Annual report 2011 - Trelleborg

Annual report 2011 - Trelleborg

Annual report 2011 - Trelleborg

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE GROUP IN BRIEF<br />

IMPROVED EARNINGS AND<br />

STRENGTHENED FINANCES<br />

Developments in the Group’s segments<br />

The market conditions among the Group’s segments varied over the course of<br />

the year. Demand for industrial capital goods was strong throughout the year,<br />

particularly during the first six months. Demand remained healthy in the automotive<br />

industry, principally in Germany, the US and Asia. In the agricultural industry,<br />

demand was highly favorable. The total order level for project-related operations<br />

in offshore oil & gas and infrastructure varied during the year, particularly during<br />

the latter part, impacted by extended lead times. The Group’s market positions<br />

were generally retained or improved during the year.<br />

Net sales<br />

Demand was favorable in most of <strong>Trelleborg</strong>’s segments. The Group’s sales to<br />

the general industry, light vehicles, transportation equipment, agriculture and<br />

aerospace segments were higher than in 2010. Sales in the offshore oil & gas<br />

and infrastructure segments were lower compared with the preceding year. Net<br />

sales increased by 7 percent for the Group’s continuing operations.<br />

Earnings<br />

Consolidated operating profit rose compared with 2010. The improvement was<br />

attributable to higher sales volumes and a strengthened offering, combined with<br />

the more efficient use of resources.<br />

Operating profit increased in the <strong>Trelleborg</strong> Sealing Solutions and <strong>Trelleborg</strong><br />

Wheel Systems business areas, driven by a high organic growth rate within the<br />

scope of a streamlined cost structure.<br />

Operating profit for <strong>Trelleborg</strong> Engineered Systems declined, mainly due to<br />

lower project deliveries, production disruptions in offshore oil & gas and start-up<br />

costs in Brazil. Other parts of the business area performed well during the year.<br />

Operating profit declined slightly for <strong>Trelleborg</strong> Automotive, primarily as a result<br />

of higher and volatile raw material prices. For further information, refer to the<br />

respective business areas on pages 8, 10, 12 and 14.<br />

Cash flow<br />

Cash flow was lower than in 2010. The favorable generation of earnings was<br />

offset by a significant rise in working capital, which was a direct result of<br />

increased sales. A higher investment level compared with the preceding year<br />

also impacted cash flow.<br />

Net debt – capital structure<br />

The capital structure remained favorable. Net debt was maintained at a level<br />

that was on a par with 2010. Combined with the improved earnings generation,<br />

this also resulted in a marginal improvement of the key figure net debt in relation<br />

to EBITDA.<br />

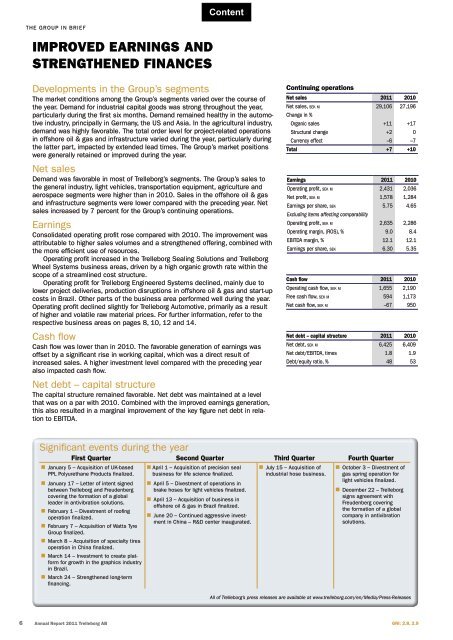

Continuing operations<br />

Net sales <strong>2011</strong> 2010<br />

Net sales, sek m 29,106 27,196<br />

Change in %<br />

Organic sales +11 +17<br />

Structural change +2 0<br />

Currency effect –6 –7<br />

Total +7 +10<br />

Earnings <strong>2011</strong> 2010<br />

Operating profit, sek m 2,431 2,036<br />

Net profit, sek m 1,578 1,284<br />

Earnings per share, sek<br />

Excluding items affecting comparability<br />

5.75 4.65<br />

Operating profit, sek m 2,635 2,286<br />

Operating margin, (ROS), % 9.0 8.4<br />

EBITDA margin, % 12.1 12.1<br />

Earnings per share, sek 6.30 5.35<br />

Cash flow <strong>2011</strong> 2010<br />

Operating cash flow, sek m 1,655 2,190<br />

Free cash flow, sek m 594 1,173<br />

Net cash flow, sek m –67 950<br />

Net debt – capital structure <strong>2011</strong> 2010<br />

Net debt, sek m 6,425 6,409<br />

Net debt/EBITDA, times 1.8 1.9<br />

Debt/equity ratio, % 48 53<br />

Significant events during the year<br />

First Quarter Second Quarter Third Quarter Fourth Quarter<br />

January 5 – Acquisition of UK-based<br />

PPL Polyurethane Products finalized.<br />

January 17 – Letter of intent signed<br />

between <strong>Trelleborg</strong> and Freudenberg<br />

covering the formation of a global<br />

leader in antivibration solutions.<br />

February 1 – Divestment of roofing<br />

operation finalized.<br />

February 7 – Acquisition of Watts Tyre<br />

Group finalized.<br />

March 8 – Acquisition of specialty tires<br />

operation in China finalized.<br />

March 14 – Investment to create platform<br />

for growth in the graphics industry<br />

in Brazil.<br />

March 24 – Strengthened long-term<br />

financing.<br />

6 <strong>Annual</strong> Report <strong>2011</strong> <strong>Trelleborg</strong> AB<br />

April 1 – Acquisition of precision seal<br />

business for life science finalized.<br />

April 5 – Divestment of operations in<br />

brake hoses for light vehicles finalized.<br />

April 13 – Acquisition of business in<br />

offshore oil & gas in Brazil finalized.<br />

June 20 – Continued aggressive investment<br />

in China – R&D center inaugurated.<br />

July 15 – Acquisition of<br />

industrial hose business.<br />

October 3 – Divestment of<br />

gas spring operation for<br />

light vehicles finalized.<br />

December 22 – <strong>Trelleborg</strong><br />

signs agreement with<br />

Freudenberg covering<br />

the formation of a global<br />

company in antivibration<br />

solutions.<br />

All of <strong>Trelleborg</strong>’s press releases are available at www.trelleborg.com/en/Media/Press-Releases<br />

GRI: 2.8, 2.9