ANNUAL REPORT 06 - Bosnalijek dd

ANNUAL REPORT 06 - Bosnalijek dd

ANNUAL REPORT 06 - Bosnalijek dd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

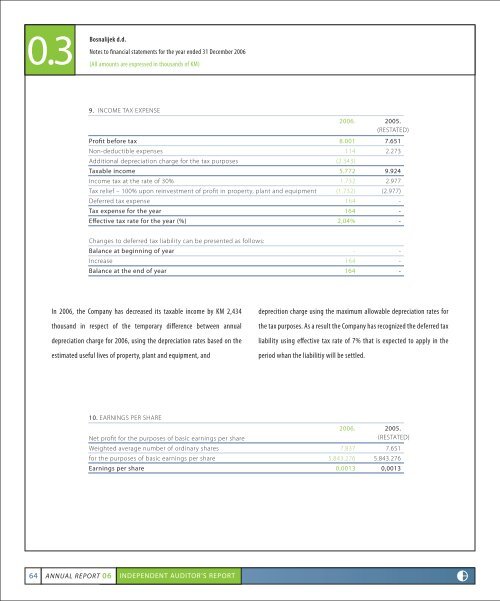

<strong>Bosnalijek</strong> d.d.Notes to financial statements for the year ended 31 December 20<strong>06</strong>(All amounts are expressed in thousands of KM)9. INCOME TAX EXPENSEProfit before taxNon-deductible expensesA<strong>dd</strong>itional depreciation charge for the tax purposesTaxable incomeIncome tax at the rate of 30%Tax relief – 100% upon reinvestment of profit in property, plant and equipmentDeferred tax expenseTax expense for the yearEffective tax rate for the year (%)20<strong>06</strong>.8.001114(2.343)5.7721.732(1.732)1641642,04%2005.(RESTATED)7.6512.2739.9242.977(2.977)---Changes to deferred tax liability can be presented as follows:Balance at beginning of yearIncreaseBalance at the end of year-164164---In 20<strong>06</strong>, the Company has decreased its taxable income by KM 2,434thousand in respect of the temporary difference between annualdepreciation charge for 20<strong>06</strong>, using the depreciation rates based on theestimated useful lives of property, plant and equipment, an<strong>dd</strong>eprecition charge using the maximum allowable depreciation rates forthe tax purposes. As a result the Company has recognized the deferred taxliability using effective tax rate of 7% that is expected to apply in theperiod whan the liabilitiy will be settled.10. EARNINGS PER SHARENet profit for the purposes of basic earnings per shareWeighted average number of ordinary sharesfor the purposes of basic earnings per shareEarnings per share20<strong>06</strong>.7.8375.843.2760,00132005.(RESTATED)7.6515.843.2760,001364 <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>06</strong> INDEPENDENT AUDITOR’S <strong>REPORT</strong>