Notes to the <strong>Accounts</strong>for the year ended 31st December 2005a. Restatement of ComparativesIt has been practice under UK GAAP, until 1st January 2005, for companies to charge dividends, both paid and proposed, to the profit andloss account and to show unpaid dividends as a liability on the balance sheet in advance of the dividend being approved by theShareholders at the Annual General Meeting. Similarly dividends from subsidiary undertakings have been accrued as receivable at thebalance sheet date.However, with effect from accounting periods beginning on or after 1st January 2005 companies must comply with FRS 21 "Events afterthe Balance Sheet Date". Consequently dividends cannot now be provided in the year-end balance sheet, since at that date, the dividenddoes not represent a liability until declared and approved at the Annual General Meeting. The Company balance sheet at 31st December2004 has therefore been restated to exclude accrued dividends payable of £24,161k and dividends receivable of £56,500k. This treatmentis consistent with the application of IAS 10 in the consolidated Group accounts.Also consistent with IFRS, dividends to shareholders are no longer charged to the Profit and Loss account but are reflected as a reductionin Shareholders’ Funds once declared and approved (or paid in the case of interim dividends). Consequently the 2004 dividend charge of£41,638k has been reversed in the Profit and Loss Account, and the dividend income has been reduced by £8,200k due to the change intiming in respect of the recognition of dividends receivable.As previously Adoption ofreported FRS 21 As restated£'000 £'000 £'000Year to 31st December 2004Debtors 373,933 (56,500) 317,433Creditors (335,016) 24,161 (310,855)Shareholders' funds 68,898 (32,339) 36,559Previous Adoption ofaccounting basis FRS 21 As reported£'000 £'000 £'000Year to 31st December 2005Debtors 433,872 - 433,872Creditors (343,742) (25,636) (318,106)Shareholders' funds 104,462 25,636 130,098b. Profit and Loss AccountThe Company has taken advantage of the exception contained within Section 230 of the Companies Act 1985 not to present its own profitand loss account and there are no recognised gains or losses other than the profit for the year. Profit for the year dealt with in the accountsof the Company is £97,008,000 (2004 restated: £33,754,000).c. Dividends2005 2004£’000 £’000Final dividend in respect of 2004 of 12.0p per share (2003: 12.0p) 25,395 23,876Interim dividend in respect of 2005 of 8.5p per share (2004: 8.5p) 18,351 17,47443,746 41,350A final dividend in respect of 2005 of 12.0p per share (2004: 12.0p) amounting to a total of £25,636,000 (2004: £25,395,000) was proposed by the Board.The dividend proposed will not be accounted for until it has been approved at the Annual General Meeting.d. InvestmentsSubsidiary Associateundertakings undertakings Total£'000 £'000 £'000CostAt 1st January 2005 27,206 242 27,448Acquisitions 38,818 - 38,818At 31st December 2005 66,024 242 66,266At 31st December 2004 27,206 242 27,448Company <strong>Accounts</strong> Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 2005109

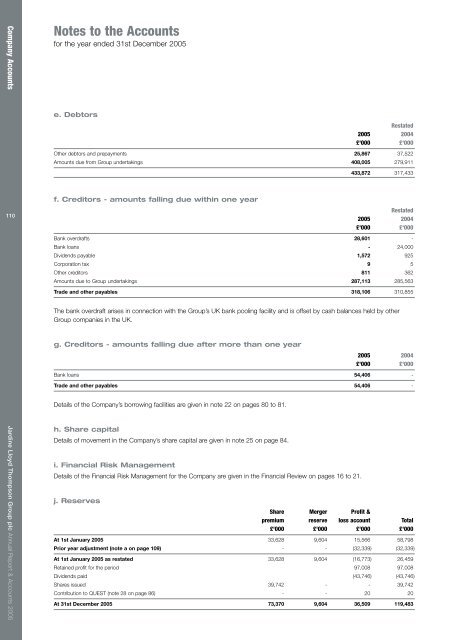

Company <strong>Accounts</strong>Notes to the <strong>Accounts</strong>for the year ended 31st December 2005e. DebtorsRestated2005 2004£'000 £'000Other debtors and prepayments 25,867 37,522Amounts due from Group undertakings 408,005 279,911433,872 317,433110f. Creditors - amounts falling due within one yearRestated2005 2004£'000 £'000Bank overdrafts 28,601 -Bank loans - 24,000Dividends payable 1,572 925Corporation tax 9 5Other creditors 811 362Amounts due to Group undertakings 287,113 285,563Trade and other payables 318,106 310,855The bank overdraft arises in connection with the Group’s UK bank pooling facility and is offset by cash balances held by otherGroup companies in the UK.g. Creditors - amounts falling due after more than one year2005 2004£'000 £'000Bank loans 54,406 -Trade and other payables 54,406 -Details of the Company’s borrowing facilities are given in note 22 on pages 80 to 81.Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 2005h. Share capitalDetails of movement in the Company’s share capital are given in note 25 on page 84.i. Financial Risk ManagementDetails of the Financial Risk Management for the Company are given in the Financial Review on pages 16 to 21.j. ReservesShare Merger Profit &premium reserve loss account Total£'000 £'000 £'000 £'000At 1st January 2005 33,628 9,604 15,566 58,798Prior year adjustment (note a on page 109) - - (32,339) (32,339)At 1st January 2005 as restated 33,628 9,604 (16,773) 26,459Retained profit for the period 97,008 97,008Dividends paid (43,746) (43,746)Shares issued 39,742 - - 39,742Contribution to QUEST (note 28 on page 86) - - 20 20At 31st December 2005 73,370 9,604 36,509 119,483