BROADENING OUR HORIZONS - Arrium

BROADENING OUR HORIZONS - Arrium

BROADENING OUR HORIZONS - Arrium

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

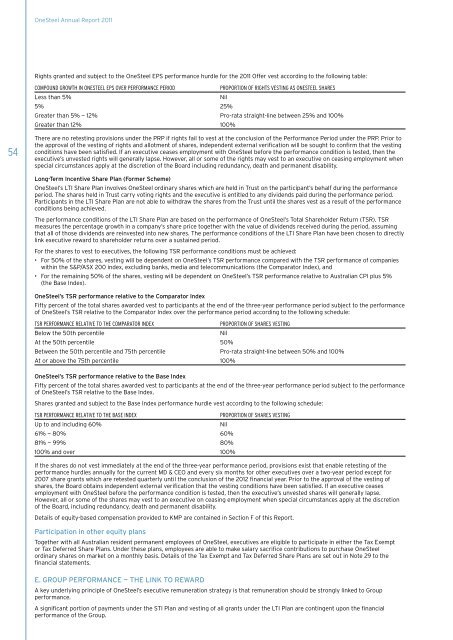

OneSteel Annual Report 2011Rights granted and subject to the OneSteel EPS performance hurdle for the 2011 Offer vest according to the following table:Compound growth in OneSteel EPS over performance periodProportion of rights vesting as OneSteel sharesLess than 5%Nil5% 25%Greater than 5% — 12% Pro-rata straight-line between 25% and 100%Greater than 12% 100%54There are no retesting provisions under the PRP if rights fail to vest at the conclusion of the Performance Period under the PRP. Prior tothe approval of the vesting of rights and allotment of shares, independent external verification will be sought to confirm that the vestingconditions have been satisfied. If an executive ceases employment with OneSteel before the performance condition is tested, then theexecutive’s unvested rights will generally lapse. However, all or some of the rights may vest to an executive on ceasing employment whenspecial circumstances apply at the discretion of the Board including redundancy, death and permanent disability.Long-Term Incentive Share Plan (Former Scheme)OneSteel’s LTI Share Plan involves OneSteel ordinary shares which are held in Trust on the participant’s behalf during the performanceperiod. The shares held in Trust carry voting rights and the executive is entitled to any dividends paid during the performance period.Participants in the LTI Share Plan are not able to withdraw the shares from the Trust until the shares vest as a result of the performanceconditions being achieved.The performance conditions of the LTI Share Plan are based on the performance of OneSteel’s Total Shareholder Return (TSR). TSRmeasures the percentage growth in a company’s share price together with the value of dividends received during the period, assumingthat all of those dividends are reinvested into new shares. The performance conditions of the LTI Share Plan have been chosen to directlylink executive reward to shareholder returns over a sustained period.For the shares to vest to executives, the following TSR performance conditions must be achieved:• For 50% of the shares, vesting will be dependent on OneSteel’s TSR performance compared with the TSR performance of companieswithin the S&P/ASX 200 index, excluding banks, media and telecommunications (the Comparator Index), and• For the remaining 50% of the shares, vesting will be dependent on OneSteel’s TSR performance relative to Australian CPI plus 5%(the Base Index).OneSteel’s TSR performance relative to the Comparator IndexFifty percent of the total shares awarded vest to participants at the end of the three-year performance period subject to the performanceof OneSteel’s TSR relative to the Comparator Index over the performance period according to the following schedule:TSR Performance relative to the Comparator IndexProportion of shares vestingBelow the 50th percentileNilAt the 50th percentile 50%Between the 50th percentile and 75th percentile Pro-rata straight-line between 50% and 100%At or above the 75th percentile 100%OneSteel’s TSR performance relative to the Base IndexFifty percent of the total shares awarded vest to participants at the end of the three-year performance period subject to the performanceof OneSteel’s TSR relative to the Base Index.Shares granted and subject to the Base Index performance hurdle vest according to the following schedule:TSR Performance relative to the Base IndexProportion of shares vestingUp to and including 60%Nil61% — 80% 60%81% — 99% 80%100% and over 100%If the shares do not vest immediately at the end of the three-year performance period, provisions exist that enable retesting of theperformance hurdles annually for the current MD & CEO and every six months for other executives over a two-year period except for2007 share grants which are retested quarterly until the conclusion of the 2012 financial year. Prior to the approval of the vesting ofshares, the Board obtains independent external verification that the vesting conditions have been satisfied. If an executive ceasesemployment with OneSteel before the performance condition is tested, then the executive’s unvested shares will generally lapse.However, all or some of the shares may vest to an executive on ceasing employment when special circumstances apply at the discretionof the Board, including redundancy, death and permanent disability.Details of equity-based compensation provided to KMP are contained in Section F of this Report.Participation in other equity plansTogether with all Australian resident permanent employees of OneSteel, executives are eligible to participate in either the Tax Exemptor Tax Deferred Share Plans. Under these plans, employees are able to make salary sacrifice contributions to purchase OneSteelordinary shares on market on a monthly basis. Details of the Tax Exempt and Tax Deferred Share Plans are set out in Note 29 to thefinancial statements.E. GROUP PERFORMANCE — THE LINK TO REWARDA key underlying principle of OneSteel’s executive remuneration strategy is that remuneration should be strongly linked to Groupperformance.A significant portion of payments under the STI Plan and vesting of all grants under the LTI Plan are contingent upon the financialperformance of the Group.