Creating

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PROTECTING INVESTORS 43<br />

TABLE 7.6<br />

Who makes it easiest to bring shareholder suits—and<br />

who most difficult?<br />

<br />

<br />

Easiest<br />

New Zealand<br />

Kenya<br />

Singapore<br />

Canada<br />

Israel<br />

United States<br />

Ireland<br />

Mauritius<br />

Colombia<br />

Nepal<br />

Most difficult<br />

United Arab Emirates<br />

Albania<br />

Venezuela<br />

Vietnam<br />

Afghanistan<br />

Syria<br />

Morocco<br />

Algeria<br />

Iran<br />

Tanzania<br />

<br />

<br />

<br />

<br />

<br />

<br />

Note: Rankings are on the ease of shareholder suits index. See the Data notes for details.<br />

Source: Doing Business database.<br />

<br />

<br />

can enforce. Even the best rules are useless if enforcement<br />

is weak. 6 Some transition economies have adopted<br />

strong company or securities laws. But in the Kyrgyz Republic<br />

and Moldova, for example, no cases of minority<br />

investor abuse have ever been resolved in the courts. And<br />

neither country has managed to maintain an active stock<br />

market. Nepal also has strong protections on the books<br />

(see table 7.6), but these are rarely invoked and equity<br />

markets are nascent.<br />

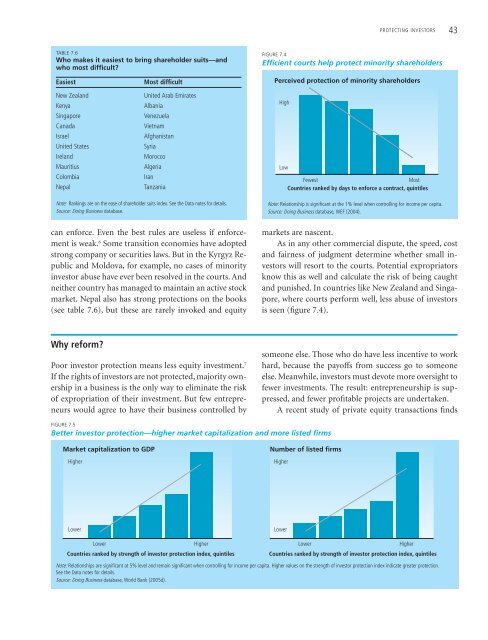

As in any other commercial dispute, the speed, cost<br />

and fairness of judgment determine whether small investors<br />

will resort to the courts. Potential expropriators<br />

know this as well and calculate the risk of being caught<br />

and punished. In countries like New Zealand and Singapore,<br />

where courts perform well, less abuse of investors<br />

is seen (figure 7.4).<br />

Why reform?<br />

Poor investor protection means less equity investment. 7<br />

If the rights of investors are not protected, majority ownership<br />

in a business is the only way to eliminate the risk<br />

of expropriation of their investment. But few entrepreneurs<br />

would agree to have their business controlled by<br />

someone else. Those who do have less incentive to work<br />

hard, because the payoffs from success go to someone<br />

else. Meanwhile, investors must devote more oversight to<br />

fewer investments. The result: entrepreneurship is suppressed,<br />

and fewer profitable projects are undertaken.<br />

A recent study of private equity transactions finds