Creating

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PAYING TAXES 47<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Second, the complexity of tax compliance matters<br />

too. Norway collects 60% of companies’ gross profit<br />

using 3 taxes filed electronically. In contrast, it takes 14<br />

taxes and 62 interactions with the tax authorities to collect<br />

46% of gross profit in the Philippines. Firms in 90%<br />

of surveyed countries rank tax administration among<br />

the top 5 obstacles to doing business. In several—<br />

including Bangladesh, Cambodia, the Kyrgyz Republic,<br />

Russia and Uzbekistan—working with the tax bureaucracy<br />

is considered a bigger problem than tax rates. 5<br />

Finally, businesses care about what they get for<br />

their taxes. Finland has higher business taxes, at 52% of<br />

gross profit, than Mexico, at 31%. But firms there have<br />

fewer complaints about the tax burden. That businesses<br />

rate Finland among the top 10 countries on quality of<br />

infrastructure and social services could have something<br />

to do with it.<br />

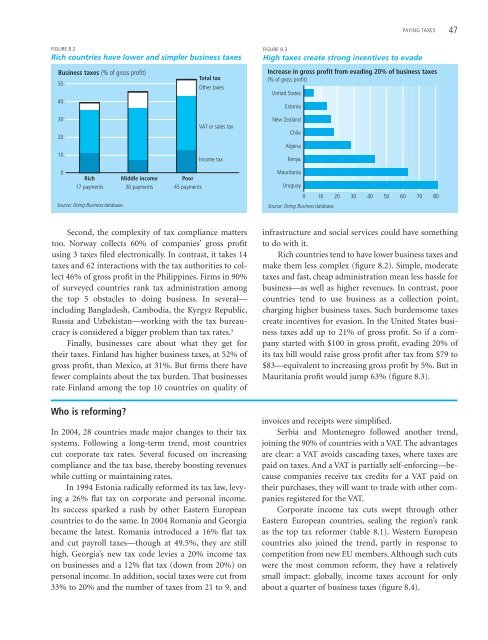

Rich countries tend to have lower business taxes and<br />

make them less complex (figure 8.2). Simple, moderate<br />

taxes and fast, cheap administration mean less hassle for<br />

business—as well as higher revenues. In contrast, poor<br />

countries tend to use business as a collection point,<br />

charging higher business taxes. Such burdensome taxes<br />

create incentives for evasion. In the United States business<br />

taxes add up to 21% of gross profit. So if a company<br />

started with $100 in gross profit, evading 20% of<br />

its tax bill would raise gross profit after tax from $79 to<br />

$83—equivalent to increasing gross profit by 5%. But in<br />

Mauritania profit would jump 63% (figure 8.3).<br />

Who is reforming?<br />

In 2004, 28 countries made major changes to their tax<br />

systems. Following a long-term trend, most countries<br />

cut corporate tax rates. Several focused on increasing<br />

compliance and the tax base, thereby boosting revenues<br />

while cutting or maintaining rates.<br />

In 1994 Estonia radically reformed its tax law, levying<br />

a 26% flat tax on corporate and personal income.<br />

Its success sparked a rush by other Eastern European<br />

countries to do the same. In 2004 Romania and Georgia<br />

became the latest. Romania introduced a 16% flat tax<br />

and cut payroll taxes—though at 49.5%, they are still<br />

high. Georgia’s new tax code levies a 20% income tax<br />

on businesses and a 12% flat tax (down from 20%) on<br />

personal income. In addition, social taxes were cut from<br />

33% to 20% and the number of taxes from 21 to 9, and<br />

invoices and receipts were simplified.<br />

Serbia and Montenegro followed another trend,<br />

joining the 90% of countries with a VAT. The advantages<br />

are clear: a VAT avoids cascading taxes, where taxes are<br />

paid on taxes. And a VAT is partially self-enforcing—because<br />

companies receive tax credits for a VAT paid on<br />

their purchases, they will want to trade with other companies<br />

registered for the VAT.<br />

Corporate income tax cuts swept through other<br />

Eastern European countries, sealing the region’s rank<br />

as the top tax reformer (table 8.1). Western European<br />

countries also joined the trend, partly in response to<br />

competition from new EU members. Although such cuts<br />

were the most common reform, they have a relatively<br />

small impact: globally, income taxes account for only<br />

about a quarter of business taxes (figure 8.4).