Fiscal Year 2011-2012 Adopted Budget - County of Sonoma

Fiscal Year 2011-2012 Adopted Budget - County of Sonoma

Fiscal Year 2011-2012 Adopted Budget - County of Sonoma

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

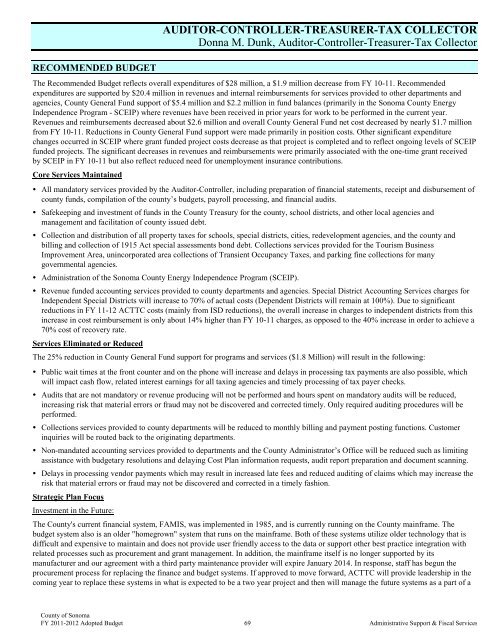

RECOMMENDED BUDGET<br />

AUDITOR-CONTROLLER-TREASURER-TAX COLLECTOR<br />

Donna M. Dunk, Auditor-Controller-Treasurer-Tax Collector<br />

The Recommended <strong>Budget</strong> reflects overall expenditures <strong>of</strong> $28 million, a $1.9 million decrease from FY 10-11. Recommended<br />

expenditures are supported by $20.4 million in revenues and internal reimbursements for services provided to other departments and<br />

agencies, <strong>County</strong> General Fund support <strong>of</strong> $5.4 million and $2.2 million in fund balances (primarily in the <strong>Sonoma</strong> <strong>County</strong> Energy<br />

Independence Program - SCEIP) where revenues have been received in prior years for work to be performed in the current year.<br />

Revenues and reimbursements decreased about $2.6 million and overall <strong>County</strong> General Fund net cost decreased by nearly $1.7 million<br />

from FY 10-11. Reductions in <strong>County</strong> General Fund support were made primarily in position costs. Other significant expenditure<br />

changes occurred in SCEIP where grant funded project costs decrease as that project is completed and to reflect ongoing levels <strong>of</strong> SCEIP<br />

funded projects. The significant decreases in revenues and reimbursements were primarily associated with the one-time grant received<br />

by SCEIP in FY 10-11 but also reflect reduced need for unemployment insurance contributions.<br />

Core Services Maintained<br />

• All mandatory services provided by the Auditor-Controller, including preparation <strong>of</strong> financial statements, receipt and disbursement <strong>of</strong><br />

county funds, compilation <strong>of</strong> the county’s budgets, payroll processing, and financial audits.<br />

• Safekeeping and investment <strong>of</strong> funds in the <strong>County</strong> Treasury for the county, school districts, and other local agencies and<br />

management and facilitation <strong>of</strong> county issued debt.<br />

• Collection and distribution <strong>of</strong> all property taxes for schools, special districts, cities, redevelopment agencies, and the county and<br />

billing and collection <strong>of</strong> 1915 Act special assessments bond debt. Collections services provided for the Tourism Business<br />

Improvement Area, unincorporated area collections <strong>of</strong> Transient Occupancy Taxes, and parking fine collections for many<br />

governmental agencies.<br />

• Administration <strong>of</strong> the <strong>Sonoma</strong> <strong>County</strong> Energy Independence Program (SCEIP).<br />

• Revenue funded accounting services provided to county departments and agencies. Special District Accounting Services charges for<br />

Independent Special Districts will increase to 70% <strong>of</strong> actual costs (Dependent Districts will remain at 100%). Due to significant<br />

reductions in FY 11-12 ACTTC costs (mainly from ISD reductions), the overall increase in charges to independent districts from this<br />

increase in cost reimbursement is only about 14% higher than FY 10-11 charges, as opposed to the 40% increase in order to achieve a<br />

70% cost <strong>of</strong> recovery rate.<br />

Services Eliminated or Reduced<br />

The 25% reduction in <strong>County</strong> General Fund support for programs and services ($1.8 Million) will result in the following:<br />

• Public wait times at the front counter and on the phone will increase and delays in processing tax payments are also possible, which<br />

will impact cash flow, related interest earnings for all taxing agencies and timely processing <strong>of</strong> tax payer checks.<br />

• Audits that are not mandatory or revenue producing will not be performed and hours spent on mandatory audits will be reduced,<br />

increasing risk that material errors or fraud may not be discovered and corrected timely. Only required auditing procedures will be<br />

performed.<br />

• Collections services provided to county departments will be reduced to monthly billing and payment posting functions. Customer<br />

inquiries will be routed back to the originating departments.<br />

• Non-mandated accounting services provided to departments and the <strong>County</strong> Administrator’s Office will be reduced such as limiting<br />

assistance with budgetary resolutions and delaying Cost Plan information requests, audit report preparation and document scanning.<br />

• Delays in processing vendor payments which may result in increased late fees and reduced auditing <strong>of</strong> claims which may increase the<br />

risk that material errors or fraud may not be discovered and corrected in a timely fashion.<br />

Strategic Plan Focus<br />

Investment in the Future:<br />

The <strong>County</strong>'s current financial system, FAMIS, was implemented in 1985, and is currently running on the <strong>County</strong> mainframe. The<br />

budget system also is an older "homegrown" system that runs on the mainframe. Both <strong>of</strong> these systems utilize older technology that is<br />

difficult and expensive to maintain and does not provide user friendly access to the data or support other best practice integration with<br />

related processes such as procurement and grant management. In addition, the mainframe itself is no longer supported by its<br />

manufacturer and our agreement with a third party maintenance provider will expire January 2014. In response, staff has begun the<br />

procurement process for replacing the finance and budget systems. If approved to move forward, ACTTC will provide leadership in the<br />

coming year to replace these systems in what is expected to be a two year project and then will manage the future systems as a part <strong>of</strong> a<br />

<strong>County</strong> <strong>of</strong> <strong>Sonoma</strong><br />

FY <strong>2011</strong>-<strong>2012</strong> <strong>Adopted</strong> <strong>Budget</strong><br />

69<br />

Administrative Support & <strong>Fiscal</strong> Services