Report & Accounts - JLT

Report & Accounts - JLT

Report & Accounts - JLT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

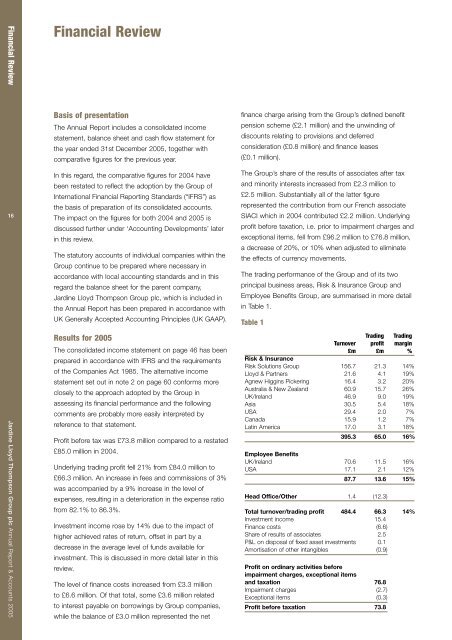

Financial ReviewFinancial Review16Basis of presentationThe Annual <strong>Report</strong> includes a consolidated incomestatement, balance sheet and cash flow statement forthe year ended 31st December 2005, together withcomparative figures for the previous year.In this regard, the comparative figures for 2004 havebeen restated to reflect the adoption by the Group ofInternational Financial <strong>Report</strong>ing Standards (“IFRS”) asthe basis of preparation of its consolidated accounts.The impact on the figures for both 2004 and 2005 isdiscussed further under ‘Accounting Developments’ laterin this review.The statutory accounts of individual companies within theGroup continue to be prepared where necessary inaccordance with local accounting standards and in thisregard the balance sheet for the parent company,Jardine Lloyd Thompson Group plc, which is included inthe Annual <strong>Report</strong> has been prepared in accordance withUK Generally Accepted Accounting Principles (UK GAAP).finance charge arising from the Group’s defined benefitpension scheme (£2.1 million) and the unwinding ofdiscounts relating to provisions and deferredconsideration (£0.8 million) and finance leases(£0.1 million).The Group’s share of the results of associates after taxand minority interests increased from £2.3 million to£2.5 million. Substantially all of the latter figurerepresented the contribution from our French associateSIACI which in 2004 contributed £2.2 million. Underlyingprofit before taxation, i.e. prior to impairment charges andexceptional items, fell from £96.2 million to £76.8 million,a decrease of 20%, or 10% when adjusted to eliminatethe effects of currency movements.The trading performance of the Group and of its twoprincipal business areas, Risk & Insurance Group andEmployee Benefits Group, are summarised in more detailin Table 1.Table 1Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 2005Results for 2005The consolidated income statement on page 46 has beenprepared in accordance with IFRS and the requirementsof the Companies Act 1985. The alternative incomestatement set out in note 2 on page 60 conforms moreclosely to the approach adopted by the Group inassessing its financial performance and the followingcomments are probably more easily interpreted byreference to that statement.Profit before tax was £73.8 million compared to a restated£85.0 million in 2004.Underlying trading profit fell 21% from £84.0 million to£66.3 million. An increase in fees and commissions of 3%was accompanied by a 9% increase in the level ofexpenses, resulting in a deterioration in the expense ratiofrom 82.1% to 86.3%.Investment income rose by 14% due to the impact ofhigher achieved rates of return, offset in part by adecrease in the average level of funds available forinvestment. This is discussed in more detail later in thisreview.The level of finance costs increased from £3.3 millionto £6.6 million. Of that total, some £3.6 million relatedto interest payable on borrowings by Group companies,while the balance of £3.0 million represented the netTrading TradingTurnover profit margin£m £m %Risk & InsuranceRisk Solutions Group 156.7 21.3 14%Lloyd & Partners 21.6 4.1 19%Agnew Higgins Pickering 16.4 3.2 20%Australia & New Zealand 60.9 15.7 26%UK/Ireland 46.9 9.0 19%Asia 30.5 5.4 18%USA 29.4 2.0 7%Canada 15.9 1.2 7%Latin America 17.0 3.1 18%395.3 65.0 16%Employee BenefitsUK/Ireland 70.6 11.5 16%USA 17.1 2.1 12%87.7 13.6 15%Head Office/Other 1.4 (12.3)Total turnover/trading profit 484.4 66.3 14%Investment income 15.4Finance costs (6.6)Share of results of associates 2.5P&L on disposal of fixed asset investments 0.1Amortisation of other intangibles (0.9)Profit on ordinary activities beforeimpairment charges, exceptional itemsand taxation 76.8Impairment charges (2.7)Exceptional items (0.3)Profit before taxation 73.8