The Impact of the Andean Trade Preference Act Twelfth ... - USITC

The Impact of the Andean Trade Preference Act Twelfth ... - USITC

The Impact of the Andean Trade Preference Act Twelfth ... - USITC

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

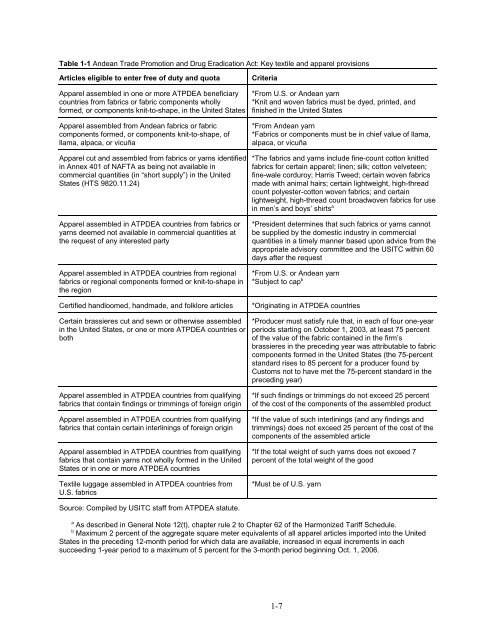

Table 1-1 <strong>Andean</strong> <strong>Trade</strong> Promotion and Drug Eradication <strong>Act</strong>: Key textile and apparel provisionsArticles eligible to enter free <strong>of</strong> duty and quotaApparel assembled in one or more ATPDEA beneficiarycountries from fabrics or fabric components whollyformed, or components knit-to-shape, in <strong>the</strong> United StatesApparel assembled from <strong>Andean</strong> fabrics or fabriccomponents formed, or components knit-to-shape, <strong>of</strong>llama, alpaca, or vicuñaApparel cut and assembled from fabrics or yarns identifiedin Annex 401 <strong>of</strong> NAFTA as being not available incommercial quantities (in “short supply”) in <strong>the</strong> UnitedStates (HTS 9820.11.24)Apparel assembled in ATPDEA countries from fabrics oryarns deemed not available in commercial quantities at<strong>the</strong> request <strong>of</strong> any interested partyApparel assembled in ATPDEA countries from regionalfabrics or regional components formed or knit-to-shape in<strong>the</strong> regionCertified handloomed, handmade, and folklore articlesCriteria*From U.S. or <strong>Andean</strong> yarn*Knit and woven fabrics must be dyed, printed, andfinished in <strong>the</strong> United States*From <strong>Andean</strong> yarn*Fabrics or components must be in chief value <strong>of</strong> llama,alpaca, or vicuña*<strong>The</strong> fabrics and yarns include fine-count cotton knittedfabrics for certain apparel; linen; silk; cotton velveteen;fine-wale corduroy; Harris Tweed; certain woven fabricsmade with animal hairs; certain lightweight, high-threadcount polyester-cotton woven fabrics; and certainlightweight, high-thread count broadwoven fabrics for usein men’s and boys’ shirts a*President determines that such fabrics or yarns cannotbe supplied by <strong>the</strong> domestic industry in commercialquantities in a timely manner based upon advice from <strong>the</strong>appropriate advisory committee and <strong>the</strong> <strong>USITC</strong> within 60days after <strong>the</strong> request*From U.S. or <strong>Andean</strong> yarn*Subject to cap b*Originating in ATPDEA countriesCertain brassieres cut and sewn or o<strong>the</strong>rwise assembledin <strong>the</strong> United States, or one or more ATPDEA countries orboth*Producer must satisfy rule that, in each <strong>of</strong> four one-yearperiods starting on October 1, 2003, at least 75 percent<strong>of</strong> <strong>the</strong> value <strong>of</strong> <strong>the</strong> fabric contained in <strong>the</strong> firm’sbrassieres in <strong>the</strong> preceding year was attributable to fabriccomponents formed in <strong>the</strong> United States (<strong>the</strong> 75-percentstandard rises to 85 percent for a producer found byCustoms not to have met <strong>the</strong> 75-percent standard in <strong>the</strong>preceding year)Apparel assembled in ATPDEA countries from qualifyingfabrics that contain findings or trimmings <strong>of</strong> foreign originApparel assembled in ATPDEA countries from qualifyingfabrics that contain certain interlinings <strong>of</strong> foreign originApparel assembled in ATPDEA countries from qualifyingfabrics that contain yarns not wholly formed in <strong>the</strong> UnitedStates or in one or more ATPDEA countriesTextile luggage assembled in ATPDEA countries fromU.S. fabrics*If such findings or trimmings do not exceed 25 percent<strong>of</strong> <strong>the</strong> cost <strong>of</strong> <strong>the</strong> components <strong>of</strong> <strong>the</strong> assembled product*If <strong>the</strong> value <strong>of</strong> such interlinings (and any findings andtrimmings) does not exceed 25 percent <strong>of</strong> <strong>the</strong> cost <strong>of</strong> <strong>the</strong>components <strong>of</strong> <strong>the</strong> assembled article*If <strong>the</strong> total weight <strong>of</strong> such yarns does not exceed 7percent <strong>of</strong> <strong>the</strong> total weight <strong>of</strong> <strong>the</strong> good*Must be <strong>of</strong> U.S. yarnSource: Compiled by <strong>USITC</strong> staff from ATPDEA statute.a As described in General Note 12(t), chapter rule 2 to Chapter 62 <strong>of</strong> <strong>the</strong> Harmonized Tariff Schedule.b Maximum 2 percent <strong>of</strong> <strong>the</strong> aggregate square meter equivalents <strong>of</strong> all apparel articles imported into <strong>the</strong> UnitedStates in <strong>the</strong> preceding 12-month period for which data are available, increased in equal increments in eachsucceeding 1-year period to a maximum <strong>of</strong> 5 percent for <strong>the</strong> 3-month period beginning Oct. 1, 2006.1-7