Regulatory and policy options to encourage development of ...

Regulatory and policy options to encourage development of ...

Regulatory and policy options to encourage development of ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

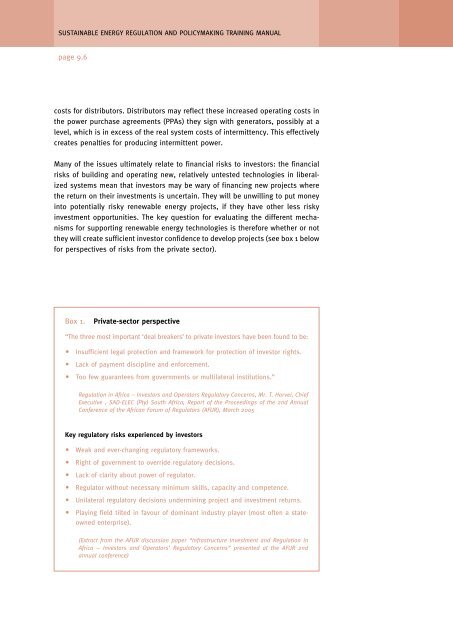

SUSTAINABLE ENERGY REGULATION AND POLICYMAKING TRAINING MANUALpage 9.6costs for distribu<strong>to</strong>rs. Distribu<strong>to</strong>rs may reflect these increased operating costs inthe power purchase agreements (PPAs) they sign with genera<strong>to</strong>rs, possibly at alevel, which is in excess <strong>of</strong> the real system costs <strong>of</strong> intermittency. This effectivelycreates penalties for producing intermittent power.Many <strong>of</strong> the issues ultimately relate <strong>to</strong> financial risks <strong>to</strong> inves<strong>to</strong>rs: the financialrisks <strong>of</strong> building <strong>and</strong> operating new, relatively untested technologies in liberalizedsystems mean that inves<strong>to</strong>rs may be wary <strong>of</strong> financing new projects wherethe return on their investments is uncertain. They will be unwilling <strong>to</strong> put moneyin<strong>to</strong> potentially risky renewable energy projects, if they have other less riskyinvestment opportunities. The key question for evaluating the different mechanismsfor supporting renewable energy technologies is therefore whether or notthey will create sufficient inves<strong>to</strong>r confidence <strong>to</strong> develop projects (see box 1 belowfor perspectives <strong>of</strong> risks from the private sec<strong>to</strong>r).Box 1.Private-sec<strong>to</strong>r perspective“The three most important ‘deal breakers’ <strong>to</strong> private inves<strong>to</strong>rs have been found <strong>to</strong> be:Insufficient legal protection <strong>and</strong> framework for protection <strong>of</strong> inves<strong>to</strong>r rights.Lack <strong>of</strong> payment discipline <strong>and</strong> enforcement.Too few guarantees from governments or multilateral institutions.”Regulation in Africa – Inves<strong>to</strong>rs <strong>and</strong> Opera<strong>to</strong>rs <strong>Regula<strong>to</strong>ry</strong> Concerns, Mr. T. Horvei, ChiefExecutive , SAD-ELEC (Pty) South Africa, Report <strong>of</strong> the Proceedings <strong>of</strong> the 2nd AnnualConference <strong>of</strong> the African Forum <strong>of</strong> Regula<strong>to</strong>rs (AFUR), March 2005Key regula<strong>to</strong>ry risks experienced by inves<strong>to</strong>rsWeak <strong>and</strong> ever-changing regula<strong>to</strong>ry frameworks.Right <strong>of</strong> government <strong>to</strong> override regula<strong>to</strong>ry decisions.Lack <strong>of</strong> clarity about power <strong>of</strong> regula<strong>to</strong>r.Regula<strong>to</strong>r without necessary minimum skills, capacity <strong>and</strong> competence.Unilateral regula<strong>to</strong>ry decisions undermining project <strong>and</strong> investment returns.Playing field tilted in favour <strong>of</strong> dominant industry player (most <strong>of</strong>ten a stateownedenterprise).(Extract from the AFUR discussion paper “Infrastructure Investment <strong>and</strong> Regulation inAfrica – Inves<strong>to</strong>rs <strong>and</strong> Opera<strong>to</strong>rs’ <strong>Regula<strong>to</strong>ry</strong> Concerns” presented at the AFUR 2ndannual conference)