How to Use Agency Credit Card in Trams Back Office

How to Use Agency Credit Card in Trams Back Office

How to Use Agency Credit Card in Trams Back Office

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

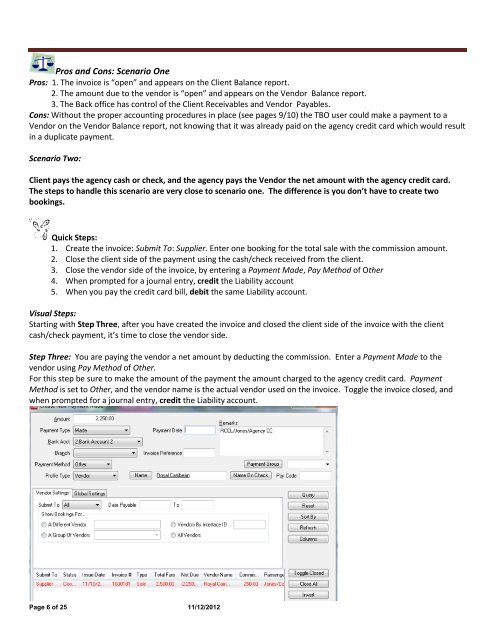

Pros and Cons: Scenario OnePros: 1. The <strong>in</strong>voice is “open” and appears on the Client Balance report.2. The amount due <strong>to</strong> the vendor is “open” and appears on the Vendor Balance report.3. The <strong>Back</strong> office has control of the Client Receivables and Vendor Payables.Cons: Without the proper account<strong>in</strong>g procedures <strong>in</strong> place (see pages 9/10) the TBO user could make a payment <strong>to</strong> aVendor on the Vendor Balance report, not know<strong>in</strong>g that it was already paid on the agency credit card which would result<strong>in</strong> a duplicate payment.Scenario Two:Client pays the agency cash or check, and the agency pays the Vendor the net amount with the agency credit card.The steps <strong>to</strong> handle this scenario are very close <strong>to</strong> scenario one. The difference is you don’t have <strong>to</strong> create twobook<strong>in</strong>gs.Quick Steps:1. Create the <strong>in</strong>voice: Submit To: Supplier. Enter one book<strong>in</strong>g for the <strong>to</strong>tal sale with the commission amount.2. Close the client side of the payment us<strong>in</strong>g the cash/check received from the client.3. Close the vendor side of the <strong>in</strong>voice, by enter<strong>in</strong>g a Payment Made, Pay Method of Other4. When prompted for a journal entry, credit the Liability account5. When you pay the credit card bill, debit the same Liability account.Visual Steps:Start<strong>in</strong>g with Step Three, after you have created the <strong>in</strong>voice and closed the client side of the <strong>in</strong>voice with the clientcash/check payment, it’s time <strong>to</strong> close the vendor side.Step Three: You are pay<strong>in</strong>g the vendor a net amount by deduct<strong>in</strong>g the commission. Enter a Payment Made <strong>to</strong> thevendor us<strong>in</strong>g Pay Method of Other.For this step be sure <strong>to</strong> make the amount of the payment the amount charged <strong>to</strong> the agency credit card. PaymentMethod is set <strong>to</strong> Other, and the vendor name is the actual vendor used on the <strong>in</strong>voice. Toggle the <strong>in</strong>voice closed, andwhen prompted for a journal entry, credit the Liability account.Page 6 of 25 11/12/2012