Creating

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

34 DOING BUSINESS IN 2006<br />

Who is reforming?<br />

In 2004, 25 countries improved the way credit information<br />

is shared. Eight new private credit bureaus<br />

kicked off operations—in India, Indonesia, the Kyrgyz<br />

Republic, Lithuania, Nigeria, Romania, Saudi Arabia and<br />

Slovakia. New public registries started up in Armenia<br />

and Azerbaijan. Several of the new registries are still<br />

getting off the ground and have only sparse coverage of<br />

borrowers (table 6.2).<br />

Other reforms to sharing credit information took 5<br />

directions:<br />

• Passing new regulations. In 2004 the most popular<br />

reform was to eliminate obstacles to sharing credit<br />

information through a special law or regulation—as<br />

in India, Israel, Kazakhstan, Nicaragua and Russia—<br />

or through amendment of the banking act—as in<br />

Azerbaijan, Kenya, FYR Macedonia and Mauritius.<br />

The revised New Zealand code launched a consumer<br />

complaints procedure and strict controls on accuracy<br />

of data. The Italian code stressed reliability and timeliness<br />

of credit reports, but cut the time that historical<br />

data can be stored. Greece and Uruguay introduced<br />

new data protection laws designed to safeguard borrowers’<br />

privacy and the integrity of data.<br />

• Expanding the scope of information. In Bangladesh<br />

the public registry incorporated consumer credit card<br />

data into its database. The Egyptian registry set up a<br />

list of borrowers defaulting on small credit card and<br />

car loans. Honduras now requires all banks to report<br />

both positive and negative information. 2 In Lebanon,<br />

FYR Macedonia, Romania and Rwanda more comprehensive<br />

credit reports are now distributed.<br />

• Including more loans. Egypt’s public registry cut<br />

the minimum loan size above which it collects data<br />

from $6,900 to $5,200. Lebanon’s registry lowered its<br />

cutoff from $6,600 to $6,000, adding 10,000 more<br />

borrowers to the registry. And the public registries in<br />

Bulgaria, Iran, Romania and Vietnam scrapped their<br />

minimum loan cutoff altogether. In Vietnam coverage<br />

of borrowers increased by a third. In Bulgaria it<br />

expanded ninefold—although these developments<br />

stalled the initiative for a private bureau.<br />

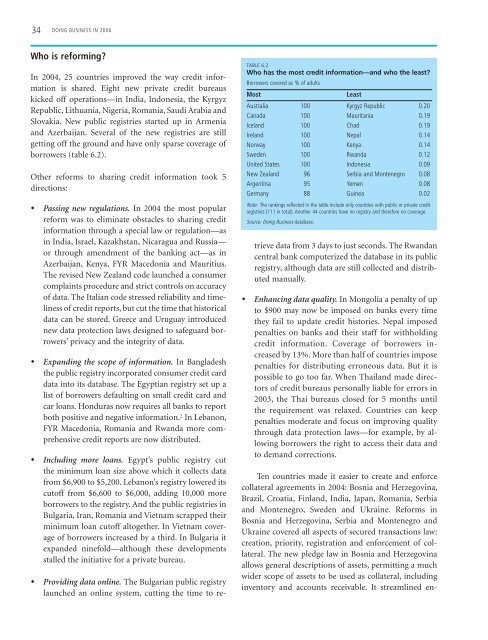

TABLE 6.2<br />

Who has the most credit information—and who the least?<br />

Borrowers covered as % of adults<br />

Most<br />

Least<br />

Australia 100 Kyrgyz Republic 0.20<br />

Canada 100 Mauritania 0.19<br />

Iceland 100 Chad 0.19<br />

Ireland 100 Nepal 0.14<br />

Norway 100 Kenya 0.14<br />

Sweden 100 Rwanda 0.12<br />

United States 100 Indonesia 0.09<br />

New Zealand 96 Serbia and Montenegro 0.08<br />

Argentina 95 Yemen 0.08<br />

Germany 88 Guinea 0.02<br />

Note: The rankings refl ected in the table include only countries with public or private credit<br />

registries (111 in total). Another 44 countries have no registry and therefore no coverage.<br />

Source: Doing Business database.<br />

• Providing data online. The Bulgarian public registry<br />

launched an online system, cutting the time to retrieve<br />

data from 3 days to just seconds. The Rwandan<br />

central bank computerized the database in its public<br />

registry, although data are still collected and distributed<br />

manually.<br />

• Enhancing data quality. In Mongolia a penalty of up<br />

to $900 may now be imposed on banks every time<br />

they fail to update credit histories. Nepal imposed<br />

penalties on banks and their staff for withholding<br />

credit information. Coverage of borrowers increased<br />

by 13%. More than half of countries impose<br />

penalties for distributing erroneous data. But it is<br />

possible to go too far. When Thailand made directors<br />

of credit bureaus personally liable for errors in<br />

2003, the Thai bureaus closed for 5 months until<br />

the requirement was relaxed. Countries can keep<br />

penalties moderate and focus on improving quality<br />

through data protection laws—for example, by allowing<br />

borrowers the right to access their data and<br />

to demand corrections.<br />

Ten countries made it easier to create and enforce<br />

collateral agreements in 2004: Bosnia and Herzegovina,<br />

Brazil, Croatia, Finland, India, Japan, Romania, Serbia<br />

and Montenegro, Sweden and Ukraine. Reforms in<br />

Bosnia and Herzegovina, Serbia and Montenegro and<br />

Ukraine covered all aspects of secured transactions law:<br />

creation, priority, registration and enforcement of collateral.<br />

The new pledge law in Bosnia and Herzegovina<br />

allows general descriptions of assets, permitting a much<br />

wider scope of assets to be used as collateral, including<br />

inventory and accounts receivable. It streamlined en-