Report & Accounts - JLT

Report & Accounts - JLT

Report & Accounts - JLT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

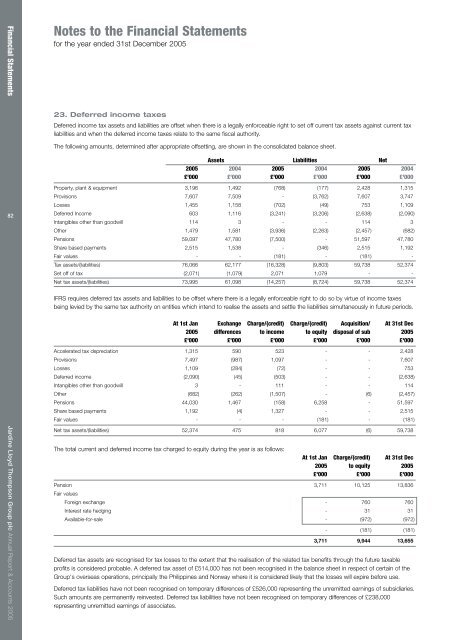

Financial StatementsNotes to the Financial Statementsfor the year ended 31st December 200523. Deferred income taxesDeferred income tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current taxliabilities and when the deferred income taxes relate to the same fiscal authority.The following amounts, determined after appropriate offsetting, are shown in the consolidated balance sheet.Assets Liabilities Net2005 2004 2005 2004 2005 2004£'000 £'000 £'000 £'000 £'000 £'00082Property, plant & equipment 3,196 1,492 (768) (177) 2,428 1,315Provisions 7,607 7,509 - (3,762) 7,607 3,747Losses 1,455 1,158 (702) (49) 753 1,109Deferred Income 603 1,116 (3,241) (3,206) (2,638) (2,090)Intangibles other than goodwill 114 3 - - 114 3Other 1,479 1,581 (3,936) (2,263) (2,457) (682)Pensions 59,097 47,780 (7,500) - 51,597 47,780Share based payments 2,515 1,538 - (346) 2,515 1,192Fair values - - (181) - (181) -Tax assets/(liabilities) 76,066 62,177 (16,328) (9,803) 59,738 52,374Set off of tax (2,071) (1,079) 2,071 1,079 - -Net tax assets/(liabilities) 73,995 61,098 (14,257) (8,724) 59,738 52,374IFRS requires deferred tax assets and liabilities to be offset where there is a legally enforceable right to do so by virtue of income taxesbeing levied by the same tax authority on entities which intend to realise the assets and settle the liabilities simultaneously in future periods.At 1st Jan Exchange Charge/(credit) Charge/(credit) Acquisition/ At 31st Dec2005 differences to income to equity disposal of sub 2005£'000 £'000 £'000 £'000 £'000 £'000Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 2005Accelerated tax depreciation 1,315 590 523 - - 2,428Provisions 7,497 (987) 1,097 - - 7,607Losses 1,109 (284) (72) - - 753Deferred income (2,090) (45) (503) - - (2,638)Intangibles other than goodwill 3 - 111 - - 114Other (682) (262) (1,507) - (6) (2,457)Pensions 44,030 1,467 (158) 6,258 - 51,597Share based payments 1,192 (4) 1,327 - - 2,515Fair values - - - (181) - (181)Net tax assets/(liabilities) 52,374 475 818 6,077 (6) 59,738The total current and deferred income tax charged to equity during the year is as follows:At 1st Jan Charge/(credit) At 31st Dec2005 to equity 2005£'000 £'000 £'000Pension 3,711 10,125 13,836Fair valuesForeign exchange - 760 760Interest rate hedging - 31 31Available-for-sale - (972) (972)- (181) (181)3,711 9,944 13,655Deferred tax assets are recognised for tax losses to the extent that the realisation of the related tax benefits through the future taxableprofits is considered probable. A deferred tax asset of £514,000 has not been recognised in the balance sheet in respect of certain of theGroup's overseas operations, principally the Philippines and Norway where it is considered likely that the losses will expire before use.Deferred tax liabilities have not been recognised on temporary differences of £526,000 representing the unremitted earnings of subsidiaries.Such amounts are permanently reinvested. Deferred tax liabilities have not been recognised on temporary differences of £238,000representing unremitted earnings of associates.