OneSteel Annual Report 2011REMUNERATION REPORT50The Directors of OneSteel Limited presentthe Remuneration Report, which formspart of the Directors’ Report, for theOneSteel Group.This Remuneration Report has beenprepared in accordance with theCorporations Act 2001 (Cth) and theCorporations Regulations 2001 and hasbeen audited.Remuneration governance and theHuman Resources CommitteeThe Board is responsible for remunerationdecisions at the OneSteel Group. To assistthe Board, governance and oversight ofremuneration is delegated to the HumanResources Committee. The HumanResources Committee responsibilities,which can be referenced in more detail onthe Company’s website, include:• Reviewing remuneration policies andpractices including the setting of fixedremuneration amounts and the structureand quantum of awards under the Short-Term Incentive (STI) and Long-TermIncentive (LTI) Plans for executives• The Group’s superannuationarrangements for executives, and• The fees for Non-Executive Directors ofthe Board (within the aggregate amountapproved by shareholders).The Human Resources Committeecomprising three Non-Executive Directorshas direct access to independentadvice and comparative studies onthe appropriateness of remunerationarrangements. The Human ResourcesCommittee makes recommendations to theBoard. The Board makes final remunerationdecisions in respect of Non‐ExecutiveDirectors and the Lead Team (see“Definitions” below).The members of the Human ResourcesCommittee, number of meetings andattendance is presented on page 48 of theDirectors’ Report.DefinitionsFor the purposes of this report:Key Management Personnel (KMP) arethose persons having authority andresponsibility for planning, directing andcontrolling the activities of the OneSteelGroup either directly or indirectly, includingthe CEO of Steel & Tube Holdings Limited,a New Zealand listed company in whichOneSteel holds a 50.3% interest, andall the Directors of OneSteel Limited(Executive and Non-Executive).Lead Team encompasses the MD & CEO anddirect reports to the MD & CEO.Dealing in Company securitiesDirectors and relevant executives areprecluded from trading in OneSteel sharesat any time if they are aware of pricesensitive information that has not beenmade public. Subject to that overridingrule, Company policy permits Directorsand relevant executives to deal in OneSteelsecurities during a trading window 1 of fourweeks commencing at the conclusion ofthe event on the date on which each of thefollowing events occurs:• The Company’s Annual General Meeting• Release of the Company’s half yearlyresults announcement to the ASX• Release of the Company’s yearly resultsannouncement to the ASX, and• Release of a disclosure document orcleansing notice in connection withan offering of OneSteel securities inthe Company.Directors and executives must not use anyderivatives or enter into margin lendingarrangements in relation to OneSteelsecurities without prior approval from theChairman for Directors and the MD & CEOfor others.The MD & CEO has entitlements to sharesunder the Long-Term Incentive Share Plan,subject to performance hurdles being met.Current shareholdings of Directors areshown in Note 30 to the Financial Report.1 Dealing in OneSteel securities is prohibitedif they are aware of inside information.Contents of the RemunerationReportThe Remuneration Report outlinesOneSteel’s remuneration strategy, thecomponents of remuneration for KMP,including Non-Executive Directors andexecutives, the link between performanceand reward and provides details ofremuneration paid to Non-ExecutiveDirectors and executives during the yearended 30 June 2011. The report is dividedinto the following sections:A. Remuneration Overview 2010-2011B. Non-Executive Director remunerationC. Overview of executive remunerationstrategy and structureD. Executive remunerationE. Group performance – the link to rewardF. Details of Non-Executive Director andexecutive remuneration for the yearended 30 June 2011G. Executive service agreementsA. REMUNERATION OVERVIEW2010-2011There have been some importantremuneration-related developmentsduring the year ended 30 June 2011 inrelation to remuneration to ensure that theCompany continues to apply appropriateand contemporary practices. Whilst theseare set out in more detail throughoutthe report, an overview, including thekey developments and changes, issummarised below:• The Long-Term Incentive (LTI) Planwas reviewed as committed to at lastyear’s Annual General Meeting. Thereview involved input from independentand specialist advisers including EganAssociates and Clayton Utz with thekey change being a Performance RightsPlan (PRP) replacing the Share Plan.Other significant changes includedmodifications to performance hurdlesand the discontinuance of retesting.Refer to Section D of the report.• As a result of these changes to the LTI,for a transition period the Companywill be operating both plans untilperformance measurement periodsexpire for grants made under theprevious plan. Executives will continue toreceive any dividends declared for grantsmade of OneSteel shares prior to 2011during this transition period.• Individual Non-Executive Directorfee amounts were last reviewed andamended in September 2007. Thesewere reviewed during the year, againwith the involvement of an independentand specialist adviser, GodfreyRemuneration Group. The reviewfollowed the significant restructuringof the Board during the year ended 30June 2011, and resulted in an increasein fees paid to Non-Executive Directorsand the introduction of separatecommittee fees. These changes havebeen accommodated within the existingAggregate Fee Limit and were appliedfrom 1 January 2011.• In February 2011, the Board Chairman andthe Executive General Manager HumanResources met with a significant numberof OneSteel’s major shareholders andtwo proxyhouse advisers to discuss andreceive feedback on key remunerationmatters. The process specifically involvedconsideration of the above mentionedreviews of the LTI Plan and Non-ExecutiveDirector remuneration as well as theapplication of the STI Plan. Feedbackobtained from these discussions wastaken into account by the Board prior tofinalisation of these reviews.• There were no other significantdevelopments or changes in theCompany’s approach to remuneration.The financial results for the Companyduring the year were such that Short-Term Incentive (STI) Plan outcomes forexecutives were well below the targetlevel and there was no vesting of sharesunder the LTI Share Plan.

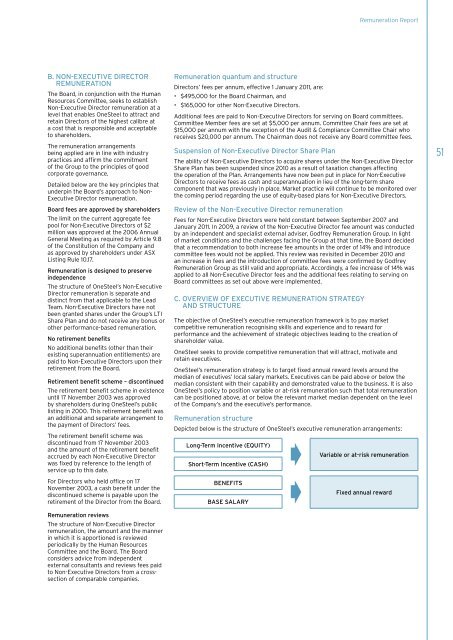

Remuneration ReportB. NON-EXECUTIVE DIRECTORREMUNERATIONThe Board, in conjunction with the HumanResources Committee, seeks to establishNon-Executive Director remuneration at alevel that enables OneSteel to attract andretain Directors of the highest calibre ata cost that is responsible and acceptableto shareholders.The remuneration arrangementsbeing applied are in line with industrypractices and affirm the commitmentof the Group to the principles of goodcorporate governance.Detailed below are the key principles thatunderpin the Board’s approach to Non-Executive Director remuneration.Board fees are approved by shareholdersThe limit on the current aggregate feepool for Non-Executive Directors of $2million was approved at the 2006 AnnualGeneral Meeting as required by Article 9.8of the Constitution of the Company andas approved by shareholders under ASXListing Rule 10.17.Remuneration is designed to preserveindependenceThe structure of OneSteel’s Non-ExecutiveDirector remuneration is separate anddistinct from that applicable to the LeadTeam. Non-Executive Directors have notbeen granted shares under the Group’s LTIShare Plan and do not receive any bonus orother performance-based remuneration.No retirement benefitsNo additional benefits (other than theirexisting superannuation entitlements) arepaid to Non-Executive Directors upon theirretirement from the Board.Retirement benefit scheme – discontinuedThe retirement benefit scheme in existenceuntil 17 November 2003 was approvedby shareholders during OneSteel’s publiclisting in 2000. This retirement benefit wasan additional and separate arrangement tothe payment of Directors’ fees.The retirement benefit scheme wasdiscontinued from 17 November 2003and the amount of the retirement benefitaccrued by each Non-Executive Directorwas fixed by reference to the length ofservice up to this date.Remuneration quantum and structureDirectors’ fees per annum, effective 1 January 2011, are:• $495,000 for the Board Chairman, and• $165,000 for other Non-Executive Directors.Additional fees are paid to Non-Executive Directors for serving on Board committees.Committee Member fees are set at $5,000 per annum. Committee Chair fees are set at$15,000 per annum with the exception of the Audit & Compliance Committee Chair whoreceives $20,000 per annum. The Chairman does not receive any Board committee fees.Suspension of Non-Executive Director Share PlanThe ability of Non-Executive Directors to acquire shares under the Non-Executive DirectorShare Plan has been suspended since 2010 as a result of taxation changes affectingthe operation of the Plan. Arrangements have now been put in place for Non-ExecutiveDirectors to receive fees as cash and superannuation in lieu of the long-term sharecomponent that was previously in place. Market practice will continue to be monitored overthe coming period regarding the use of equity-based plans for Non-Executive Directors.Review of the Non-Executive Director remunerationFees for Non-Executive Directors were held constant between September 2007 andJanuary 2011. In 2009, a review of the Non-Executive Director fee amount was conductedby an independent and specialist external adviser, Godfrey Remuneration Group. In lightof market conditions and the challenges facing the Group at that time, the Board decidedthat a recommendation to both increase fee amounts in the order of 14% and introducecommittee fees would not be applied. This review was revisited in December 2010 andan increase in fees and the introduction of committee fees were confirmed by GodfreyRemuneration Group as still valid and appropriate. Accordingly, a fee increase of 14% wasapplied to all Non-Executive Director fees and the additional fees relating to serving onBoard committees as set out above were implemented.C. OVERVIEW OF EXECUTIVE REMUNERATION STRATEGYAND STRUCTUREThe objective of OneSteel’s executive remuneration framework is to pay marketcompetitive remuneration recognising skills and experience and to reward forperformance and the achievement of strategic objectives leading to the creation ofshareholder value.OneSteel seeks to provide competitive remuneration that will attract, motivate andretain executives.OneSteel’s remuneration strategy is to target fixed annual reward levels around themedian of executives’ local salary markets. Executives can be paid above or below themedian consistent with their capability and demonstrated value to the business. It is alsoOneSteel’s policy to position variable or at-risk remuneration such that total remunerationcan be positioned above, at or below the relevant market median dependent on the levelof the Company’s and the executive’s performance.Remuneration structureDepicted below is the structure of OneSteel’s executive remuneration arrangements:Long-Term Incentive (EQUITY)Short-Term Incentive (CASH)Variable or at-risk remuneration51For Directors who held office on 17November 2003, a cash benefit under thediscontinued scheme is payable upon theretirement of the Director from the Board.Remuneration reviewsThe structure of Non-Executive Directorremuneration, the amount and the mannerin which it is apportioned is reviewedperiodically by the Human ResourcesCommittee and the Board. The Boardconsiders advice from independentexternal consultants and reviews fees paidto Non-Executive Directors from a crosssectionof comparable companies.BENEFITSBASE SALARYFixed annual reward