BROADENING OUR HORIZONS - Arrium

BROADENING OUR HORIZONS - Arrium

BROADENING OUR HORIZONS - Arrium

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

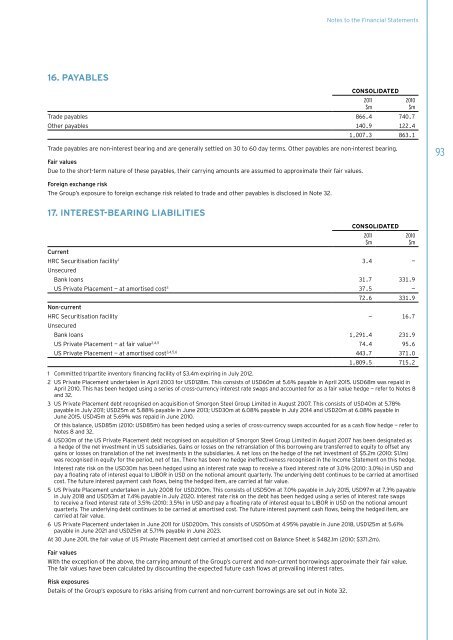

Notes to the Financial Statements16. PayablesCONSOLIDATEDTrade payables 866.4 740.7Other payables 140.9 122.42011$m2010$m1,007.3 863.1Trade payables are non-interest bearing and are generally settled on 30 to 60 day terms. Other payables are non-interest bearing.Fair valuesDue to the short-term nature of these payables, their carrying amounts are assumed to approximate their fair values.93Foreign exchange riskThe Group’s exposure to foreign exchange risk related to trade and other payables is disclosed in Note 32.17. Interest-bearing liabilitiesCONSOLIDATED2011$m2010$mCurrentHRC Securitisation facility 1 3.4 —UnsecuredBank loans 31.7 331.9US Private Placement — at amortised cost 3 37.5 —72.6 331.9Non-currentHRC Securitisation facility — 16.7UnsecuredBank loans 1,291.4 231.9US Private Placement — at fair value 2,4,5 74.4 95.6US Private Placement — at amortised cost 3,4,5,6 443.7 371.01,809.5 715.21 Committed tripartite inventory financing facility of $3.4m expiring in July 2012.2 US Private Placement undertaken in April 2003 for USD128m. This consists of USD60m at 5.6% payable in April 2015. USD68m was repaid inApril 2010. This has been hedged using a series of cross-currency interest rate swaps and accounted for as a fair value hedge — refer to Notes 8and 32.3 US Private Placement debt recognised on acquisition of Smorgon Steel Group Limited in August 2007. This consists of USD40m at 5.78%payable in July 2011; USD25m at 5.88% payable in June 2013; USD30m at 6.08% payable in July 2014 and USD20m at 6.08% payable inJune 2015. USD45m at 5.69% was repaid in June 2010.Of this balance, USD85m (2010: USD85m) has been hedged using a series of cross-currency swaps accounted for as a cash flow hedge — refer toNotes 8 and 32.4 USD30m of the US Private Placement debt recognised on acquisition of Smorgon Steel Group Limited in August 2007 has been designated asa hedge of the net investment in US subsidiaries. Gains or losses on the retranslation of this borrowing are transferred to equity to offset anygains or losses on translation of the net investments in the subsidiaries. A net loss on the hedge of the net investment of $5.2m (2010: $1.1m)was recognised in equity for the period, net of tax. There has been no hedge ineffectiveness recognised in the Income Statement on this hedge.Interest rate risk on the USD30m has been hedged using an interest rate swap to receive a fixed interest rate of 3.0% (2010: 3.0%) in USD andpay a floating rate of interest equal to LIBOR in USD on the notional amount quarterly. The underlying debt continues to be carried at amortisedcost. The future interest payment cash flows, being the hedged item, are carried at fair value.5 US Private Placement undertaken in July 2008 for USD200m. This consists of USD50m at 7.0% payable in July 2015, USD97m at 7.3% payablein July 2018 and USD53m at 7.4% payable in July 2020. Interest rate risk on the debt has been hedged using a series of interest rate swapsto receive a fixed interest rate of 3.5% (2010: 3.5%) in USD and pay a floating rate of interest equal to LIBOR in USD on the notional amountquarterly. The underlying debt continues to be carried at amortised cost. The future interest payment cash flows, being the hedged item, arecarried at fair value.6 US Private Placement undertaken in June 2011 for USD200m. This consists of USD50m at 4.95% payable in June 2018, USD125m at 5.61%payable in June 2021 and USD25m at 5.71% payable in June 2023.At 30 June 2011, the fair value of US Private Placement debt carried at amortised cost on Balance Sheet is $482.1m (2010: $371.2m).Fair valuesWith the exception of the above, the carrying amount of the Group’s current and non-current borrowings approximate their fair value.The fair values have been calculated by discounting the expected future cash flows at prevailing interest rates.Risk exposuresDetails of the Group’s exposure to risks arising from current and non-current borrowings are set out in Note 32.