Creating

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

30 DOING BUSINESS IN 2006<br />

What to reform?<br />

To ease property registration, Doing Business in 2005<br />

recommended simplifying and combining procedures,<br />

linking and then unifying the agencies involved and providing<br />

easier access to the registries. It warned against<br />

viewing technology as a panacea, especially in poor<br />

countries. The analysis here shows that those reforms<br />

work. Here are 3 more ways to ease property registration:<br />

• Make registration an administrative process.<br />

• Simplify taxes and fees.<br />

• Make the involvement of notaries optional.<br />

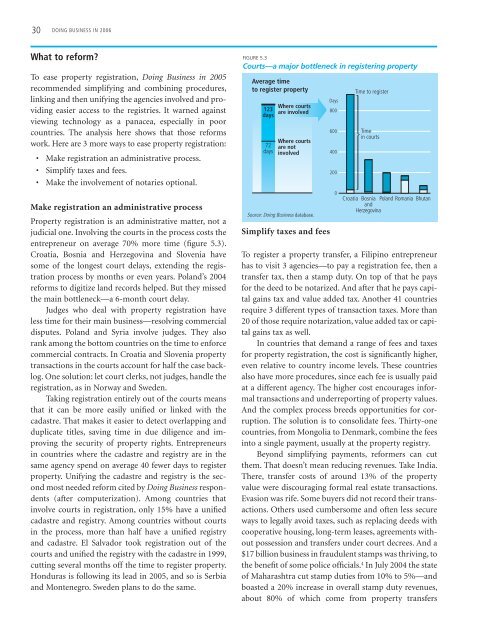

Make registration an administrative process<br />

Property registration is an administrative matter, not a<br />

judicial one. Involving the courts in the process costs the<br />

entrepreneur on average 70% more time (figure 5.3).<br />

Croatia, Bosnia and Herzegovina and Slovenia have<br />

some of the longest court delays, extending the registration<br />

process by months or even years. Poland’s 2004<br />

reforms to digitize land records helped. But they missed<br />

the main bottleneck—a 6-month court delay.<br />

Judges who deal with property registration have<br />

less time for their main business—resolving commercial<br />

disputes. Poland and Syria involve judges. They also<br />

rank among the bottom countries on the time to enforce<br />

commercial contracts. In Croatia and Slovenia property<br />

transactions in the courts account for half the case backlog.<br />

One solution: let court clerks, not judges, handle the<br />

registration, as in Norway and Sweden.<br />

Taking registration entirely out of the courts means<br />

that it can be more easily unified or linked with the<br />

cadastre. That makes it easier to detect overlapping and<br />

duplicate titles, saving time in due diligence and improving<br />

the security of property rights. Entrepreneurs<br />

in countries where the cadastre and registry are in the<br />

same agency spend on average 40 fewer days to register<br />

property. Unifying the cadastre and registry is the second<br />

most needed reform cited by Doing Business respondents<br />

(after computerization). Among countries that<br />

involve courts in registration, only 15% have a unified<br />

cadastre and registry. Among countries without courts<br />

in the process, more than half have a unified registry<br />

and cadastre. El Salvador took registration out of the<br />

courts and unified the registry with the cadastre in 1999,<br />

cutting several months off the time to register property.<br />

Honduras is following its lead in 2005, and so is Serbia<br />

and Montenegro. Sweden plans to do the same.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Simplify taxes and fees<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

To register a property transfer, a Filipino entrepreneur<br />

has to visit 3 agencies—to pay a registration fee, then a<br />

transfer tax, then a stamp duty. On top of that he pays<br />

for the deed to be notarized. And after that he pays capital<br />

gains tax and value added tax. Another 41 countries<br />

require 3 different types of transaction taxes. More than<br />

20 of those require notarization, value added tax or capital<br />

gains tax as well.<br />

In countries that demand a range of fees and taxes<br />

for property registration, the cost is significantly higher,<br />

even relative to country income levels. These countries<br />

also have more procedures, since each fee is usually paid<br />

at a different agency. The higher cost encourages informal<br />

transactions and underreporting of property values.<br />

And the complex process breeds opportunities for corruption.<br />

The solution is to consolidate fees. Thirty-one<br />

countries, from Mongolia to Denmark, combine the fees<br />

into a single payment, usually at the property registry.<br />

Beyond simplifying payments, reformers can cut<br />

them. That doesn’t mean reducing revenues. Take India.<br />

There, transfer costs of around 13% of the property<br />

value were discouraging formal real estate transactions.<br />

Evasion was rife. Some buyers did not record their transactions.<br />

Others used cumbersome and often less secure<br />

ways to legally avoid taxes, such as replacing deeds with<br />

cooperative housing, long-term leases, agreements without<br />

possession and transfers under court decrees. And a<br />

$17 billion business in fraudulent stamps was thriving, to<br />

the benefit of some police officials. 4 In July 2004 the state<br />

of Maharashtra cut stamp duties from 10% to 5%—and<br />

boasted a 20% increase in overall stamp duty revenues,<br />

about 80% of which come from property transfers