Creating

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

45<br />

Paying taxes<br />

Who is reforming?<br />

What to reform?<br />

Why reform?<br />

Tax collection has long been a despised activity. In biblical<br />

times the Pharisees scorned the disciples by asking,<br />

“Why does your teacher eat with tax collectors and sinners?”<br />

1 Things had not improved by the French Revolution—tax<br />

collectors were convicted of treason and sent<br />

to the guillotine.<br />

Yet taxes are essential. Without them there would<br />

be no money to build schools, hospitals, courts, roads,<br />

airports or other public infrastructure that helps businesses<br />

and society to be more productive and better off.<br />

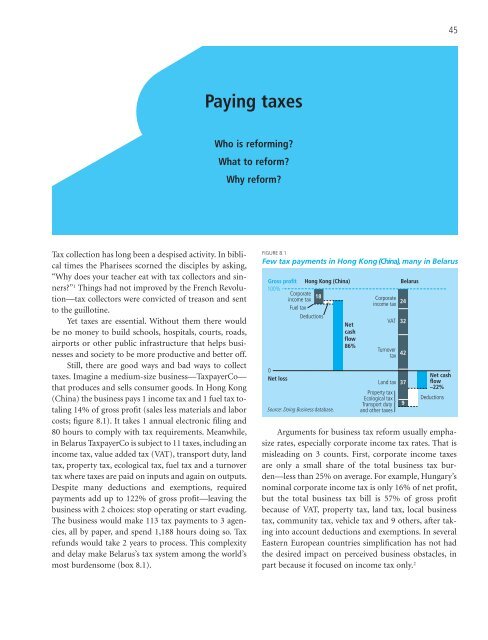

Still, there are good ways and bad ways to collect<br />

taxes. Imagine a medium-size business—TaxpayerCo—<br />

that produces and sells consumer goods. In Hong Kong<br />

(China) the business pays 1 income tax and 1 fuel tax totaling<br />

14% of gross profit (sales less materials and labor<br />

costs; figure 8.1). It takes 1 annual electronic filing and<br />

80 hours to comply with tax requirements. Meanwhile,<br />

in Belarus TaxpayerCo is subject to 11 taxes, including an<br />

income tax, value added tax (VAT), transport duty, land<br />

tax, property tax, ecological tax, fuel tax and a turnover<br />

tax where taxes are paid on inputs and again on outputs.<br />

Despite many deductions and exemptions, required<br />

payments add up to 122% of gross profit—leaving the<br />

business with 2 choices: stop operating or start evading.<br />

The business would make 113 tax payments to 3 agencies,<br />

all by paper, and spend 1,188 hours doing so. Tax<br />

refunds would take 2 years to process. This complexity<br />

and delay make Belarus’s tax system among the world’s<br />

most burdensome (box 8.1).<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Arguments for business tax reform usually emphasize<br />

rates, especially corporate income tax rates. That is<br />

misleading on 3 counts. First, corporate income taxes<br />

are only a small share of the total business tax burden—less<br />

than 25% on average. For example, Hungary’s<br />

nominal corporate income tax is only 16% of net profit,<br />

but the total business tax bill is 57% of gross profit<br />

because of VAT, property tax, land tax, local business<br />

tax, community tax, vehicle tax and 9 others, after taking<br />

into account deductions and exemptions. In several<br />

Eastern European countries simplification has not had<br />

the desired impact on perceived business obstacles, in<br />

part because it focused on income tax only. 2