Report & Accounts - JLT

Report & Accounts - JLT

Report & Accounts - JLT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

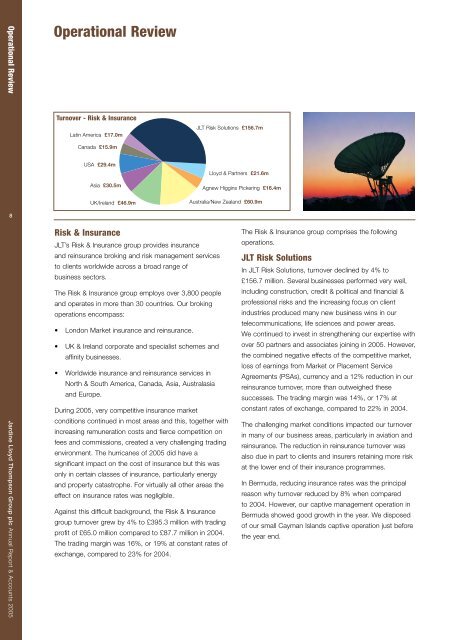

Operational ReviewOperational ReviewTurnover - Risk & InsuranceLatin America £17.0m<strong>JLT</strong> Risk Solutions £156.7mCanada £15.9mUSA £29.4mAsia £30.5mUK/Ireland £46.9mLloyd & Partners £21.6mAgnew Higgins Pickering £16.4mAustralia/New Zealand £60.9m8Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 2005Risk & Insurance<strong>JLT</strong>’s Risk & Insurance group provides insuranceand reinsurance broking and risk management servicesto clients worldwide across a broad range ofbusiness sectors.The Risk & Insurance group employs over 3,800 peopleand operates in more than 30 countries. Our brokingoperations encompass:• London Market insurance and reinsurance.• UK & Ireland corporate and specialist schemes andaffinity businesses.• Worldwide insurance and reinsurance services inNorth & South America, Canada, Asia, Australasiaand Europe.During 2005, very competitive insurance marketconditions continued in most areas and this, together withincreasing remuneration costs and fierce competition onfees and commissions, created a very challenging tradingenvironment. The hurricanes of 2005 did have asignificant impact on the cost of insurance but this wasonly in certain classes of insurance, particularly energyand property catastrophe. For virtually all other areas theeffect on insurance rates was negligible.Against this difficult background, the Risk & Insurancegroup turnover grew by 4% to £395.3 million with tradingprofit of £65.0 million compared to £87.7 million in 2004.The trading margin was 16%, or 19% at constant rates ofexchange, compared to 23% for 2004.The Risk & Insurance group comprises the followingoperations.<strong>JLT</strong> Risk SolutionsIn <strong>JLT</strong> Risk Solutions, turnover declined by 4% to£156.7 million. Several businesses performed very well,including construction, credit & political and financial &professional risks and the increasing focus on clientindustries produced many new business wins in ourtelecommunications, life sciences and power areas.We continued to invest in strengthening our expertise withover 50 partners and associates joining in 2005. However,the combined negative effects of the competitive market,loss of earnings from Market or Placement ServiceAgreements (PSAs), currency and a 12% reduction in ourreinsurance turnover, more than outweighed thesesuccesses. The trading margin was 14%, or 17% atconstant rates of exchange, compared to 22% in 2004.The challenging market conditions impacted our turnoverin many of our business areas, particularly in aviation andreinsurance. The reduction in reinsurance turnover wasalso due in part to clients and insurers retaining more riskat the lower end of their insurance programmes.In Bermuda, reducing insurance rates was the principalreason why turnover reduced by 8% when comparedto 2004. However, our captive management operation inBermuda showed good growth in the year. We disposedof our small Cayman Islands captive operation just beforethe year end.