Report & Accounts - JLT

Report & Accounts - JLT

Report & Accounts - JLT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

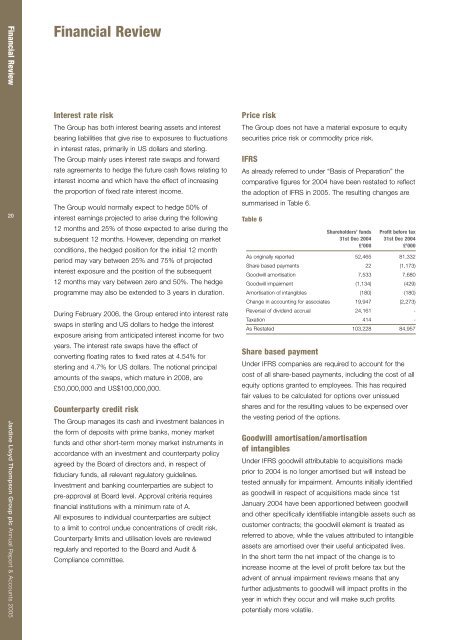

Financial ReviewFinancial Review20Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 2005Interest rate riskThe Group has both interest bearing assets and interestbearing liabilities that give rise to exposures to fluctuationsin interest rates, primarily in US dollars and sterling.The Group mainly uses interest rate swaps and forwardrate agreements to hedge the future cash flows relating tointerest income and which have the effect of increasingthe proportion of fixed rate interest income.The Group would normally expect to hedge 50% ofinterest earnings projected to arise during the following12 months and 25% of those expected to arise during thesubsequent 12 months. However, depending on marketconditions, the hedged position for the initial 12 monthperiod may vary between 25% and 75% of projectedinterest exposure and the position of the subsequent12 months may vary between zero and 50%. The hedgeprogramme may also be extended to 3 years in duration.During February 2006, the Group entered into interest rateswaps in sterling and US dollars to hedge the interestexposure arising from anticipated interest income for twoyears. The interest rate swaps have the effect ofconverting floating rates to fixed rates at 4.54% forsterling and 4.7% for US dollars. The notional principalamounts of the swaps, which mature in 2008, are£50,000,000 and US$100,000,000.Counterparty credit riskThe Group manages its cash and investment balances inthe form of deposits with prime banks, money marketfunds and other short-term money market instruments inaccordance with an investment and counterparty policyagreed by the Board of directors and, in respect offiduciary funds, all relevant regulatory guidelines.Investment and banking counterparties are subject topre-approval at Board level. Approval criteria requiresfinancial institutions with a minimum rate of A.All exposures to individual counterparties are subjectto a limit to control undue concentrations of credit risk.Counterparty limits and utilisation levels are reviewedregularly and reported to the Board and Audit &Compliance committee.Price riskThe Group does not have a material exposure to equitysecurities price risk or commodity price risk.IFRSAs already referred to under “Basis of Preparation” thecomparative figures for 2004 have been restated to reflectthe adoption of IFRS in 2005. The resulting changes aresummarised in Table 6.Table 6Shareholders’ funds Profit before tax31st Dec 2004 31st Dec 2004£’000 £’000As originally reported 52,465 81,332Share based payments 22 (1,173)Goodwill amortisation 7,533 7,680Goodwill impairment (1,134) (429)Amortisation of intangibles (180) (180)Change in accounting for associates 19,947 (2,273)Reversal of dividend accrual 24,161 -Taxation 414 -As Restated 103,228 84,957Share based paymentUnder IFRS companies are required to account for thecost of all share-based payments, including the cost of allequity options granted to employees. This has requiredfair values to be calculated for options over unissuedshares and for the resulting values to be expensed overthe vesting period of the options.Goodwill amortisation/amortisationof intangiblesUnder IFRS goodwill attributable to acquisitions madeprior to 2004 is no longer amortised but will instead betested annually for impairment. Amounts initially identifiedas goodwill in respect of acquisitions made since 1stJanuary 2004 have been apportioned between goodwilland other specifically identifiable intangible assets such ascustomer contracts; the goodwill element is treated asreferred to above, while the values attributed to intangibleassets are amortised over their useful anticipated lives.In the short term the net impact of the change is toincrease income at the level of profit before tax but theadvent of annual impairment reviews means that anyfurther adjustments to goodwill will impact profits in theyear in which they occur and will make such profitspotentially more volatile.