ANNUAL REPORT 06 - Bosnalijek dd

ANNUAL REPORT 06 - Bosnalijek dd

ANNUAL REPORT 06 - Bosnalijek dd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

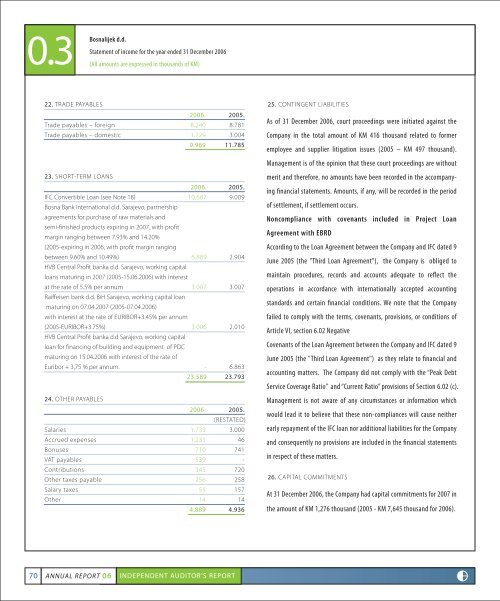

<strong>Bosnalijek</strong> d.d.Statement of income for the year ended 31 December 20<strong>06</strong>(All amounts are expressed in thousands of KM)22. TRADE PAYABLES20<strong>06</strong>.Trade payables – foreign8.240Trade payables – domestic1.7299.96923. SHORT-TERM LOANS20<strong>06</strong>.IFC Convertible Loan (see Note 18)10.687Bosna Bank International d.d. Sarajevo, partnershipagreements for purchase of raw materials andsemi-finished products expiring in 2007, with profitmargin ranging between 7.93% and 14.20%(2005-expiring in 20<strong>06</strong>, with profit margin rangingbetween 9.60% and 10.49%)6.889HVB Central Profit banka d.d. Sarajevo, working capitalloans maturing in 2007 (2005-15.<strong>06</strong>.20<strong>06</strong>) with interestat the rate of 5.5% per annum3.007Raiffeisen bank d.d. BiH Sarajevo, working capital loanmaturing on 07.04.2007 (2005-07.04.20<strong>06</strong>)with interest at the rate of EURIBOR+3.45% per annum(2005-EURIBOR+3.75%)3.0<strong>06</strong>HVB Central Profit banka d.d Sarajevo, working capitalloan for financing of building and equipment of PDCmaturing on 15.04.20<strong>06</strong> with interest of the rate ofEuribor + 3,75 % per annum.-23.58924. OTHER PAYABLES20<strong>06</strong>.Salaries1.739Accrued expenses1.231Bonuses710VAT payables539Contributions345Other taxes payable256Salary taxes55Other144.8892005.8.7813.00411.7852005.9.0092.9043.0072.01<strong>06</strong>.86323.7932005.(RESTATED)3.00046741-720258157144.93625. CONTINGENT LIABILITIESAs of 31 December 20<strong>06</strong>, court proceedings were initiated against theCompany in the total amount of KM 416 thousand related to formeremployee and supplier litigation issues (2005 – KM 497 thousand).Management is of the opinion that these court proceedings are withoutmerit and therefore, no amounts have been recorded in the accompanyingfinancial statements. Amounts, if any, will be recorded in the periodof settlement, if settlement occurs.Noncompliance with covenants included in Project LoanAgreement with EBRDAccording to the Loan Agreement between the Company and IFC dated 9June 2005 (the "Third Loan Agreement"), the Company is obliged tomaintain procedures, records and accounts adequate to reflect theoperations in accordance with internationally accepted accountingstandards and certain financial conditions. We note that the Companyfailed to comply with the terms, covenants, provisions, or conditions ofArticle VI, section 6.02 NegativeCovenants of the Loan Agreement between the Company and IFC dated 9June 2005 (the "Third Loan Agreement") as they relate to financial andaccounting matters. The Company did not comply with the “Peak DebtService Coverage Ratio” and “Current Ratio” provisions of Section 6.02 (c).Management is not aware of any circumstances or information whichwould lead it to believe that these non-compliances will cause neitherearly repayment of the IFC loan nor a<strong>dd</strong>itional liabilities for the Companyand consequently no provisions are included in the financial statementsin respect of these matters.26. CAPITAL COMMITMENTSAt 31 December 20<strong>06</strong>, the Company had capital commitments for 2007 inthe amount of KM 1,276 thousand (2005 - KM 7,645 thousand for 20<strong>06</strong>).70 <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>06</strong> INDEPENDENT AUDITOR’S <strong>REPORT</strong>