March - CI Investments

March - CI Investments

March - CI Investments

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

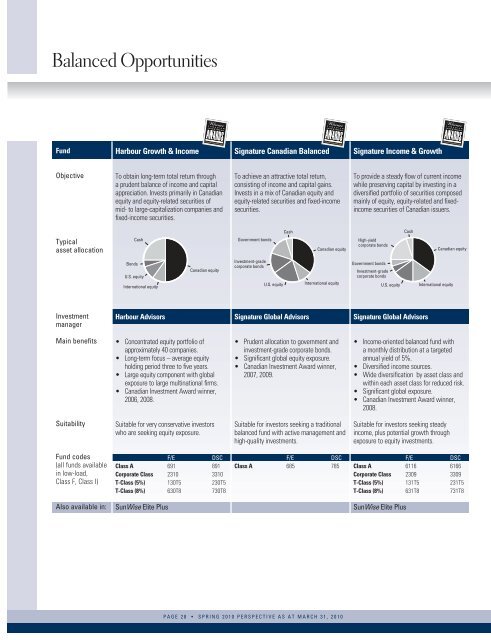

Balanced OpportunitiesFundHarbour Growth & IncomeSignature Canadian BalancedSignature Income & GrowthObjectiveTo obtain long-term total return througha prudent balance of income and capitalappreciation. Invests primarily in Canadianequity and equity-related securities ofmid- to large-capitalization companies andfixed-income securities.To achieve an attractive total return,consisting of income and capital gains.Invests in a mix of Canadian equity andequity-related securities and fixed-incomesecurities.To provide a steady flow of current incomewhile preserving capital by investing in adiversified portfolio of securities composedmainly of equity, equity-related and fixedincomesecurities of Canadian issuers.Typicalasset allocationCashGovernment bondsCashCanadian equityHigh-yieldcorporate bondsCashCanadian equityBondsU.S. equityInternational equityCanadian equityInvestment-gradecorporate bondsU.S. equityInternational equityGovernment bondsInvestment-gradecorporate bondsU.S. equityInternational equityInvestmentmanagerHarbour AdvisorsSignature Global AdvisorsSignature Global AdvisorsMain benefits• Concentrated equity portfolio ofapproximately 40 companies.• Long-term focus – average equityholding period three to five years.• Large equity component with globalexposure to large multinational firms.• Canadian Investment Award winner,2006, 2008.• Prudent allocation to government andinvestment-grade corporate bonds.• Significant global equity exposure.• Canadian Investment Award winner,2007, 2009.• Income-oriented balanced fund witha monthly distribution at a targetedannual yield of 5%.• Diversified income sources.• Wide diversification by asset class andwithin each asset class for reduced risk.• Significant global exposure.• Canadian Investment Award winner,2008.SuitabilitySuitable for very conservative investorswho are seeking equity exposure.Suitable for investors seeking a traditionalbalanced fund with active management andhigh-quality investments.Suitable for investors seeking steadyincome, plus potential growth throughexposure to equity investments.Fund codes(all funds availablein low-load,Class F, Class I)F/EDSCClass A 691 891Corporate Class 2310 3310T-Class (5%) 130T5 230T5T-Class (8%) 630T8 730T8F/EDSCClass A 685 785F/EDSCClass A 6116 6166Corporate Class 2309 3309T-Class (5%) 131T5 231T5T-Class (8%) 631T8 731T8Also available in:SunWise Elite PlusSunWise Elite PlusPAGE 28 • SPRING 2010 PERSPECTIVE AS AT MARCH 31, 2010