Report & Accounts - JLT

Report & Accounts - JLT

Report & Accounts - JLT

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

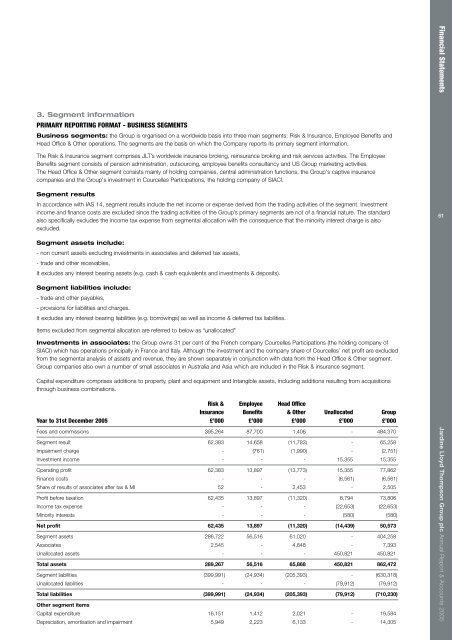

3. Segment informationPRIMARY REPORTING FORMAT - BUSINESS SEGMENTSBusiness segments: the Group is organised on a worldwide basis into three main segments: Risk & Insurance, Employee Benefits andHead Office & Other operations. The segments are the basis on which the Company reports its primary segment information.The Risk & Insurance segment comprises <strong>JLT</strong>’s worldwide insurance broking, reinsurance broking and risk services activities. The EmployeeBenefits segment consists of pension administration, outsourcing, employee benefits consultancy and US Group marketing activities.The Head Office & Other segment consists mainly of holding companies, central administration functions, the Group's captive insurancecompanies and the Group's investment in Courcelles Participations, the holding company of SIACI.Segment resultsIn accordance with IAS 14, segment results include the net income or expense derived from the trading activities of the segment. Investmentincome and finance costs are excluded since the trading activities of the Group’s primary segments are not of a financial nature. The standardalso specifically excludes the income tax expense from segmental allocation with the consequence that the minority interest charge is alsoexcluded.Segment assets include:- non current assets excluding investments in associates and deferred tax assets,- trade and other receivables,It excludes any interest bearing assets (e.g. cash & cash equivalents and investments & deposits).Segment liabilities include:- trade and other payables,- provisions for liabilities and charges.It excludes any interest bearing liabilities (e.g. borrowings) as well as income & deferred tax liabilities.Items excluded from segmental allocation are referred to below as “unallocated"Investments in associates: the Group owns 31 per cent of the French company Courcelles Participations (the holding company ofSIACI) which has operations principally in France and Italy. Although the investment and the company share of Courcelles’ net profit are excludedfrom the segmental analysis of assets and revenue, they are shown separately in conjunction with data from the Head Office & Other segment.Group companies also own a number of small associates in Australia and Asia which are included in the Risk & insurance segment.Capital expenditure comprises additions to property, plant and equipment and Intangible assets, including additions resulting from acquisitionsthrough business combinations.Risk & Employee Head OfficeInsurance Benefits & Other Unallocated GroupYear to 31st December 2005 £’000 £’000 £’000 £’000 £’000Fees and commissions 395,264 87,700 1,406 - 484,370Segment result 62,383 14,658 (11,783) - 65,258Impairment charge - (761) (1,990) - (2,751)Investment income - - - 15,355 15,355Operating profit 62,383 13,897 (13,773) 15,355 77,862Finance costs - - - (6,561) (6,561)Share of results of associates after tax & MI 52 - 2,453 - 2,505Profit before taxation 62,435 13,897 (11,320) 8,794 73,806Income tax expense - - - (22,653) (22,653)Minority interests - - - (580) (580)Net profit 62,435 13,897 (11,320) (14,439) 50,573Segment assets 286,722 56,516 61,020 - 404,258Associates 2,545 - 4,848 - 7,393Unallocated assets - - - 450,821 450,821Total assets 289,267 56,516 65,868 450,821 862,472Segment liabilities (399,991) (24,934) (205,393) - (630,318)Unallocated liabilities - - - (79,912) (79,912)Total liabilities (399,991) (24,934) (205,393) (79,912) (710,230)Other segment itemsCapital expenditure 16,151 1,412 2,021 - 19,584Depreciation, amortisation and impairment 5,949 2,223 6,133 - 14,305Financial Statements Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 200561