Creating

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

40 DOING BUSINESS IN 2006<br />

action voided if its terms are unfair. And they permit<br />

shareholders who take the company directors to court to<br />

access all relevant documents.<br />

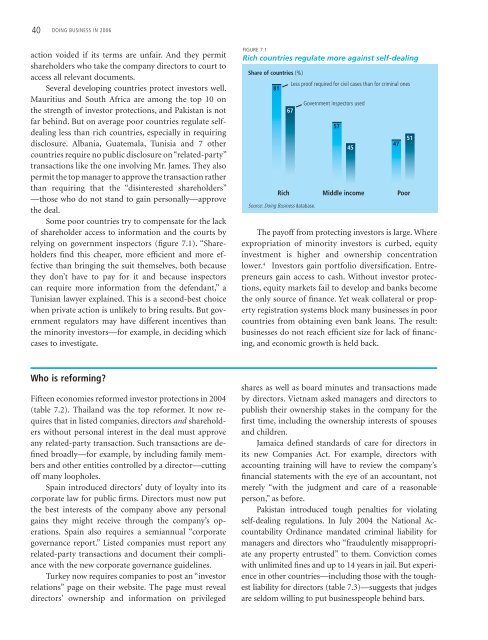

Several developing countries protect investors well.<br />

Mauritius and South Africa are among the top 10 on<br />

the strength of investor protections, and Pakistan is not<br />

far behind. But on average poor countries regulate selfdealing<br />

less than rich countries, especially in requiring<br />

disclosure. Albania, Guatemala, Tunisia and 7 other<br />

countries require no public disclosure on “related-party”<br />

transactions like the one involving Mr. James. They also<br />

permit the top manager to approve the transaction rather<br />

than requiring that the “disinterested shareholders”<br />

—those who do not stand to gain personally—approve<br />

the deal.<br />

Some poor countries try to compensate for the lack<br />

of shareholder access to information and the courts by<br />

relying on government inspectors (figure 7.1). “Shareholders<br />

find this cheaper, more efficient and more effective<br />

than bringing the suit themselves, both because<br />

they don’t have to pay for it and because inspectors<br />

can require more information from the defendant,” a<br />

Tunisian lawyer explained. This is a second-best choice<br />

when private action is unlikely to bring results. But government<br />

regulators may have different incentives than<br />

the minority investors—for example, in deciding which<br />

cases to investigate.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

The payoff from protecting investors is large. Where<br />

expropriation of minority investors is curbed, equity<br />

investment is higher and ownership concentration<br />

lower. 4 Investors gain portfolio diversification. Entrepreneurs<br />

gain access to cash. Without investor protections,<br />

equity markets fail to develop and banks become<br />

the only source of finance. Yet weak collateral or property<br />

registration systems block many businesses in poor<br />

countries from obtaining even bank loans. The result:<br />

businesses do not reach efficient size for lack of financing,<br />

and economic growth is held back.<br />

<br />

<br />

<br />

<br />

<br />

Who is reforming?<br />

Fifteen economies reformed investor protections in 2004<br />

(table 7.2). Thailand was the top reformer. It now requires<br />

that in listed companies, directors and shareholders<br />

without personal interest in the deal must approve<br />

any related-party transaction. Such transactions are defined<br />

broadly—for example, by including family members<br />

and other entities controlled by a director—cutting<br />

off many loopholes.<br />

Spain introduced directors’ duty of loyalty into its<br />

corporate law for public firms. Directors must now put<br />

the best interests of the company above any personal<br />

gains they might receive through the company’s operations.<br />

Spain also requires a semiannual “corporate<br />

governance report.” Listed companies must report any<br />

related-party transactions and document their compliance<br />

with the new corporate governance guidelines.<br />

Turkey now requires companies to post an “investor<br />

relations” page on their website. The page must reveal<br />

directors’ ownership and information on privileged<br />

shares as well as board minutes and transactions made<br />

by directors. Vietnam asked managers and directors to<br />

publish their ownership stakes in the company for the<br />

first time, including the ownership interests of spouses<br />

and children.<br />

Jamaica defined standards of care for directors in<br />

its new Companies Act. For example, directors with<br />

accounting training will have to review the company’s<br />

financial statements with the eye of an accountant, not<br />

merely “with the judgment and care of a reasonable<br />

person,” as before.<br />

Pakistan introduced tough penalties for violating<br />

self-dealing regulations. In July 2004 the National Accountability<br />

Ordinance mandated criminal liability for<br />

managers and directors who “fraudulently misappropriate<br />

any property entrusted” to them. Conviction comes<br />

with unlimited fines and up to 14 years in jail. But experience<br />

in other countries—including those with the toughest<br />

liability for directors (table 7.3)—suggests that judges<br />

are seldom willing to put businesspeople behind bars.