Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

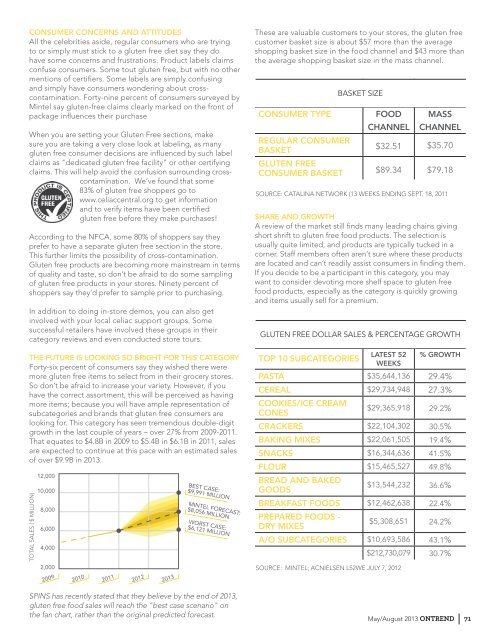

Consumer Concerns and AttitudesAll the celebrities aside, regular consumers who are tryingto or simply must stick to a gluten free diet say they dohave some concerns and frustrations. Product labels claimsconfuse consumers. Some tout gluten free, but with no othermentions of certifiers. Some labels are simply confusingand simply have consumers wondering about crosscontamination.Forty-nine percent of consumers surveyed byMintel say gluten-free claims clearly marked on the front ofpackage influences their purchaseWhen you are setting your Gluten Free sections, makesure you are taking a very close look at labeling, as manygluten free consumer decisions are influenced by such labelclaims as "dedicated gluten free facility" or other certifyingclaims. This will help avoid the confusion surrounding crosscontamination.We’ve found that some83% of gluten free shoppers go towww.celiaccentral.org to get informationand to verify items have been certifiedgluten free before they make purchases!According to the NFCA, some 80% of shoppers say theyprefer to have a separate gluten free section in the store.This further limits the possibility of cross-contamination.Gluten free products are becoming more mainstream in termsof quality and taste, so don’t be afraid to do some samplingof gluten free products in your stores. Ninety percent ofshoppers say they’d prefer to sample prior to purchasing.In addition to doing in-store demos, you can also getinvolved with your local celiac support groups. Somesuccessful retailers have involved these groups in theircategory reviews and even conducted store tours.The future is looking so bright for this categoryForty-six percent of consumers say they wished there weremore gluten free items to select from in their grocery stores.So don’t be afraid to increase your variety. However, if youhave the correct assortment, this will be perceived as havingmore items; because you will have ample representation ofsubcategories and brands that gluten free consumers arelooking for. This category has seen tremendous double-digitgrowth in the last couple of years – over 27% from 2009-2011.That equates to $4.8B in 2009 to $5.4B in $6.1B in 2011, salesare expected to continue at this pace with an estimated salesof over $9.9B in 2013.12,00010,0008,0006,0004,000These are valuable customers to your stores, the gluten freecustomer basket size is about $57 more than the averageshopping basket size in the food channel and $43 more thanthe average shopping basket size in the mass channel.Consumer typeregular consumerBasketbasket sizefoodchannelmasschannel$32.51 $35.70gluten freeconsumer basket $89.34 $79.18Source: Catalina Network (13 weeks ending Sept. 18, 2011Share and GrowthA review of the market still finds many leading chains givingshort shrift to gluten free food products. The selection isusually quite limited, and products are typically tucked in acorner. Staff members often aren’t sure where these productsare located and can’t readily assist consumers in finding them.If you decide to be a participant in this category, you maywant to consider devoting more shelf space to gluten freefood products, especially as the category is quickly growingand items usually sell for a premium.gluten free dollar sales & percentage growthtop 10 subcategoriesLatest 52weeks% Growthpasta $35,644,136 29.4%cereal $29,734,948 27.3%Cookies/ice creamcones$29,365,918 29.2%crackers $22,104,302 30.5%baking mixes $22,061,505 19.4%snacks $16,344,636 41.5%flour $15,465,527 49.8%bread and bakedgoods$13,544,232 36.6%breakfast foods $12,462,638 22.4%prepared foods -dry mixes$5,308,651 24.2%a/o subcategories $10,693,586 43.1%$212,730,079 30.7%2,00020092010201120122013Source: Mintel; ACNielsen L52WE July 7, 2012SPINS has recently stated that they believe by the end of 2013,gluten free food sales will reach the "best case scenario" onthe fan chart, rather than the original predicted forecast.May/August 2013 ONTREND 71