pn to commit a class 3 felony commits a class 4 felony.

pn to commit a class 3 felony commits a class 4 felony.

pn to commit a class 3 felony commits a class 4 felony.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

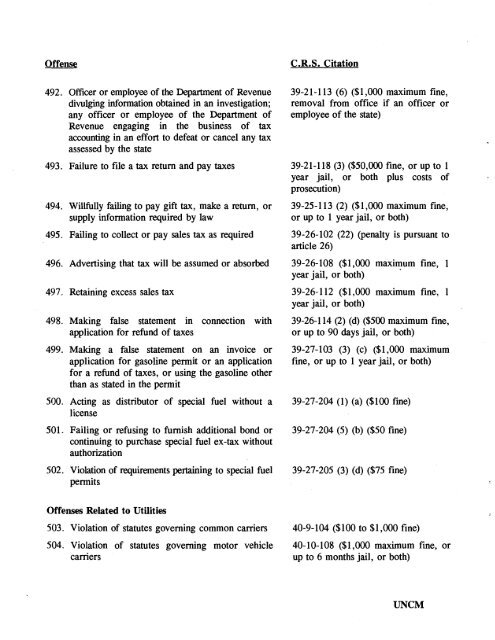

C.R.S. Citation<br />

492. Officer or employee of the Department of Revenue 39-2 1 -1 13 (6) ($1,000 maximum fine,<br />

divulging information obtained in an investigation; removal from office if an officer or<br />

any officer or employee of the Department of employee of the state)<br />

Revenue engaging in the business of tax<br />

accounting in an effort <strong>to</strong> defeat or cancel any tax<br />

assessed by the state<br />

493. Failure <strong>to</strong> file a tax return and pay taxes 39-21-1 18 (3) ($50,000 fine, or up <strong>to</strong> 1<br />

year jail, or both plus costs of<br />

prosecution)<br />

Willfully failing <strong>to</strong> pay gift tax, make a return, or 39-25-1 13 (2) ($1,000 maximum fine,<br />

supply information required by law or up <strong>to</strong> 1 year jail, or both)<br />

Failing <strong>to</strong> collect or pay sales tax as required 39-26-102 (22) (penalty is pursuant <strong>to</strong><br />

article 26)<br />

Advertising that tax will be assumed or absorbed 39-26-108 ($1,000 maximum fine, 1<br />

year jail, or both)<br />

Retaining excess sales tax 39-26-112 ($1,000 maximum fine, 1<br />

year jail, or both)<br />

Making false statement in connection with 39-26-1 14 (2) (d) ($500 maximum fine,<br />

application for refund of taxes or up <strong>to</strong> 90 days jail, or both)<br />

Making a false statement on an invoice or 39-27-103 (3) (c) ($1,000 maximum<br />

application for gasoline permit or an application fine, or up <strong>to</strong> 1 year jail, or both)<br />

for a refund of taxes, or using the gasoline other<br />

than as stated in the permit<br />

Acting as distribu<strong>to</strong>r of special fuel without a 39-27-204 (1) (a) ($100 fine)<br />

license<br />

Failing or refusing <strong>to</strong> furnish additional bond or 39-27-204 (5) (b) ($50 fine)<br />

continuing <strong>to</strong> purchase special fuel ex-tax without<br />

authorization<br />

502. Violation of requirements pertaining <strong>to</strong> special fuel 39-27-205 (3) (d) ($75 fine)<br />

permits<br />

Offenses Related <strong>to</strong> Utilities<br />

503. Violation of statutes governing common carriers 40-9-104 ($100 <strong>to</strong> $1,000 fine)<br />

504. Violation of statutes governing mo<strong>to</strong>r vehicle 40-10-108 ($1,000 maximum fine, or<br />

carriers up <strong>to</strong> 6 months jail, or both)<br />

UNCM