Long Term Incentive Plan*Awards to directors made under the Long Term Incentive Plan and LTIP 2004 are set out in the table below.The performance conditions relating to these awards are set out in the notes following the table.Remuneration <strong>Report</strong>MarketMarketNumber value on Number value on Exercisedgranted date of vested date of [lapsed] Date fromAt 1st Date of during grant during vesting during the At 31st Exercise which ExpiryJan 2005 grant 2005 pence 2005 pence year Dec 2005 price exercisable dateD J Burke 125,000 21.09.04 - 421.5 - - - 125,000 nil 01.03.07 20.09.14- 31.03.05 138,000 383.0 - - - 138,000 nil 31.03.08 30.03.15K A Carter - 31.03.05 236,000 383.0 - - - 236,000 nil 31.03.08 30.03.15A D J B Collins 100,000 21.03.02 - 615.5 50,000 - 50,000 - nil 21.03.05 20.03.09[50,000]75,000 20.11.03 - 559.0 - - - 75,000 nil 20.11.06 19.11.13100,000 21.09.04 - 421.5 - - - 100,000 nil 01.03.07 20.09.14- 31.03.05 138,000 383.0 - - - 138,000 nil 31.03.08 30.03.15J P Hastings-Bass 50,000 10.09.99 - 273.5 - - - 50,000 nil 01.03.02 09.09.0650,000 23.03.01 - 453.0 - - - 50,000 nil 23.03.04 22.03.0850,000 21.03.02 - 615.5 25,000 408.25 [25,000] 25,000 nil 21.03.05 20.03.0960,000 20.11.03 - 559.0 - - - 60,000 nil 20.11.06 19.11.13- 31.03.05 66,000 383.0 - - - 66,000 nil 31.03.08 30.03.15G W Stuart-Clarke 100,000 23.03.01 - 453.0 - - 100,000 - nil 23.03.04 22.03.0835,000 21.03.02 - 615.5 17,500 408.25 17,500 - nil 21.03.05 20.03.09[17,500]60,000 20.11.03 - 559.0 - - - 60,000 nil 20.11.06 19.11.1375,000 21.09.04 - 421.5 - - - 75,000 nil 01.03.07 20.09.14- 31.03.05 72,000 383.0 - - - 72,000 nil 31.03.08 30.03.15V Y A C Wade 20,000 23.03.01 - 453.0 - - 20,000 - nil 23.03.04 22.03.0825,000 21.03.02 - 615.5 12,500 408.25 12,500 - nil 21.03.05 20.03.09[12,500]60,000 20.11.03 - 559.0 - - - 60,000 nil 20.11.06 19.11.1375,000 21.09.04 - 421.5 - - - 75,000 nil 01.03.07 20.09.14- 31.03.05 72,000 383.0 - - - 72,000 nil 31.03.08 30.03.15M P Hammond 125,000 21.09.04 - 421.5 - - [125,000] - nil 01.03.07 20.09.14- 31.03.05 138,000 383.0 - - [138,000] - nil 31.03.08 30.03.1539*This table has been audited by PricewaterhouseCoopers LLPNote 1: At the Annual General Meeting on 30th April 2004, a newLong Term Incentive Plan for the executive directors was approved(the LTIP 2004). Further details on this plan under which awards weremade in 2004 and 2005 are set out on page 33.Note 2: For awards made under the old Long-Term Incentive Plan upto and including 2003, awards were all subject to performanceconditions based on growth in the Company's earnings per share("EPS"). For 50 per cent of each award, EPS growth was measuredover three years. Full vesting occurred if average annual EPS growthexceeded inflation by at least 10 per cent and vesting started ifaverage annual EPS growth exceeded inflation by 2 per cent, with prorata vesting between 2 per cent and 10 per cent. If the minimum EPSgrowth hurdle was not achieved over the 3 years, there was discretionto extend the measurement period for a further year.The other 50 per cent of the award vested depending on EPS growth(using the same 2 per cent-10 per cent range) over a single year.However, if the condition was not satisfied in full, the remainingproportion of the award could vest depending on performance overthe remainder of the three year period.The awards made in 2003 partially satisfied their single year EPSgrowth target in 2003, as previously reported, although they did notsatisfy their EPS growth target in respect of the period 2003-2005.As a result 31% of the awards will become exercisable on 20thNovember 2006.There have been no variations in the terms and conditions of schemeinterests during the year.Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 2005

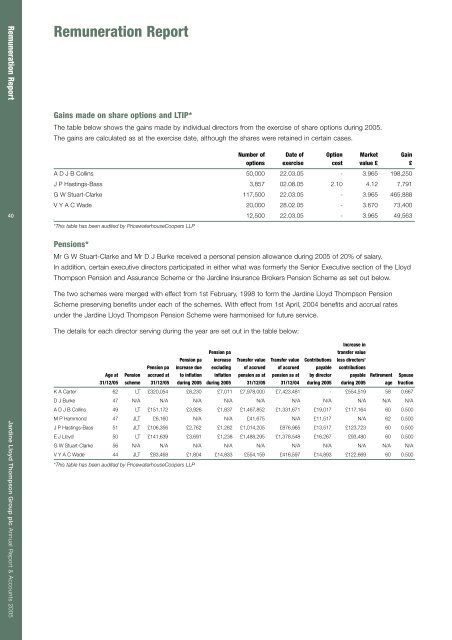

Remuneration <strong>Report</strong>Remuneration <strong>Report</strong>Gains made on share options and LTIP*The table below shows the gains made by individual directors from the exercise of share options during 2005.The gains are calculated as at the exercise date, although the shares were retained in certain cases.Number of Date of Option Market Gainoptions exercise cost value £ £A D J B Collins 50,000 22.03.05 - 3.965 198,250J P Hastings-Bass 3,857 02.08.05 2.10 4.12 7,791G W Stuart-Clarke 117,500 22.03.05 - 3.965 465,888V Y A C Wade 20,000 28.02.05 - 3.670 73,4004012,500 22.03.05 - 3.965 49,563*This table has been audited by PricewaterhouseCoopers LLPPensions*Mr G W Stuart-Clarke and Mr D J Burke received a personal pension allowance during 2005 of 20% of salary.In addition, certain executive directors participated in either what was formerly the Senior Executive section of the LloydThompson Pension and Assurance Scheme or the Jardine Insurance Brokers Pension Scheme as set out below.The two schemes were merged with effect from 1st February, 1998 to form the Jardine Lloyd Thompson PensionScheme preserving benefits under each of the schemes. With effect from 1st April, 2004 benefits and accrual ratesunder the Jardine Lloyd Thompson Pension Scheme were harmonised for future service.The details for each director serving during the year are set out in the table below:Jardine Lloyd Thompson Group plc Annual <strong>Report</strong> & <strong>Accounts</strong> 2005Increase inPension patransfer valuePension pa increase Transfer value Transfer value Contributions less directors’Pension pa increase due excluding of accrued of accrued payable contributionsAge at Pension accrued at to inflation inflation pension as at pension as at by director payable Retirement Spouse31/12/05 scheme 31/12/05 during 2005 during 2005 31/12/05 31/12/04 during 2005 during 2005 age fractionK A Carter 62 LT £320,054 £8,230 £7,011 £7,978,000 £7,423,481 - £554,519 58 0.667D J Burke 47 N/A N/A N/A N/A N/A N/A N/A N/A N/A N/AA D J B Collins 49 LT £151,172 £3,926 £1,837 £1,467,852 £1,331,671 £19,017 £117,164 60 0.500M P Hammond 47 <strong>JLT</strong> £6,160 N/A N/A £41,675 N/A £11,517 N/A 62 0.500J P Hastings-Bass 51 <strong>JLT</strong> £106,356 £2,762 £1,282 £1,014,205 £876,965 £13,517 £123,723 60 0.500E J Lloyd 50 LT £141,639 £3,691 £1,238 £1,488,295 £1,378,548 £16,267 £93,480 60 0.500G W Stuart-Clarke 56 N/A N/A N/A N/A N/A N/A N/A N/A N/A N/AV Y A C Wade 44 <strong>JLT</strong> £83,468 £1,804 £14,833 £554,159 £416,597 £14,893 £122,669 60 0.500*This table has been audited by PricewaterhouseCoopers LLP