Report & Accounts - JLT

Report & Accounts - JLT

Report & Accounts - JLT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

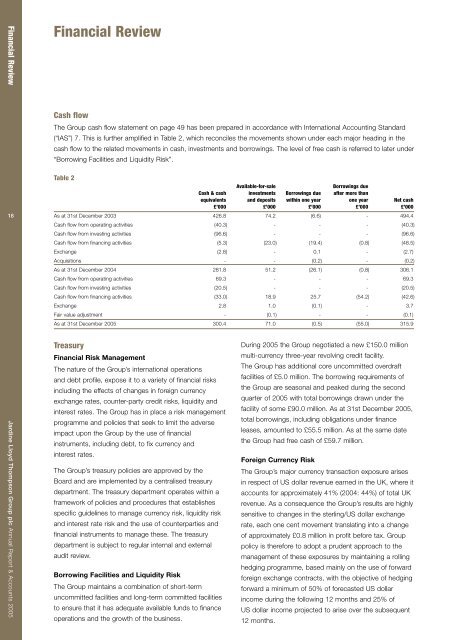

Financial ReviewFinancial ReviewCash flowThe Group cash flow statement on page 49 has been prepared in accordance with International Accounting Standard(“IAS”) 7. This is further amplified in Table 2, which reconciles the movements shown under each major heading in thecash flow to the related movements in cash, investments and borrowings. The level of free cash is referred to later under“Borrowing Facilities and Liquidity Risk”.18Table 2Available-for-saleBorrowings dueCash & cash investments Borrowings due after more thanequivalents and deposits within one year one year Net cash£’000 £’000 £’000 £’000 £’000As at 31st December 2003 426.8 74.2 (6.6) - 494.4Cash flow from operating activities (40.3) - - - (40.3)Cash flow from investing activities (96.6) - - - (96.6)Cash flow from financing activities (5.3) (23.0) (19.4) (0.8) (48.5)Exchange (2.8) - 0.1 - (2.7)Acquisitions - - (0.2) - (0.2)As at 31st December 2004 281.8 51.2 (26.1) (0.8) 306.1Cash flow from operating activities 69.3 - - - 69.3Cash flow from investing activities (20.5) - - - (20.5)Cash flow from financing activities (33.0) 18.9 25.7 (54.2) (42.6)Exchange 2.8 1.0 (0.1) - 3.7Fair value adjustment - (0.1) - - (0.1)As at 31st December 2005 300.4 71.0 (0.5) (55.0) 315.9Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 2005TreasuryFinancial Risk ManagementThe nature of the Group’s international operationsand debt profile, expose it to a variety of financial risksincluding the effects of changes in foreign currencyexchange rates, counter-party credit risks, liquidity andinterest rates. The Group has in place a risk managementprogramme and policies that seek to limit the adverseimpact upon the Group by the use of financialinstruments, including debt, to fix currency andinterest rates.The Group’s treasury policies are approved by theBoard and are implemented by a centralised treasurydepartment. The treasury department operates within aframework of policies and procedures that establishesspecific guidelines to manage currency risk, liquidity riskand interest rate risk and the use of counterparties andfinancial instruments to manage these. The treasurydepartment is subject to regular internal and externalaudit review.Borrowing Facilities and Liquidity RiskThe Group maintains a combination of short-termuncommitted facilities and long-term committed facilitiesto ensure that it has adequate available funds to financeoperations and the growth of the business.During 2005 the Group negotiated a new £150.0 millionmulti-currency three-year revolving credit facility.The Group has additional core uncommitted overdraftfacilities of £5.0 million. The borrowing requirements ofthe Group are seasonal and peaked during the secondquarter of 2005 with total borrowings drawn under thefacility of some £90.0 million. As at 31st December 2005,total borrowings, including obligations under financeleases, amounted to £55.5 million. As at the same datethe Group had free cash of £59.7 million.Foreign Currency RiskThe Group’s major currency transaction exposure arisesin respect of US dollar revenue earned in the UK, where itaccounts for approximately 41% (2004: 44%) of total UKrevenue. As a consequence the Group’s results are highlysensitive to changes in the sterling/US dollar exchangerate, each one cent movement translating into a changeof approximately £0.8 million in profit before tax. Grouppolicy is therefore to adopt a prudent approach to themanagement of these exposures by maintaining a rollinghedging programme, based mainly on the use of forwardforeign exchange contracts, with the objective of hedgingforward a minimum of 50% of forecasted US dollarincome during the following 12 months and 25% ofUS dollar income projected to arise over the subsequent12 months.