Creating

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22 DOING BUSINESS IN 2006<br />

<br />

<br />

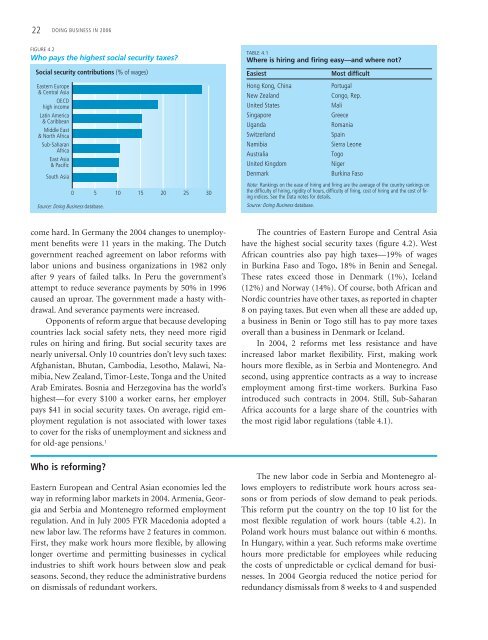

TABLE 4.1<br />

Where is hiring and firing easy—and where not?<br />

<br />

Easiest<br />

Most difficult<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Hong Kong, China<br />

New Zealand<br />

United States<br />

Singapore<br />

Uganda<br />

Switzerland<br />

Namibia<br />

Australia<br />

United Kingdom<br />

Denmark<br />

Portugal<br />

Congo, Rep.<br />

Mali<br />

Greece<br />

Romania<br />

Spain<br />

Sierra Leone<br />

Togo<br />

Niger<br />

Burkina Faso<br />

Note: Rankings on the ease of hiring and fi ring are the average of the country rankings on<br />

the diffi culty of hiring, rigidity of hours, diffi culty of fi ring, cost of hiring and the cost of fi r-<br />

ing indices. See the Data notes for details.<br />

Source: Doing Business database.<br />

come hard. In Germany the 2004 changes to unemployment<br />

benefits were 11 years in the making. The Dutch<br />

government reached agreement on labor reforms with<br />

labor unions and business organizations in 1982 only<br />

after 9 years of failed talks. In Peru the government’s<br />

attempt to reduce severance payments by 50% in 1996<br />

caused an uproar. The government made a hasty withdrawal.<br />

And severance payments were increased.<br />

Opponents of reform argue that because developing<br />

countries lack social safety nets, they need more rigid<br />

rules on hiring and firing. But social security taxes are<br />

nearly universal. Only 10 countries don’t levy such taxes:<br />

Afghanistan, Bhutan, Cambodia, Lesotho, Malawi, Namibia,<br />

New Zealand, Timor-Leste, Tonga and the United<br />

Arab Emirates. Bosnia and Herzegovina has the world’s<br />

highest—for every $100 a worker earns, her employer<br />

pays $41 in social security taxes. On average, rigid employment<br />

regulation is not associated with lower taxes<br />

to cover for the risks of unemployment and sickness and<br />

for old-age pensions. 1<br />

The countries of Eastern Europe and Central Asia<br />

have the highest social security taxes (figure 4.2). West<br />

African countries also pay high taxes—19% of wages<br />

in Burkina Faso and Togo, 18% in Benin and Senegal.<br />

These rates exceed those in Denmark (1%), Iceland<br />

(12%) and Norway (14%). Of course, both African and<br />

Nordic countries have other taxes, as reported in chapter<br />

8 on paying taxes. But even when all these are added up,<br />

a business in Benin or Togo still has to pay more taxes<br />

overall than a business in Denmark or Iceland.<br />

In 2004, 2 reforms met less resistance and have<br />

increased labor market flexibility. First, making work<br />

hours more flexible, as in Serbia and Montenegro. And<br />

second, using apprentice contracts as a way to increase<br />

employment among first-time workers. Burkina Faso<br />

introduced such contracts in 2004. Still, Sub-Saharan<br />

Africa accounts for a large share of the countries with<br />

the most rigid labor regulations (table 4.1).<br />

Who is reforming?<br />

Eastern European and Central Asian economies led the<br />

way in reforming labor markets in 2004. Armenia, Georgia<br />

and Serbia and Montenegro reformed employment<br />

regulation. And in July 2005 FYR Macedonia adopted a<br />

new labor law. The reforms have 2 features in common.<br />

First, they make work hours more flexible, by allowing<br />

longer overtime and permitting businesses in cyclical<br />

industries to shift work hours between slow and peak<br />

seasons. Second, they reduce the administrative burdens<br />

on dismissals of redundant workers.<br />

The new labor code in Serbia and Montenegro allows<br />

employers to redistribute work hours across seasons<br />

or from periods of slow demand to peak periods.<br />

This reform put the country on the top 10 list for the<br />

most flexible regulation of work hours (table 4.2). In<br />

Poland work hours must balance out within 6 months.<br />

In Hungary, within a year. Such reforms make overtime<br />

hours more predictable for employees while reducing<br />

the costs of unpredictable or cyclical demand for businesses.<br />

In 2004 Georgia reduced the notice period for<br />

redundancy dismissals from 8 weeks to 4 and suspended