Annual report 2011 - Trelleborg

Annual report 2011 - Trelleborg

Annual report 2011 - Trelleborg

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

32<br />

GOVERNANCE AND RESPONSIBILITY – RISKS AND RISK MANAGEMENT<br />

Financial risks, cont.<br />

Risk description and policy Exposure and comments<br />

Translation risks – Income statement<br />

Exchange-rate fluctuations impact the Group’s<br />

earnings in connection with the translation of<br />

foreign subsidiaries’ income statements to sek.<br />

Policy. The Group does not normally hedge this<br />

risk.<br />

Translation risks – Balance sheet<br />

When translating the Group’s investments in<br />

foreign subsidiaries to sek, there is a risk that<br />

the Group’s balance sheet will be impacted by<br />

changes in exchange rates. The Group has<br />

significant net investments in foreign<br />

subsidiaries and associated companies.<br />

Policy. Investments in foreign subsidiaries and<br />

associated companies may be hedged in a<br />

range of between 0 and 100 percent of the<br />

investment’s value (which, because of the tax<br />

effect, implies a maximum hedge ratio of<br />

approximately 70 percent of the investment’s<br />

value). The decision regarding possible hedging<br />

measures is taken following an overall evaluation<br />

of foreign exchange rate levels and the effects<br />

on net financial items, liquidity and taxes,<br />

as well as on the Group’s debt/equity ratio.<br />

Interest-rate risks<br />

Because most of <strong>Trelleborg</strong>’s net debt bears<br />

variable interest, the Group focuses on managing<br />

the cash-flow risk related to interest rate<br />

fluctuations, meaning the risk that movements<br />

in market interest rates could have an impact<br />

on the financial cash flow and earnings. The<br />

scope of the impact depends on the fixed<br />

interest term of the borrowing and investment.<br />

The Group seeks a balance between a reasonable<br />

current cost of borrowing and the risk of<br />

having a significantly negative impact on earnings<br />

in the event of a sudden major movement<br />

in interest rates. <strong>Trelleborg</strong> employs interestrate<br />

hedging when it is considered appropriate.<br />

Policy. Borrowing – The average fixed-interest<br />

term on the Group’s gross borrowing, including<br />

the impact of derivative instruments, may not<br />

exceed four years.<br />

Investments – The average fixed-interest<br />

term on interest-bearing investments, including<br />

the impact of derivative instruments, may not<br />

exceed two years on a maximum amount of sek<br />

2,000 m, or the equivalent amount in other<br />

currencies.<br />

<strong>Annual</strong> Report <strong>2011</strong> <strong>Trelleborg</strong> AB<br />

<strong>Trelleborg</strong>’s earnings are largely generated outside Sweden. Accordingly, the impact of exchange-rate fluctuations<br />

on the Group’s sales and earnings can be significant. In <strong>2011</strong>, operating profit for continuing operations<br />

was affected by a total of neg. sek 165 m (neg: 122) and net profit in an amount of neg. sek 102 m<br />

(neg: 65), due to exchange-rate fluctuations upon translation of the income statements of foreign<br />

subsidiaries.<br />

Translation effects: foreign exchange effects on income statement (sek m)<br />

Currency Net sales Operating profit Net Profit/loss<br />

EUR –698 –51 –33<br />

GBP –139 –15 –11<br />

USD –612 –46 –20<br />

Other –314 –53 –38<br />

Total <strong>2011</strong> –1,763 –165 –102<br />

Total 2010 –1,707 –122 –65<br />

At year-end <strong>2011</strong>, net investments in <strong>Trelleborg</strong>’s foreign operations amounted to approximately<br />

sek 20,766 m (18,876). In <strong>2011</strong>, <strong>Trelleborg</strong>’s translation differences amounted to negative sek 30 m<br />

(neg: 1,223), calculated after hedging with deductions for estimated taxes.<br />

At year-end <strong>2011</strong>, 45 percent (47) of net investments were hedged.<br />

If sek appreciates by 1 percent in relation to all currencies in which the <strong>Trelleborg</strong> Group has foreign net<br />

investments, there would be a change in shareholders’ equity of neg. sek 137 m (neg: 120) after tax effects.<br />

Sensitivity analysis: translation risk in balance sheet, after consideration<br />

of possible tax effects (sek m)<br />

Currency Net investment,<br />

sek m<br />

Hedging,<br />

%<br />

Effect on equity, if sek 1%<br />

stronger, sek m<br />

EUR 10,479 53% –64<br />

GBP 1,963 60% –11<br />

USD 2,520 45% –17<br />

Other 5,804 24% –45<br />

Total <strong>2011</strong> 20,766 45% –137<br />

Total 2010 18,876 47% –120<br />

The Group’s average interest-bearing net debt amounted to sek 6,775 m (7,847) during the year. Net financial<br />

items corresponded to 3.1 percent (2.8) of the average net debt, while net interest items corresponded<br />

to 2.2 percent (2.2).<br />

At December 31, <strong>2011</strong>, the Group’s interest-bearing debt totaled sek 7,623 m (7,505). The average<br />

fixed-interest term, including derivatives, was approximately 16 months (15 months). At December 31,<br />

outstanding interest-bearing investments amounted to sek 1,198 m (1,096), with an average period of fixed<br />

interest of approximately 11 months (3.5). At year-end, the Group’s net interest-bearing debt amounted to<br />

sek 6,425 m (6,409) with an average remaining period of fixed interest of about 17 months (17 months).<br />

Based on the level of interest-bearing net at year-end, a one percent point rise in market interest rates<br />

in all currencies in which the Group has loans or investments would generate a net cost increase of approximately<br />

sek 24 m (22) after tax effects in net financial items for 2012. The currencies with the greatest<br />

impact are eur, usd and gbp. Taking into account the interest-rate hedges in place at year-end, and for which<br />

hedge accounting has been applied, an increase in the market interest rates of one percentage point in<br />

currencies that have been hedged would have a positive impact on other comprehensive income of sek 67 m<br />

(66) after tax effects.<br />

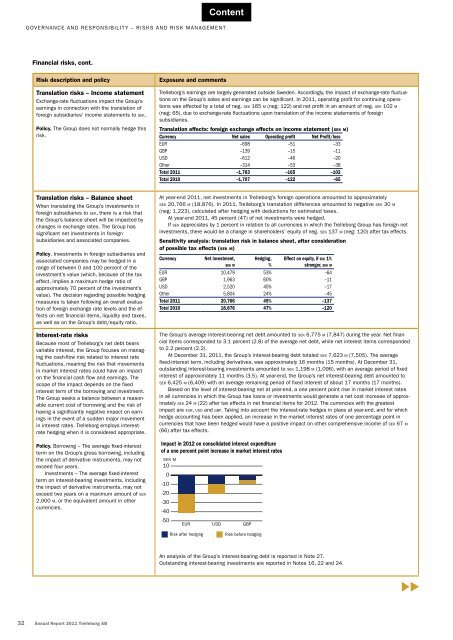

Impact in 2012 on consolidated interest expenditure<br />

of a one percent point increase in market interest rates<br />

SEK M<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

EUR USD GBP<br />

Risk after hedging<br />

Risk before hedging<br />

An analysis of the Group’s interest-bearing debt is <strong>report</strong>ed in Note 27.<br />

Outstanding interest-bearing investments are <strong>report</strong>ed in Notes 16, 22 and 24.