Annual report 2011 - Trelleborg

Annual report 2011 - Trelleborg

Annual report 2011 - Trelleborg

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BUSINESS AREA<br />

TRELLEBORG<br />

AUTOMOTIVE<br />

Market segments:<br />

Light vehicles and Transportation<br />

Equipment (trucks):<br />

• Antivibration Solutions: noise and<br />

vibration-damping solutions for all<br />

vehicle segments.<br />

• Damping Solutions: brake shims<br />

and applied damping materials<br />

(ADM).<br />

• Insulation & Applied Solutions: polymer<br />

boots for drive shafts and<br />

steering applications as well as<br />

other customized products.<br />

Production units:<br />

Brazil, China, France, Germany, India,<br />

Mexico, Romania, Russia, South<br />

Korea, Spain, Sweden, Turkey and<br />

the US.<br />

Key customers<br />

Audi, Benteler, BMW, Chrysler,<br />

Delphi, FAW, Fiat, Ford, GKN, GM,<br />

Hendrickson, Hyundai, Mazda,<br />

Maruti, Mercedes Benz, Nexteer, PSA,<br />

Renault Nissan, Suzuki, Tata, Tenneco<br />

Monroe, Toyota, Volvo and VW.<br />

Principal competitors<br />

Anvis, Bridgestone, Cooper Standard,<br />

Continental, DTR, Freudenberg/<br />

Vibracoustic, Hutchinson/Paulstra,<br />

Keeper, Kwang Duk Auto, Meneta,<br />

MSC, NOK, Tokai, Wolverine, ZF and<br />

Zhongding.<br />

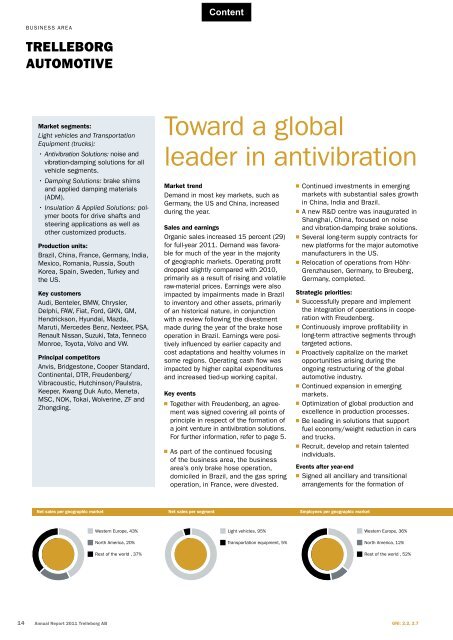

Net sales per geographic market<br />

14 <strong>Annual</strong> Report <strong>2011</strong> <strong>Trelleborg</strong> AB<br />

Western Europe, 43%<br />

North America, 20%<br />

Rest of the world , 37%<br />

Toward a global<br />

leader in antivibration<br />

Market trend<br />

Demand in most key markets, such as<br />

Germany, the US and China, increased<br />

during the year.<br />

Sales and earnings<br />

Organic sales increased 15 percent (29)<br />

for full-year <strong>2011</strong>. Demand was favorable<br />

for much of the year in the majority<br />

of geographic markets. Operating profit<br />

dropped slightly compared with 2010,<br />

primarily as a result of rising and volatile<br />

raw-material prices. Earnings were also<br />

impacted by impairments made in Brazil<br />

to inventory and other assets, primarily<br />

of an historical nature, in conjunction<br />

with a review following the divestment<br />

made during the year of the brake hose<br />

operation in Brazil. Earnings were positively<br />

influenced by earlier capacity and<br />

cost adaptations and healthy volumes in<br />

some regions. Operating cash flow was<br />

impacted by higher capital expenditures<br />

and increased tied-up working capital.<br />

Key events<br />

Together with Freudenberg, an agreement<br />

was signed covering all points of<br />

principle in respect of the formation of<br />

a joint venture in antivibration solutions.<br />

For further information, refer to page 5.<br />

As part of the continued focusing<br />

of the business area, the business<br />

area’s only brake hose operation,<br />

domiciled in Brazil, and the gas spring<br />

operation, in France, were divested.<br />

Net sales per segment<br />

Light vehicles, 95%<br />

Transportation equipment, 5%<br />

Continued investments in emerging<br />

markets with substantial sales growth<br />

in China, India and Brazil.<br />

A new R&D centre was inaugurated in<br />

Shanghai, China, focused on noise<br />

and vibration-damping brake solutions.<br />

Several long-term supply contracts for<br />

new platforms for the major automotive<br />

manufacturers in the US.<br />

Relocation of operations from Höhr-<br />

Grenzhausen, Germany, to Breuberg,<br />

Germany, completed.<br />

Strategic priorities:<br />

Successfully prepare and implement<br />

the integration of operations in cooperation<br />

with Freudenberg.<br />

Continuously improve profitability in<br />

long-term attractive segments through<br />

targeted actions.<br />

Proactively capitalize on the market<br />

opportunities arising during the<br />

ongoing restructuring of the global<br />

automotive industry.<br />

Continued expansion in emerging<br />

markets.<br />

Optimization of global production and<br />

excellence in production processes.<br />

Be leading in solutions that support<br />

fuel economy/weight reduction in cars<br />

and trucks.<br />

Recruit, develop and retain talented<br />

individuals.<br />

Events after year-end<br />

Signed all ancillary and transitional<br />

arrangements for the formation of<br />

Employees per geographic market<br />

Western Europe, 36%<br />

North America, 12%<br />

Rest of the world , 52%<br />

GRI: 2.2, 2.7