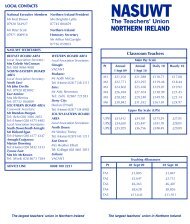

NASUWT Representatives

NASUWT Representatives

NASUWT Representatives

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

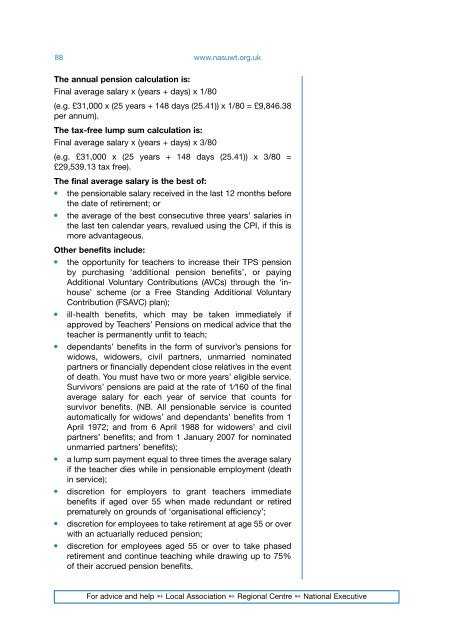

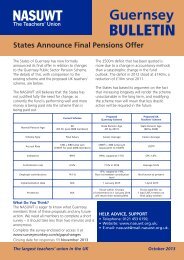

88 www.nasuwt.org.ukThe annual pension calculation is:Final average salary x (years + days) x 1/80(e.g. £31,000 x (25 years + 148 days (25.41)) x 1/80 = £9,846.38per annum).The tax-free lump sum calculation is:Final average salary x (years + days) x 3/80(e.g. £31,000 x (25 years + 148 days (25.41)) x 3/80 =£29,539.13 tax free).The final average salary is the best of:l the pensionable salary received in the last 12 months beforethe date of retirement; orl the average of the best consecutive three years’ salaries inthe last ten calendar years, revalued using the CPI, if this ismore advantageous.Other benefits include:l the opportunity for teachers to increase their TPS pensionby purchasing ‘additional pension benefits’, or payingAdditional Voluntary Contributions (AVCs) through the ‘inhouse’scheme (or a Free Standing Additional VoluntaryContribution (FSAVC) plan);l ill-health benefits, which may be taken immediately ifapproved by Teachers’ Pensions on medical advice that theteacher is permanently unfit to teach;l dependants’ benefits in the form of survivor’s pensions forwidows, widowers, civil partners, unmarried nominatedpartners or financially dependent close relatives in the eventof death. You must have two or more years’ eligible service.Survivors’ pensions are paid at the rate of 1⁄160 of the finalaverage salary for each year of service that counts forsurvivor benefits. (NB. All pensionable service is countedautomatically for widows’ and dependants’ benefits from 1April 1972; and from 6 April 1988 for widowers’ and civilpartners’ benefits; and from 1 January 2007 for nominatedunmarried partners’ benefits);l a lump sum payment equal to three times the average salaryif the teacher dies while in pensionable employment (deathin service);l discretion for employers to grant teachers immediatebenefits if aged over 55 when made redundant or retiredprematurely on grounds of ‘organisational efficiency’;l discretion for employees to take retirement at age 55 or overwith an actuarially reduced pension;l discretion for employees aged 55 or over to take phasedretirement and continue teaching while drawing up to 75%of their accrued pension benefits.For advice and help ˚ Local Association ˚ Regional Centre ˚ National Executive

![Salaries (London & Fringe) 2012-2013 [pdf - 281 kb] - NASUWT](https://img.yumpu.com/47816007/1/190x112/salaries-london-fringe-2012-2013-pdf-281-kb-nasuwt.jpg?quality=85)