BROADENING OUR HORIZONS - Arrium

BROADENING OUR HORIZONS - Arrium

BROADENING OUR HORIZONS - Arrium

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

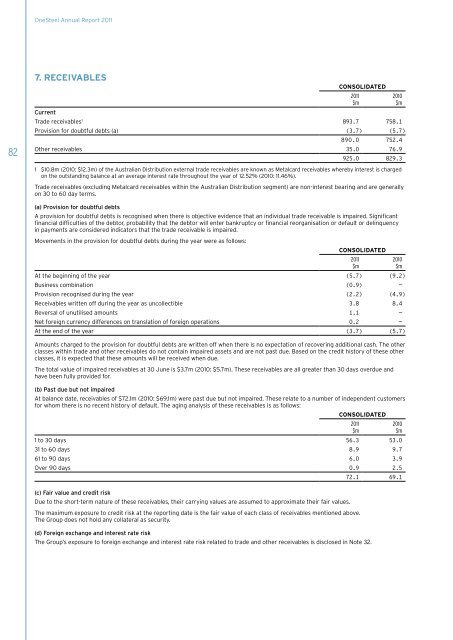

OneSteel Annual Report 2011827. ReceivablesCONSOLIDATEDCurrentTrade receivables 1 893.7 758.1Provision for doubtful debts (a) (3.7) (5.7)890.0 752.4Other receivables 35.0 76.9925.0 829.32011$m2010$m1 $10.8m (2010: $12.3m) of the Australian Distribution external trade receivables are known as Metalcard receivables whereby interest is chargedon the outstanding balance at an average interest rate throughout the year of 12.52% (2010: 11.46%).Trade receivables (excluding Metalcard receivables within the Australian Distribution segment) are non-interest bearing and are generallyon 30 to 60 day terms.(a) Provision for doubtful debtsA provision for doubtful debts is recognised when there is objective evidence that an individual trade receivable is impaired. Significantfinancial difficulties of the debtor, probability that the debtor will enter bankruptcy or financial reorganisation or default or delinquencyin payments are considered indicators that the trade receivable is impaired.Movements in the provision for doubtful debts during the year were as follows:CONSOLIDATEDAt the beginning of the year (5.7) (9.2)Business combination (0.9) —Provision recognised during the year (2.2) (4.9)Receivables written off during the year as uncollectible 3.8 8.4Reversal of unutilised amounts 1.1 —Net foreign currency differences on translation of foreign operations 0.2 —At the end of the year (3.7) (5.7)Amounts charged to the provision for doubtful debts are written off when there is no expectation of recovering additional cash. The otherclasses within trade and other receivables do not contain impaired assets and are not past due. Based on the credit history of these otherclasses, it is expected that these amounts will be received when due.The total value of impaired receivables at 30 June is $3.7m (2010: $5.7m). These receivables are all greater than 30 days overdue andhave been fully provided for.(b) Past due but not impairedAt balance date, receivables of $72.1m (2010: $69.1m) were past due but not impaired. These relate to a number of independent customersfor whom there is no recent history of default. The aging analysis of these receivables is as follows:CONSOLIDATED1 to 30 days 56.3 53.031 to 60 days 8.9 9.761 to 90 days 6.0 3.9Over 90 days 0.9 2.572.1 69.1(c) Fair value and credit riskDue to the short-term nature of these receivables, their carrying values are assumed to approximate their fair values.The maximum exposure to credit risk at the reporting date is the fair value of each class of receivables mentioned above.The Group does not hold any collateral as security.(d) Foreign exchange and interest rate riskThe Group’s exposure to foreign exchange and interest rate risk related to trade and other receivables is disclosed in Note 32.2011$m2011$m2010$m2010$m