Report & Accounts - JLT

Report & Accounts - JLT

Report & Accounts - JLT

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

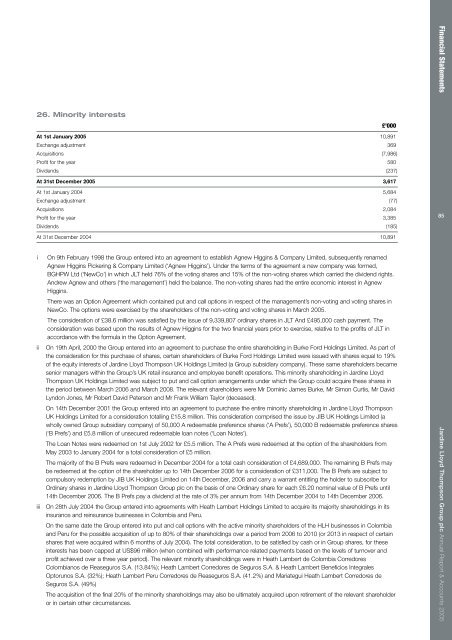

26. Minority interestsAt 1st January 2005 10,891Exchange adjustment 369Acquisitions (7,986)Profit for the year 580Dividends (237)At 31st December 2005 3,617At 1st January 2004 5,684Exchange adjustment (77)Acquisitions 2,084Profit for the year 3,385Dividends (185)At 31st December 2004 10,891iiiiiiOn 9th February 1998 the Group entered into an agreement to establish Agnew Higgins & Company Limited, subsequently renamedAgnew Higgins Pickering & Company Limited (‘Agnew Higgins’). Under the terms of the agreement a new company was formed,BGHPW Ltd (‘NewCo’) in which <strong>JLT</strong> held 76% of the voting shares and 15% of the non-voting shares which carried the dividend rights.Andrew Agnew and others (‘the management’) held the balance. The non-voting shares had the entire economic interest in AgnewHiggins.There was an Option Agreement which contained put and call options in respect of the management’s non-voting and voting shares inNewCo. The options were exercised by the shareholders of the non-voting and voting shares in March 2005.The consideration of £38.6 million was satisfied by the issue of 9,339,807 ordinary shares in <strong>JLT</strong> And £495,000 cash payment. Theconsideration was based upon the results of Agnew Higgins for the two financial years prior to exercise, relative to the profits of <strong>JLT</strong> inaccordance with the formula in the Option Agreement.On 19th April, 2000 the Group entered into an agreement to purchase the entire shareholding in Burke Ford Holdings Limited. As part ofthe consideration for this purchase of shares, certain shareholders of Burke Ford Holdings Limited were issued with shares equal to 19%of the equity interests of Jardine Lloyd Thompson UK Holdings Limited (a Group subsidiary company). These same shareholders becamesenior managers within the Group’s UK retail insurance and employee benefit operations. This minority shareholding in Jardine LloydThompson UK Holdings Limited was subject to put and call option arrangements under which the Group could acquire these shares inthe period between March 2006 and March 2008. The relevant shareholders were Mr Dominic James Burke, Mr Simon Curtis, Mr DavidLyndon Jones, Mr Robert David Peterson and Mr Frank William Taylor (deceased).On 14th December 2001 the Group entered into an agreement to purchase the entire minority shareholding in Jardine Lloyd ThompsonUK Holdings Limited for a consideration totalling £15.8 million. This consideration comprised the issue by JIB UK Holdings Limited (awholly owned Group subsidiary company) of 50,000 A redeemable preference shares (‘A Prefs’), 50,000 B redeemable preference shares(‘B Prefs’) and £5.8 million of unsecured redeemable loan notes (‘Loan Notes’).The Loan Notes were redeemed on 1st July 2002 for £5.5 million. The A Prefs were redeemed at the option of the shareholders fromMay 2003 to January 2004 for a total consideration of £5 million.The majority of the B Prefs were redeemed in December 2004 for a total cash consideration of £4,689,000. The remaining B Prefs maybe redeemed at the option of the shareholder up to 14th December 2006 for a consideration of £311,000. The B Prefs are subject tocompulsory redemption by JIB UK Holdings Limited on 14th December, 2006 and carry a warrant entitling the holder to subscribe forOrdinary shares in Jardine Lloyd Thompson Group plc on the basis of one Ordinary share for each £6.20 nominal value of B Prefs until14th December 2006. The B Prefs pay a dividend at the rate of 3% per annum from 14th December 2004 to 14th December 2006.On 28th July 2004 the Group entered into agreements with Heath Lambert Holdings Limited to acquire its majority shareholdings in itsinsurance and reinsurance businesses in Colombia and Peru.On the same date the Group entered into put and call options with the active minority shareholders of the HLH businesses in Colombiaand Peru for the possible acquisition of up to 80% of their shareholdings over a period from 2006 to 2010 (or 2013 in respect of certainshares that were acquired within 6 months of July 2004). The total consideration, to be satisfied by cash or in Group shares, for theseinterests has been capped at US$96 million (when combined with performance related payments based on the levels of turnover andprofit achieved over a three year period). The relevant minority shareholdings were in Heath Lambert de Colombia CorredoresColombianos de Reaseguros S.A. (13.84%); Heath Lambert Corredores de Seguros S.A. & Heath Lambert Beneficios IntegralesOptorunos S.A. (32%); Heath Lambert Peru Corredores de Reaseguros S.A. (41.2%) and Mariategui Heath Lambert Corredores deSeguros S.A. (49%)The acquisition of the final 20% of the minority shareholdings may also be ultimately acquired upon retirement of the relevant shareholderor in certain other circumstances.£'000Financial Statements Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 200585