BROADENING OUR HORIZONS - Arrium

BROADENING OUR HORIZONS - Arrium

BROADENING OUR HORIZONS - Arrium

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

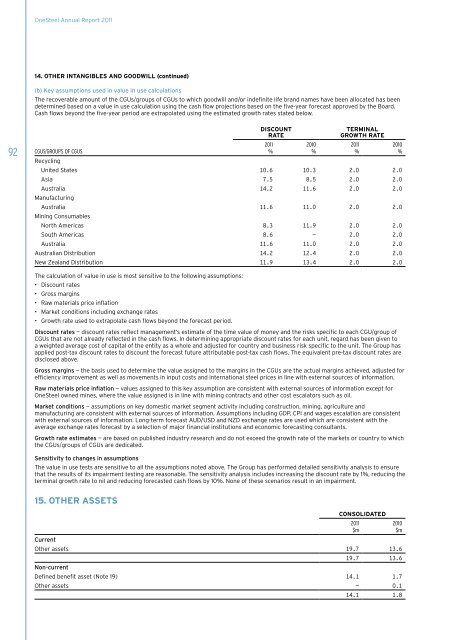

OneSteel Annual Report 201114. Other intangibles and goodwill (continued)(b) Key assumptions used in value in use calculationsThe recoverable amount of the CGUs/groups of CGUs to which goodwill and/or indefinite life brand names have been allocated has beendetermined based on a value in use calculation using the cash flow projections based on the five-year forecast approved by the Board.Cash flows beyond the five-year period are extrapolated using the estimated growth rates stated below.92DISCOUNTRATE2011%TERMINALGROWTH RATE2011%20102010CGUS/GROUPS OF CGUS%%RecyclingUnited States 10.6 10.3 2.0 2.0Asia 7.5 8.5 2.0 2.0Australia 14.2 11.6 2.0 2.0ManufacturingAustralia 11.6 11.0 2.0 2.0Mining ConsumablesNorth Americas 8.3 11.9 2.0 2.0South Americas 8.6 — 2.0 2.0Australia 11.6 11.0 2.0 2.0Australian Distribution 14.2 12.4 2.0 2.0New Zealand Distribution 11.9 13.4 2.0 2.0The calculation of value in use is most sensitive to the following assumptions:• Discount rates• Gross margins• Raw materials price inflation• Market conditions including exchange rates• Growth rate used to extrapolate cash flows beyond the forecast period.Discount rates — discount rates reflect management’s estimate of the time value of money and the risks specific to each CGU/group ofCGUs that are not already reflected in the cash flows. In determining appropriate discount rates for each unit, regard has been given toa weighted average cost of capital of the entity as a whole and adjusted for country and business risk specific to the unit. The Group hasapplied post-tax discount rates to discount the forecast future attributable post-tax cash flows. The equivalent pre-tax discount rates aredisclosed above.Gross margins — the basis used to determine the value assigned to the margins in the CGUs are the actual margins achieved, adjusted forefficiency improvement as well as movements in input costs and international steel prices in line with external sources of information.Raw materials price inflation — values assigned to this key assumption are consistent with external sources of information except forOneSteel owned mines, where the value assigned is in line with mining contracts and other cost escalators such as oil.Market conditions — assumptions on key domestic market segment activity including construction, mining, agriculture andmanufacturing are consistent with external sources of information. Assumptions including GDP, CPI and wages escalation are consistentwith external sources of information. Long-term forecast AUD/USD and NZD exchange rates are used which are consistent with theaverage exchange rates forecast by a selection of major financial institutions and economic forecasting consultants.Growth rate estimates — are based on published industry research and do not exceed the growth rate of the markets or country to whichthe CGUs/groups of CGUs are dedicated.Sensitivity to changes in assumptionsThe value in use tests are sensitive to all the assumptions noted above. The Group has performed detailed sensitivity analysis to ensurethat the results of its impairment testing are reasonable. The sensitivity analysis includes increasing the discount rate by 1%, reducing theterminal growth rate to nil and reducing forecasted cash flows by 10%. None of these scenarios result in an impairment.15. Other assetsCONSOLIDATED2011$m2010$mCurrentOther assets 19.7 13.619.7 13.6Non-currentDefined benefit asset (Note 19) 14.1 1.7Other assets — 0.114.1 1.8