Report & Accounts - JLT

Report & Accounts - JLT

Report & Accounts - JLT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

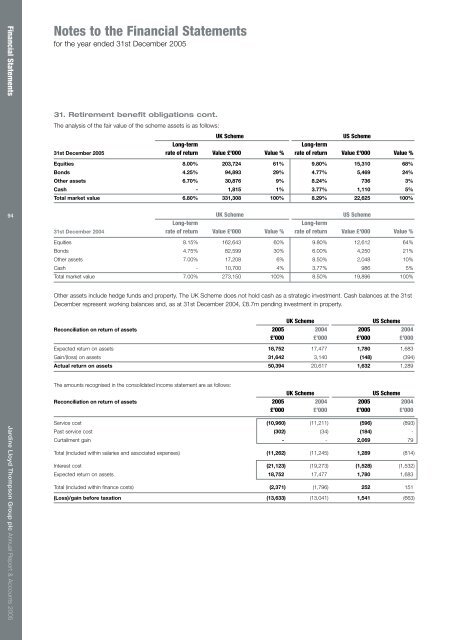

Financial StatementsNotes to the Financial Statementsfor the year ended 31st December 200531. Retirement benefit obligations cont.The analysis of the fair value of the scheme assets is as follows:UK SchemeUS SchemeLong-termLong-term31st December 2005 rate of return Value £'000 Value % rate of return Value £'000 Value %Equities 8.00% 203,724 61% 9.80% 15,310 68%Bonds 4.25% 94,893 29% 4.77% 5,469 24%Other assets 6.70% 30,876 9% 8.24% 736 3%Cash - 1,815 1% 3.77% 1,110 5%Total market value 6.80% 331,308 100% 8.29% 22,625 100%94UK SchemeUS SchemeLong-termLong-term31st December 2004 rate of return Value £'000 Value % rate of return Value £'000 Value %Equities 8.15% 162,643 60% 9.80% 12,612 64%Bonds 4.75% 82,599 30% 6.00% 4,250 21%Other assets 7.00% 17,208 6% 8.50% 2,048 10%Cash - 10,700 4% 3.77% 986 5%Total market value 7.00% 273,150 100% 8.50% 19,896 100%Other assets include hedge funds and property. The UK Scheme does not hold cash as a strategic investment. Cash balances at the 31stDecember represent working balances and, as at 31st December 2004, £8.7m pending investment in property.UK SchemeUS SchemeReconciliation on return of assets 2005 2004 2005 2004£’000 £’000 £’000 £’000Expected return on assets 18,752 17,477 1,780 1,683Gain/(loss) on assets 31,642 3,140 (148) (394)Actual return on assets 50,394 20,617 1,632 1,289The amounts recognised in the consolidated income statement are as follows:UK SchemeUS SchemeReconciliation on return of assets 2005 2004 2005 2004£’000 £’000 £’000 £’000Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 2005Service cost (10,960) (11,211) (596) (893)Past service cost (302) (34) (184) -Curtailment gain - - 2,069 79Total (included within salaries and associated expenses) (11,262) (11,245) 1,289 (814)Interest cost (21,123) (19,273) (1,528) (1,532)Expected return on assets 18,752 17,477 1,780 1,683Total (included within finance costs) (2,371) (1,796) 252 151(Loss)/gain before taxation (13,633) (13,041) 1,541 (663)