas at <strong>March</strong> 31, 2010<strong>CI</strong> Canadian Investment Corp Class 11.39%<strong>CI</strong> International Value Corp Class 10.37%<strong>CI</strong> Signature Select Cdn Corp Cl 10.03%<strong>CI</strong> Signature Canadian Bond 9.85%<strong>CI</strong> International Corporate Class 7.41%<strong>CI</strong> Harbour Corporate Class 6.11%<strong>CI</strong> Signature High Income 6.11%<strong>CI</strong> American Value Corporate Class 5.57%<strong>CI</strong> Synergy Canadian Corporate Class 5.25%<strong>CI</strong> Canadian Small/Mid Cap 4.67%Total 76.76%OBJECTIVEThis portfolio’s objective is to provide long−term capital growth by investing directly in other mutual funds managed by <strong>CI</strong>. Any change tothe investment objective must be approved by a majority of votes cast at a meeting of unitholders held for that reason.Compound Returns and Quartile Rankings (as at <strong>March</strong> 31, 2010)This table shows the historical annual compound total return of the fund compared with the Globefund Group Average and Globefund’sbenchmark Blend: 60% MS<strong>CI</strong> World, 40% Barclays Cap. The returns listed below are percentages.YTD 1Mo 3Mo 1Yr 3Yr 5Yr 10YrSinceInception*Qrtl 2 2 2 2 3 3 {N/A} {N/A}Return 1.55 2.58 1.55 24.82 −4.65 1.49 {N/A} 2.24Grp Avg 1.42 2.32 1.42 26.13 −4.28 1.41 0.87 {N/A}Ind Ret −0.32 −0.03 −0.32 7.6 −4.28 0.93 −0.53 {N/A}*December 17, 2001Performance DataThis chart shows you the fund´s annual performance and how an investment would have changed over time. Volatility MeterAsset ClassCurrent Value of a $10,000 InvestmentLowHighBased on 3−year standard deviation relative to other fundsin its category, from Globe HySales.Equity Style and Capitalization OverviewLargeMidSmallBlend Growth ValueIncome 20.0%American Equities 28.0%Canadian Equities 31.0%International Equities 21.0% Source: <strong>CI</strong> <strong>Investments</strong> and CTVglobemedia Publishing Inc.PAGE 57 • SPRING 2010 PERSPECTIVE AS AT MARCH 31, 2010