OneSteel Annual Report 201132. Financial risk management (continued)The Group trades only with recognised, creditworthy third parties. It is the Group’s policy that all customers who wish to trade on creditterms are subject to credit verification procedures including an assessment of their independent credit rating, financial position, pastexperience and industry reputation. Risk limits are set for each individual customer in accordance with parameters set by the Board andare regularly monitored. In addition, receivables are monitored on an ongoing basis with the result that the Group’s exposure to bad debtis not significant.116For financial instruments, limits for each counterparty are set primarily on credit rating, adjusted for country rating and the nominal levelof shareholders’ funds. The Group does not expect any counterparties to fail to meet their obligations given their high credit ratings. Forfinancial assets and liabilities measured at fair value through profit and loss, the amount of change in fair value that is attributable tocredit risk is not material.(e) Liquidity riskThe Group’s objective is to maintain a balance between continuity of funding and flexibility through the use of bank overdrafts, bankloans, US private placement senior notes and finance leases. In addition to committed facilities, OneSteel has 11am money market linesand an overdraft facility that assists with the intra-month cash management. Debt maturities are spread out to limit risk on debt rollover.The Group manages liquidity risk by continuously monitoring forecast and actual cash flows and matching the maturity profiles of assetsand liabilities.Financing arrangementsThe Group had access to the following undrawn borrowing facilities at balance date:CONSOLIDATED2011$m2010$mFloating rateExpiring within one year 22.4 —Expiring beyond one year 1,278.5 1,538.21,300.9 1,538.2Maturity analysis of financial assets and liabilitiesThe tables below analyse the Group’s financial assets and liabilities into relevant maturity groupings based on the remaining period at thebalance date to the contractual maturity date. The amounts disclosed in the table reflect all contractually fixed pay-offs and receivablesfor settlement, repayments and interest resulting from recognised financial assets and liabilities. For interest rate swaps, the cash flowshave been estimated using forward interest rates applicable at the reporting date.For all other obligations, the respective undiscounted cash flows are presented. Cash flows for financial assets and liabilities without fixedmaturity are based on the conditions existing at balance date.TotalCONSOLIDATEDLess than12 months$m1 — 5 years$mGreater than5 years$mcontractualcash flows$m2011Financial assetsCash and cash equivalents 153.7 — — 153.7Trade and other receivables 925.0 — — 925.0Forward exchange contracts 422.9 28.8 — 451.7Commodity contracts 1.4 — — 1.4Interest rate swaps 15.3 37.4 11.6 64.3Cross-currency interest rate swaps 44.1 112.3 — 156.4Other financial assets 1.5 — — 1.51,563.9 178.5 11.6 1,754.0Financial liabilitiesTrade and other payables 1,007.3 — — 1,007.3Forward exchange contracts 430.1 — — 430.1Commodity contracts 1.7 — — 1.7Interest rate swaps 17.7 23.9 0.7 42.3Cross-currency interest rate swaps 70.7 198.1 — 268.8Bank loans 31.7 1,131.4 180.8 1,343.9US Private Placement — Senior Notes 69.9 306.6 413.7 790.2HRC Securitisation facility 3.4 — — 3.41,632.5 1,660.0 595.2 3,887.7Net contractual cash flows (68.6) (1,481.5) (583.6) (2,133.7)

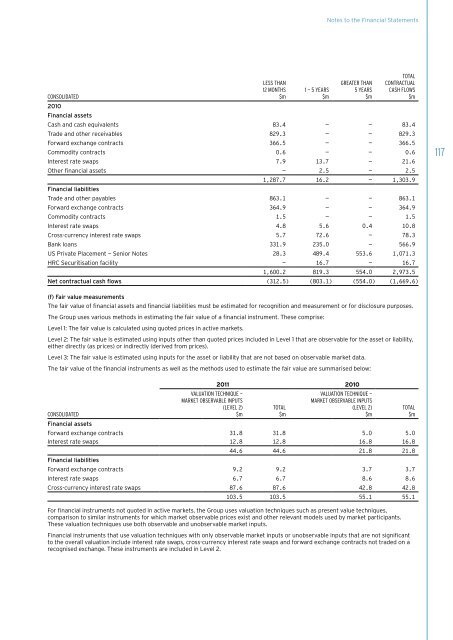

Notes to the Financial StatementsCONSOLIDATEDLess than12 months$m1 — 5 years$mGreater than5 years$mTotalcontractualcash flows$m2010Financial assetsCash and cash equivalents 83.4 — — 83.4Trade and other receivables 829.3 — — 829.3Forward exchange contracts 366.5 — — 366.5Commodity contracts 0.6 — — 0.6Interest rate swaps 7.9 13.7 — 21.6Other financial assets — 2.5 — 2.51,287.7 16.2 — 1,303.9Financial liabilitiesTrade and other payables 863.1 — — 863.1Forward exchange contracts 364.9 — — 364.9Commodity contracts 1.5 — — 1.5Interest rate swaps 4.8 5.6 0.4 10.8Cross-currency interest rate swaps 5.7 72.6 — 78.3Bank loans 331.9 235.0 — 566.9US Private Placement — Senior Notes 28.3 489.4 553.6 1,071.3HRC Securitisation facility — 16.7 — 16.71,600.2 819.3 554.0 2,973.5Net contractual cash flows (312.5) (803.1) (554.0) (1,669.6)117(f) Fair value measurementsThe fair value of financial assets and financial liabilities must be estimated for recognition and measurement or for disclosure purposes.The Group uses various methods in estimating the fair value of a financial instrument. These comprise:Level 1: The fair value is calculated using quoted prices in active markets.Level 2: The fair value is estimated using inputs other than quoted prices included in Level 1 that are observable for the asset or liability,either directly (as prices) or indirectly (derived from prices).Level 3: The fair value is estimated using inputs for the asset or liability that are not based on observable market data.The fair value of the financial instruments as well as the methods used to estimate the fair value are summarised below:CONSOLIDATEDFinancial assetsValuation technique —market observable inputs(Level 2)$m2011 2010Total$mValuation technique —market observable inputs(Level 2)$mForward exchange contracts 31.8 31.8 5.0 5.0Interest rate swaps 12.8 12.8 16.8 16.844.6 44.6 21.8 21.8Financial liabilitiesForward exchange contracts 9.2 9.2 3.7 3.7Interest rate swaps 6.7 6.7 8.6 8.6Cross-currency interest rate swaps 87.6 87.6 42.8 42.8103.5 103.5 55.1 55.1For financial instruments not quoted in active markets, the Group uses valuation techniques such as present value techniques,comparison to similar instruments for which market observable prices exist and other relevant models used by market participants.These valuation techniques use both observable and unobservable market inputs.Financial instruments that use valuation techniques with only observable market inputs or unobservable inputs that are not significantto the overall valuation include interest rate swaps, cross-currency interest rate swaps and forward exchange contracts not traded on arecognised exchange. These instruments are included in Level 2.Total$m