Creating

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

48 DOING BUSINESS IN 2006<br />

TABLE 8.1<br />

Most 2004 tax reforms in Eastern Europe—<br />

and to corporate income tax rates<br />

All reforms Reforms including cuts in<br />

Region (number) corporate income tax rate (%)<br />

Eastern Europe 12 Albania 25 to 23<br />

& Central Asia Bulgaria 19.5 to 15<br />

Czech Republic 28 to 26<br />

Estonia 26 to 24<br />

Latvia 19 to 15<br />

Moldova 20 to 18<br />

Poland 27 to 19<br />

Uzbekistan 18 to 15<br />

OECD high income 6 Austria 34 to 25<br />

Denmark 30 to 28<br />

Finland 29 to 26<br />

Greece 35 to 32<br />

Netherlands 34.5 to 31.5<br />

Sub-Saharan Africa 3 Ghana 32.5 to 28<br />

Senegal 35 to 33<br />

Latin America & Caribbean 2 Mexico 33 to 30<br />

South Asia 1 Afghanistan 25 to 20<br />

East Asia & Pacifi c 0<br />

Middle East & North Africa 0<br />

Source: Doing Business database.<br />

Other countries focused on reforming tax administration.<br />

Spain introduced rules streamlining audits and<br />

appeals and increasing penalties. Lithuania did the same,<br />

and provided for electronic filing. Tax administrators<br />

there must now prove the basis for any tax recalculation.<br />

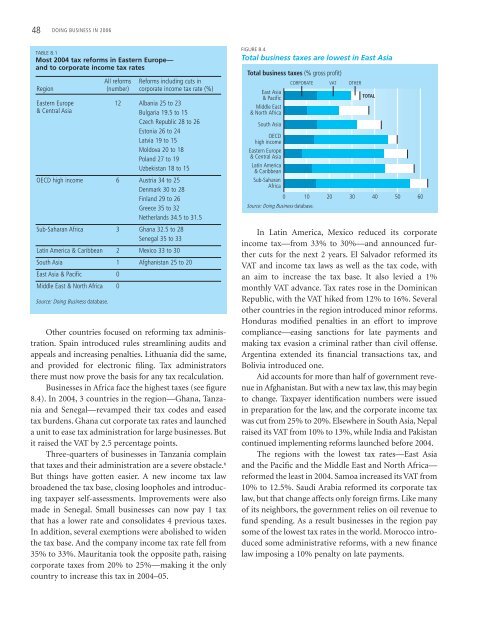

Businesses in Africa face the highest taxes (see figure<br />

8.4). In 2004, 3 countries in the region—Ghana, Tanzania<br />

and Senegal—revamped their tax codes and eased<br />

tax burdens. Ghana cut corporate tax rates and launched<br />

a unit to ease tax administration for large businesses. But<br />

it raised the VAT by 2.5 percentage points.<br />

Three-quarters of businesses in Tanzania complain<br />

that taxes and their administration are a severe obstacle. 6<br />

But things have gotten easier. A new income tax law<br />

broadened the tax base, closing loopholes and introducing<br />

taxpayer self-assessments. Improvements were also<br />

made in Senegal. Small businesses can now pay 1 tax<br />

that has a lower rate and consolidates 4 previous taxes.<br />

In addition, several exemptions were abolished to widen<br />

the tax base. And the company income tax rate fell from<br />

35% to 33%. Mauritania took the opposite path, raising<br />

corporate taxes from 20% to 25%—making it the only<br />

country to increase this tax in 2004–05.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

In Latin America, Mexico reduced its corporate<br />

income tax—from 33% to 30%—and announced further<br />

cuts for the next 2 years. El Salvador reformed its<br />

VAT and income tax laws as well as the tax code, with<br />

an aim to increase the tax base. It also levied a 1%<br />

monthly VAT advance. Tax rates rose in the Dominican<br />

Republic, with the VAT hiked from 12% to 16%. Several<br />

other countries in the region introduced minor reforms.<br />

Honduras modified penalties in an effort to improve<br />

compliance—easing sanctions for late payments and<br />

making tax evasion a criminal rather than civil offense.<br />

Argentina extended its financial transactions tax, and<br />

Bolivia introduced one.<br />

Aid accounts for more than half of government revenue<br />

in Afghanistan. But with a new tax law, this may begin<br />

to change. Taxpayer identification numbers were issued<br />

in preparation for the law, and the corporate income tax<br />

was cut from 25% to 20%. Elsewhere in South Asia, Nepal<br />

raised its VAT from 10% to 13%, while India and Pakistan<br />

continued implementing reforms launched before 2004.<br />

The regions with the lowest tax rates—East Asia<br />

and the Pacific and the Middle East and North Africa—<br />

reformed the least in 2004. Samoa increased its VAT from<br />

10% to 12.5%. Saudi Arabia reformed its corporate tax<br />

law, but that change affects only foreign firms. Like many<br />

of its neighbors, the government relies on oil revenue to<br />

fund spending. As a result businesses in the region pay<br />

some of the lowest tax rates in the world. Morocco introduced<br />

some administrative reforms, with a new finance<br />

law imposing a 10% penalty on late payments.