BROADENING OUR HORIZONS - Arrium

BROADENING OUR HORIZONS - Arrium

BROADENING OUR HORIZONS - Arrium

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

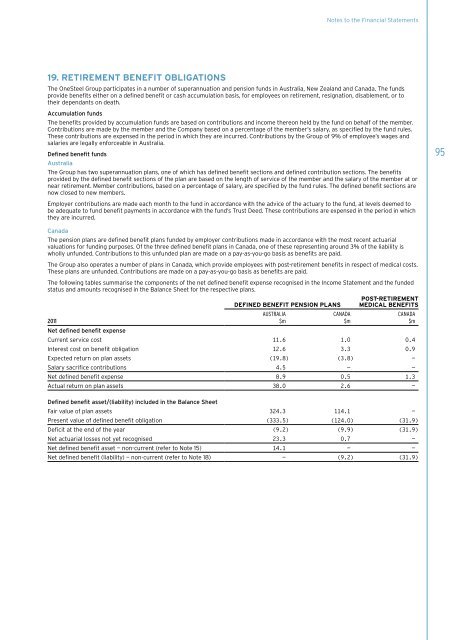

Notes to the Financial Statements19. Retirement benefit obligationsThe OneSteel Group participates in a number of superannuation and pension funds in Australia, New Zealand and Canada. The fundsprovide benefits either on a defined benefit or cash accumulation basis, for employees on retirement, resignation, disablement, or totheir dependants on death.Accumulation fundsThe benefits provided by accumulation funds are based on contributions and income thereon held by the fund on behalf of the member.Contributions are made by the member and the Company based on a percentage of the member’s salary, as specified by the fund rules.These contributions are expensed in the period in which they are incurred. Contributions by the Group of 9% of employee’s wages andsalaries are legally enforceable in Australia.Defined benefit fundsAustraliaThe Group has two superannuation plans, one of which has defined benefit sections and defined contribution sections. The benefitsprovided by the defined benefit sections of the plan are based on the length of service of the member and the salary of the member at ornear retirement. Member contributions, based on a percentage of salary, are specified by the fund rules. The defined benefit sections arenow closed to new members.95Employer contributions are made each month to the fund in accordance with the advice of the actuary to the fund, at levels deemed tobe adequate to fund benefit payments in accordance with the fund’s Trust Deed. These contributions are expensed in the period in whichthey are incurred.CanadaThe pension plans are defined benefit plans funded by employer contributions made in accordance with the most recent actuarialvaluations for funding purposes. Of the three defined benefit plans in Canada, one of these representing around 3% of the liability iswholly unfunded. Contributions to this unfunded plan are made on a pay-as-you-go basis as benefits are paid.The Group also operates a number of plans in Canada, which provide employees with post-retirement benefits in respect of medical costs.These plans are unfunded. Contributions are made on a pay-as-you-go basis as benefits are paid.The following tables summarise the components of the net defined benefit expense recognised in the Income Statement and the fundedstatus and amounts recognised in the Balance Sheet for the respective plans.Post-retirementDefined benefit pension plans medical benefitsAUSTRALIA CANADA CANADA2011 $m $m $mNet defined benefit expenseCurrent service cost 11.6 1.0 0.4Interest cost on benefit obligation 12.6 3.3 0.9Expected return on plan assets (19.8) (3.8) —Salary sacrifice contributions 4.5 — —Net defined benefit expense 8.9 0.5 1.3Actual return on plan assets 38.0 2.6 —Defined benefit asset/(liability) included in the Balance SheetFair value of plan assets 324.3 114.1 —Present value of defined benefit obligation (333.5) (124.0) (31.9)Deficit at the end of the year (9.2) (9.9) (31.9)Net actuarial losses not yet recognised 23.3 0.7 —Net defined benefit asset — non-current (refer to Note 15) 14.1 — —Net defined benefit (liability) — non-current (refer to Note 18) — (9.2) (31.9)