Poverty Footprint Study on how the Coca Cola - Oxfam America

Poverty Footprint Study on how the Coca Cola - Oxfam America

Poverty Footprint Study on how the Coca Cola - Oxfam America

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

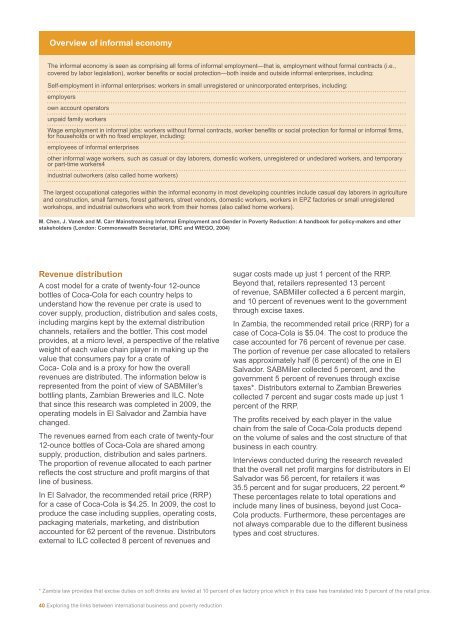

Overview of informal ec<strong>on</strong>omy<br />

The informal ec<strong>on</strong>omy is seen as comprising all forms of informal employment—that is, employment without formal c<strong>on</strong>tracts (i.e.,<br />

covered by labor legislati<strong>on</strong>), worker benefits or social protecti<strong>on</strong>—both inside and outside informal enterprises, including:<br />

Self-employment in informal enterprises: workers in small unregistered or unincorporated enterprises, including:<br />

employers<br />

own account operators<br />

unpaid family workers<br />

Wage employment in informal jobs: workers without formal c<strong>on</strong>tracts, worker benefits or social protecti<strong>on</strong> for formal or informal firms,<br />

for households or with no fixed employer, including:<br />

employees of informal enterprises<br />

o<strong>the</strong>r informal wage workers, such as casual or day laborers, domestic workers, unregistered or undeclared workers, and temporary<br />

or part-time workers4<br />

industrial outworkers (also called home workers)<br />

The largest occupati<strong>on</strong>al categories within <strong>the</strong> informal ec<strong>on</strong>omy in most developing countries include casual day laborers in agriculture<br />

and c<strong>on</strong>structi<strong>on</strong>, small farmers, forest ga<strong>the</strong>rers, street vendors, domestic workers, workers in EPZ factories or small unregistered<br />

workshops, and industrial outworkers who work from <strong>the</strong>ir homes (also called home workers).<br />

M. Chen, J. Vanek and M. Carr Mainstreaming Informal Employment and Gender in <str<strong>on</strong>g>Poverty</str<strong>on</strong>g> Reducti<strong>on</strong>: A handbook for policy-makers and o<strong>the</strong>r<br />

stakeholders (L<strong>on</strong>d<strong>on</strong>: Comm<strong>on</strong>wealth Secretariat, IDRC and WIEGO, 2004)<br />

Revenue distributi<strong>on</strong><br />

A cost model for a crate of twenty-four 12-ounce<br />

bottles of <strong>Coca</strong>-<strong>Cola</strong> for each country helps to<br />

understand <strong>how</strong> <strong>the</strong> revenue per crate is used to<br />

cover supply, producti<strong>on</strong>, distributi<strong>on</strong> and sales costs,<br />

including margins kept by <strong>the</strong> external distributi<strong>on</strong><br />

channels, retailers and <strong>the</strong> bottler. This cost model<br />

provides, at a micro level, a perspective of <strong>the</strong> relative<br />

weight of each value chain player in making up <strong>the</strong><br />

value that c<strong>on</strong>sumers pay for a crate of<br />

<strong>Coca</strong>- <strong>Cola</strong> and is a proxy for <strong>how</strong> <strong>the</strong> overall<br />

revenues are distributed. The informati<strong>on</strong> below is<br />

represented from <strong>the</strong> point of view of SABMiller’s<br />

bottling plants, Zambian Breweries and ILC. Note<br />

that since this research was completed in 2009, <strong>the</strong><br />

operating models in El Salvador and Zambia have<br />

changed.<br />

The revenues earned from each crate of twenty-four<br />

12-ounce bottles of <strong>Coca</strong>-<strong>Cola</strong> are shared am<strong>on</strong>g<br />

supply, producti<strong>on</strong>, distributi<strong>on</strong> and sales partners.<br />

The proporti<strong>on</strong> of revenue allocated to each partner<br />

reflects <strong>the</strong> cost structure and profit margins of that<br />

line of business.<br />

In El Salvador, <strong>the</strong> recommended retail price (RRP)<br />

for a case of <strong>Coca</strong>-<strong>Cola</strong> is $4.25. In 2009, <strong>the</strong> cost to<br />

produce <strong>the</strong> case including supplies, operating costs,<br />

packaging materials, marketing, and distributi<strong>on</strong><br />

accounted for 62 percent of <strong>the</strong> revenue. Distributors<br />

external to ILC collected 8 percent of revenues and<br />

* Zambia law provides that excise duties <strong>on</strong> soft drinks are levied at 10 percent of ex factory price which in this case has translated into 5 percent of <strong>the</strong> retail price.<br />

40 Exploring <strong>the</strong> links between internati<strong>on</strong>al business and poverty reducti<strong>on</strong><br />

sugar costs made up just 1 percent of <strong>the</strong> RRP.<br />

Bey<strong>on</strong>d that, retailers represented 13 percent<br />

of revenue, SABMiller collected a 6 percent margin,<br />

and 10 percent of revenues went to <strong>the</strong> government<br />

through excise taxes.<br />

In Zambia, <strong>the</strong> recommended retail price (RRP) for a<br />

case of <strong>Coca</strong>-<strong>Cola</strong> is $5.04. The cost to produce <strong>the</strong><br />

case accounted for 76 percent of revenue per case.<br />

The porti<strong>on</strong> of revenue per case allocated to retailers<br />

was approximately half (6 percent) of <strong>the</strong> <strong>on</strong>e in El<br />

Salvador. SABMiller collected 5 percent, and <strong>the</strong><br />

government 5 percent of revenues through excise<br />

taxes*. Distributors external to Zambian Breweries<br />

collected 7 percent and sugar costs made up just 1<br />

percent of <strong>the</strong> RRP.<br />

The profits received by each player in <strong>the</strong> value<br />

chain from <strong>the</strong> sale of <strong>Coca</strong>-<strong>Cola</strong> products depend<br />

<strong>on</strong> <strong>the</strong> volume of sales and <strong>the</strong> cost structure of that<br />

business in each country.<br />

Interviews c<strong>on</strong>ducted during <strong>the</strong> research revealed<br />

that <strong>the</strong> overall net profit margins for distributors in El<br />

Salvador was 56 percent, for retailers it was<br />

35.5 percent and for sugar producers, 22 percent. 49<br />

These percentages relate to total operati<strong>on</strong>s and<br />

include many lines of business, bey<strong>on</strong>d just <strong>Coca</strong>-<br />

<strong>Cola</strong> products. Fur<strong>the</strong>rmore, <strong>the</strong>se percentages are<br />

not always comparable due to <strong>the</strong> different business<br />

types and cost structures.