Report & Accounts - JLT

Report & Accounts - JLT

Report & Accounts - JLT

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

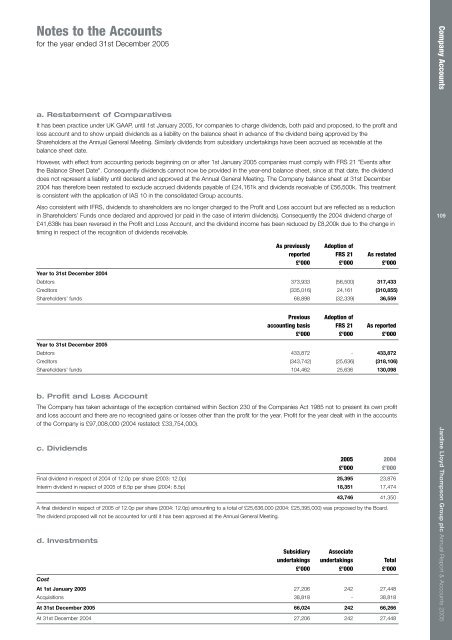

Notes to the <strong>Accounts</strong>for the year ended 31st December 2005a. Restatement of ComparativesIt has been practice under UK GAAP, until 1st January 2005, for companies to charge dividends, both paid and proposed, to the profit andloss account and to show unpaid dividends as a liability on the balance sheet in advance of the dividend being approved by theShareholders at the Annual General Meeting. Similarly dividends from subsidiary undertakings have been accrued as receivable at thebalance sheet date.However, with effect from accounting periods beginning on or after 1st January 2005 companies must comply with FRS 21 "Events afterthe Balance Sheet Date". Consequently dividends cannot now be provided in the year-end balance sheet, since at that date, the dividenddoes not represent a liability until declared and approved at the Annual General Meeting. The Company balance sheet at 31st December2004 has therefore been restated to exclude accrued dividends payable of £24,161k and dividends receivable of £56,500k. This treatmentis consistent with the application of IAS 10 in the consolidated Group accounts.Also consistent with IFRS, dividends to shareholders are no longer charged to the Profit and Loss account but are reflected as a reductionin Shareholders’ Funds once declared and approved (or paid in the case of interim dividends). Consequently the 2004 dividend charge of£41,638k has been reversed in the Profit and Loss Account, and the dividend income has been reduced by £8,200k due to the change intiming in respect of the recognition of dividends receivable.As previously Adoption ofreported FRS 21 As restated£'000 £'000 £'000Year to 31st December 2004Debtors 373,933 (56,500) 317,433Creditors (335,016) 24,161 (310,855)Shareholders' funds 68,898 (32,339) 36,559Previous Adoption ofaccounting basis FRS 21 As reported£'000 £'000 £'000Year to 31st December 2005Debtors 433,872 - 433,872Creditors (343,742) (25,636) (318,106)Shareholders' funds 104,462 25,636 130,098b. Profit and Loss AccountThe Company has taken advantage of the exception contained within Section 230 of the Companies Act 1985 not to present its own profitand loss account and there are no recognised gains or losses other than the profit for the year. Profit for the year dealt with in the accountsof the Company is £97,008,000 (2004 restated: £33,754,000).c. Dividends2005 2004£’000 £’000Final dividend in respect of 2004 of 12.0p per share (2003: 12.0p) 25,395 23,876Interim dividend in respect of 2005 of 8.5p per share (2004: 8.5p) 18,351 17,47443,746 41,350A final dividend in respect of 2005 of 12.0p per share (2004: 12.0p) amounting to a total of £25,636,000 (2004: £25,395,000) was proposed by the Board.The dividend proposed will not be accounted for until it has been approved at the Annual General Meeting.d. InvestmentsSubsidiary Associateundertakings undertakings Total£'000 £'000 £'000CostAt 1st January 2005 27,206 242 27,448Acquisitions 38,818 - 38,818At 31st December 2005 66,024 242 66,266At 31st December 2004 27,206 242 27,448Company <strong>Accounts</strong> Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 2005109