March - CI Investments

March - CI Investments

March - CI Investments

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

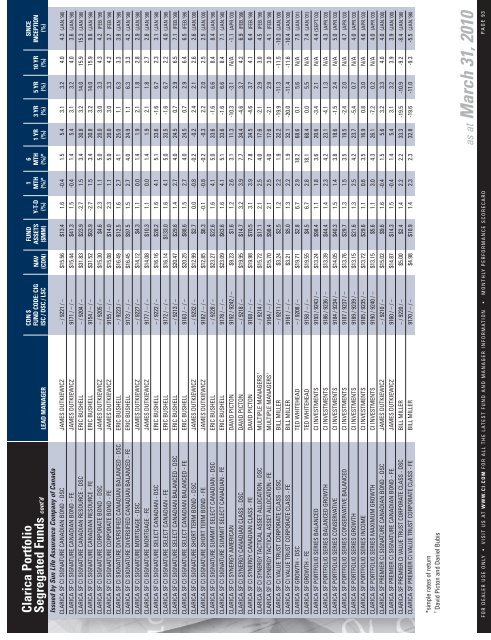

Clarica PortfolioSegregated Funds cont’dIssued by Sun Life Assurance Company of CanadaLEAD MANAGERCDN $FUND CODE: <strong>CI</strong>GISC / DSC / LSCCLARICA SF <strong>CI</strong> SIGNATURE CANADIAN BOND - DSC JAMES DUTKIEWICZ – / 9221 / – $15.56 $13.4 1.6 -0.4 1.5 5.4 3.1 3.2 4.0 4.3 (JAN.’98)CLARICA SF <strong>CI</strong> SIGNATURE CANADIAN BOND - FE JAMES DUTKIEWICZ 9171 / – / – $15.44 $41.3 1.5 -0.4 1.4 5.4 3.1 3.2 4.0 3.6 (JAN.’98)CLARICA SF <strong>CI</strong> SIGNATURE CANADIAN RESOURCE - DSC ERIC BUSHELL – / 9204 / – $31.83 $23.9 -2.7 1.5 3.4 30.8 3.2 14.0 15.9 15.3 (JAN ’98)CLARICA SF <strong>CI</strong> SIGNATURE CANADIAN RESOURCE - FE ERIC BUSHELL 9154 / – / – $31.52 $63.9 -2.7 1.5 3.4 30.8 3.2 14.0 15.9 9.8 (JAN ’98)CLARICA SF <strong>CI</strong> SIGNATURE CORPORATE BOND - DSC JAMES DUTKIEWICZ – / 9205 / – $15.30 $4.6NAV(CDN)FUNDASSETS($MM)Y-T-D(%)1MTH(%)*6MTH(%)*1 YR(%)3 YR(%)5 YR(%)10 YR(%)SINCEINCEPTION(%)2.3 1.1 5.0 20.0 3.0 3.3 4.3 4.2 (FEB.’99)CLARICA SF <strong>CI</strong> SIGNATURE CORPORATE BOND - FE JAMES DUTKIEWICZ 9155 / – / – $15.08 $14.0 2.3 1.1 5.0 20.0 3.0 3.3 4.2 3.7 (FEB.’99)CLARICA SF <strong>CI</strong> SIGNATURE DIVERSIFIED CANADIAN BALANCED - DSC ERIC BUSHELL – / 9223 / – $16.49 $12.5 1.6 2.7 4.1 25.0 1.1 6.3 3.3 3.9 (JAN ’98)CLARICA SF <strong>CI</strong> SIGNATURE DIVERSIFIED CANADIAN BALANCED - FE ERIC BUSHELL 9173 / – / – $16.45 $97.5 1.5 2.7 4.0 24.9 1.1 6.3 3.3 4.2 (JAN ’98)CLARICA SF <strong>CI</strong> SIGNATURE MORTGAGE - DSC JAMES DUTKIEWICZ – / 9227 / – $14.12 $4.3 1.1 0.0 1.4 1.9 2.1 1.8 2.8 2.9 (JAN.’98)CLARICA SF <strong>CI</strong> SIGNATURE MORTGAGE - FE JAMES DUTKIEWICZ 9177 / – / – $14.08 $10.3 1.1 0.0 1.4 1.9 2.1 1.8 2.7 2.8 (JAN.’98)CLARICA SF <strong>CI</strong> SIGNATURE SELECT CANADIAN - DSC ERIC BUSHELL – / 9222 / – $16.16 $28.2 1.6 4.1 5.1 33.6 -1.6 6.7 2.3 3.1 (JAN ’98)CLARICA SF <strong>CI</strong> SIGNATURE SELECT CANADIAN - FE ERIC BUSHELL 9172 / – / – $16.14 $133.0 1.6 4.1 5.0 33.5 -1.6 6.7 2.2 4.0 (JAN ’98)CLARICA SF <strong>CI</strong> SIGNATURE SELECT CANADIAN BALANCED - DSC ERIC BUSHELL – / 9213 / – $20.47 $29.6 1.4 2.7 4.0 24.5 0.7 2.9 6.5 7.1 (FEB.’99)CLARICA SF <strong>CI</strong> SIGNATURE SELECT CANADIAN BALANCED - FE ERIC BUSHELL 9163 / – / – $20.25 $88.6 1.5 2.7 4.0 24.5 0.7 2.9 6.4 6.5 (FEB.’99)CLARICA SF <strong>CI</strong> SIGNATURE SHORT TERM BOND - DSC JAMES DUTKIEWICZ – / 9232 / – $12.99 $2.7 0.0 -0.8 -0.2 -0.2 2.4 2.1 2.6 2.6 (JAN.’00)CLARICA SF <strong>CI</strong> SIGNATURE SHORT TERM BOND - FE JAMES DUTKIEWICZ 9182 / – / – $12.85 $6.3 -0.1 -0.8 -0.2 -0.3 2.2 2.0 2.5 2.5 (JAN.’00)CLARICA SF <strong>CI</strong> SIGNATURE SUMMIT SELECT CANADIAN - DSC ERIC BUSHELL – / 9228 / – $23.27 $22.6 1.6 4.1 5.0 33.6 -1.6 6.6 8.4 8.4 (JAN.’98)CLARICA SF <strong>CI</strong> SIGNATURE SUMMIT SELECT CANADIAN - FE ERIC BUSHELL 9178 / – / – $23.09 $63.6 1.6 4.1 5.1 33.6 -1.6 6.6 8.4 7.1 (JAN.’98)CLARICA SF <strong>CI</strong> SYNERGY AMERICAN DAVID PICTON 9192 / 9242 / – $9.23 $1.6 1.2 2.6 3.1 11.3 -10.3 -3.1 N/A -1.1 (APR.’03)CLARICA SF <strong>CI</strong> SYNERGY CANADIAN CLASS - DSC DAVID PICTON – / 9218 / – $19.95 $14.7 3.2 3.9 7.7 34.4 -4.6 3.7 4.2 6.9 (FEB.’99)CLARICA SF <strong>CI</strong> SYNERGY CANADIAN CLASS - FE DAVID PICTON 9168 / – / – $19.98 $70.5 3.1 3.9 7.8 34.5 -4.6 3.7 4.1 6.4 (FEB.’99)CLARICA SF <strong>CI</strong> SYNERGY TACTICAL ASSET ALLOCATION - DSC MULTIPLE MANAGERS † – / 9214 / – $15.72 $17.1 2.1 2.5 4.0 17.6 -2.1 2.9 3.0 4.5 (FEB.’99)CLARICA SF <strong>CI</strong> SYNERGY TACTICAL ASSET ALLOCATION - FE MULTIPLE MANAGERS † 9164 / – / – $15.70 $98.4 2.1 2.5 4.0 17.6 -2.1 2.9 3.0 4.1 (FEB.’99)CLARICA SF <strong>CI</strong> VALUE TRUST CORPORATE CLASS - DSC BILL MILLER – / 9211 / – $3.24 $2.5 1.2 2.2 1.9 32.2 -19.9 -11.3 -11.5 -10.3 (JAN.’00)CLARICA SF <strong>CI</strong> VALUE TRUST CORPORATE CLASS - FE BILL MILLER 9161 / – / – $3.21 $5.0 1.3 2.2 1.9 32.1 -20.0 -11.4 -11.6 -10.4 (JAN.’00)CLARICA SF GROWTH - DSC TED WHITEHEAD – / 9208 / – $19.71 $2.8 6.7 2.9 18.2 68.6 0.1 5.6 N/A 7.5 (JAN.’01)CLARICA SF GROWTH - FE TED WHITEHEAD 9158 / – / – $19.55 $4.5 6.7 2.8 18.1 68.4 0.0 5.5 N/A 7.4 (JAN.’01)CLARICA SF PORTFOLIO SERIES BALANCED <strong>CI</strong> INVESTMENTS 9193 / 9243 / – $13.24 $98.4 1.1 1.8 3.6 20.6 -3.4 2.1 N/A 4.4 (SEPT.’03)CLARICA SF PORTFOLIO SERIES BALANCED GROWTH <strong>CI</strong> INVESTMENTS 9186 / 9236 / – $13.39 $44.4 1.4 2.3 4.2 23.1 -4.1 1.3 N/A 4.3 (APR.’03)CLARICA SF PORTFOLIO SERIES CONSERVATIVE <strong>CI</strong> INVESTMENTS 9184 / 9234 / – $14.05 $40.3 1.5 1.4 3.8 18.6 -1.5 2.4 N/A 5.0 (APR.’03)CLARICA SF PORTFOLIO SERIES CONSERVATIVE BALANCED <strong>CI</strong> INVESTMENTS 9187 / 9237 / – $13.76 $29.7 1.3 1.5 3.5 19.5 -2.4 2.0 N/A 4.7 (APR.’03)CLARICA SF PORTFOLIO SERIES GROWTH <strong>CI</strong> INVESTMENTS 9189 / 9239 / – $13.15 $21.6 1.3 2.5 4.2 23.7 -5.4 0.7 N/A 4.0 (APR.’03)CLARICA SF PORTFOLIO SERIES INCOME <strong>CI</strong> INVESTMENTS 9185 / 9235 / – $13.72 $29.6 1.1 0.6 3.5 16.9 0.8 3.0 N/A 4.6 (APR.’03)CLARICA SF PORTFOLIO SERIES MAXIMUM GROWTH <strong>CI</strong> INVESTMENTS 9190 / 9240 / – $13.15 $5.6 1.1 3.0 4.3 26.1 -7.2 0.2 N/A 4.0 (APR.’03)CLARICA SF PREMIER <strong>CI</strong> SIGNATURE CANADIAN BOND - DSC JAMES DUTKIEWICZ – / 9210 / – $15.02 $9.6 1.6 -0.4 1.5 5.6 3.2 3.3 4.0 4.0 (JAN.’00)CLARICA SF PREMIER <strong>CI</strong> SIGNATURE CANADIAN BOND - FE JAMES DUTKIEWICZ 9160 / – / – $14.87 $14.3 1.5 -0.4 1.4 5.4 3.1 3.2 3.9 3.9 (JAN.’00)CLARICA SF PREMIER <strong>CI</strong> VALUE TRUST CORPORATE CLASS - DSC BILL MILLER – / 9220 / – $5.00 $2.4 1.4 2.2 2.2 33.3 -19.5 -10.9 -9.2 -8.4 (JAN.’98)CLARICA SF PREMIER <strong>CI</strong> VALUE TRUST CORPORATE CLASS - FE BILL MILLER 9170 / – / – $4.98 $10.9 1.4 2.3 2.3 32.8 -19.6 -11.0 -9.3 -5.5 (JAN.’98)†*simple rates of returnDavid Picton and Daniel Bubisas at <strong>March</strong> 31, 2010F O R DEALE R U SE ONLY • VIS IT U S AT WWW.<strong>CI</strong> .COM F O R ALL THE LATEST FUND AND MANAGER INFO RMATIO N • M O NTHLY P E RFO RMANCE SCOR ECARD PAGE 93 96