2012 Full-year results: Presentation - Unibail-Rodamco

2012 Full-year results: Presentation - Unibail-Rodamco

2012 Full-year results: Presentation - Unibail-Rodamco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

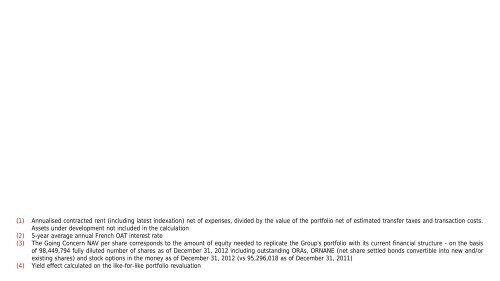

(1) Annualised contracted rent (including latest indexation) net of expenses, divided by the value of the portfolio net of estimated transfer taxes and transaction costs.Assets under development not included in the calculation(2) 5-<strong>year</strong> average annual French OAT interest rate(3) The Going Concern NAV per share corresponds to the amount of equity needed to replicate the Group’s portfolio with its current financial structure - on the basisof 98,449,794 fully diluted number of shares as of December 31, <strong>2012</strong> including outstanding ORAs, ORNANE (net share settled bonds convertible into new and/orexisting shares) and stock options in the money as of December 31, <strong>2012</strong> (vs 95,296,018 as of December 31, 2011)(4) Yield effect calculated on the like-for-like portfolio revaluation