Creating

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

39<br />

Protecting<br />

investors<br />

Who is reforming?<br />

What to reform?<br />

Why reform?<br />

Executives at Elf Aquitaine, France’s largest oil company,<br />

took bribes in exchange for awarding business deals.<br />

Along with the extra cash, they got 7 years in jail and<br />

a 2 million euro fine for abuse of power. 1 Russian oil<br />

firm Gazprom purchased materials for new pipelines<br />

through intermediaries owned by company officers. The<br />

high prices charged for the materials raised eyebrows,<br />

but not court battles. 2<br />

Big cases like these make headlines, but looting<br />

by corporate insiders occurs every day on a smaller<br />

scale. And it often goes undetected. Protecting investors<br />

against self-dealing—the use of corporate assets for personal<br />

gain—is necessary for equity markets to develop. It<br />

is just one corporate governance issue, but it is the most<br />

important one. Other issues in investor protection—for<br />

example, writing management contracts that provide<br />

incentives for optimal investment decisions—are not<br />

discussed in the chapter.<br />

To document investor protections against selfdealing,<br />

Doing Business measures how countries would<br />

regulate a standardized case. 3 The case facts are simple.<br />

Mr. James, who owns 60% of the stock in a public company<br />

and sits on its board, proposes that the company<br />

purchase 50 used trucks from a private company of<br />

which he owns 90%. The price is higher than the going<br />

price. Mr. James benefits from the transaction, since for<br />

each dollar that his private company receives, 40 cents<br />

come from income belonging to the minority investors<br />

in the public company. This is not fraud—such transactions<br />

are perfectly legal if proper disclosures are made<br />

and approvals obtained. Several questions arise. Who<br />

approves the transaction? What information must be<br />

disclosed? What company documents can investors access?<br />

What do minority shareholders have to prove to<br />

stop the transaction or to receive compensation from<br />

Mr. James? An index of investor protection is constructed<br />

based on these and other answers.<br />

New Zealand protects investors against self-dealing<br />

the most (table 7.1). Singapore is next. Regulation is<br />

so extensive in Singapore that one lawyer describes<br />

practicing law there as “tip toeing through the tulips.”<br />

The countries that best protect against self-dealing have<br />

several things in common. They require immediate<br />

disclosure of the transaction and Mr. James’s conflict of<br />

interest. They require prior approval of the transaction<br />

by other shareholders. They enable shareholders to hold<br />

the company’s directors liable and to have the trans-<br />

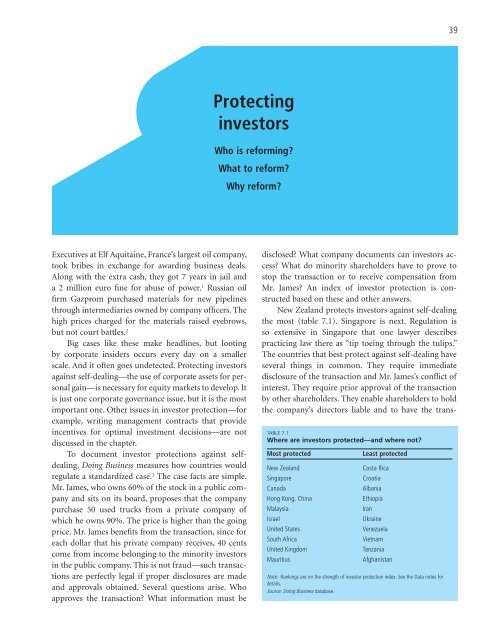

TABLE 7.1<br />

Where are investors protected—and where not?<br />

Most protected<br />

New Zealand<br />

Singapore<br />

Canada<br />

Hong Kong, China<br />

Malaysia<br />

Israel<br />

United States<br />

South Africa<br />

United Kingdom<br />

Mauritius<br />

Least protected<br />

Costa Rica<br />

Croatia<br />

Albania<br />

Ethiopia<br />

Iran<br />

Ukraine<br />

Venezuela<br />

Vietnam<br />

Tanzania<br />

Afghanistan<br />

Note: Rankings are on the strength of investor protection index. See the Data notes for<br />

details.<br />

Source: Doing Business database.