Creating

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

Doing Business in 2006 -- Creating Jobs - Caribbean Elections

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

70 DOING BUSINESS IN 2006<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Foreclosures and liquidations, by contrast, can keep<br />

businesses in operation. Foreclosure often leads to the<br />

sale of the entire firm to new owners, who keep it running<br />

as a going concern. And even in liquidation the<br />

firm can keep operating, as in Botswana, Denmark, Poland<br />

and Sweden. Creditors win, because saving viable<br />

firms yields higher recovery. Workers win too, because<br />

they keep their jobs.<br />

There are better ways than reorganization to save<br />

viable firms. First, don’t require interruption of business<br />

operations. Twenty-five countries require firms to<br />

discontinue operations once the bankruptcy petition is<br />

approved. Second, keep the bankruptcy process moving.<br />

By the time companies are in their third year of bankruptcy,<br />

the chance of surviving is slim. Short processes<br />

help maximize the value of the estate. Long ones often<br />

lead to the stripping of enterprise assets.<br />

Brazil’s new law encourages going-concern sales<br />

at the beginning of liquidation and allows buyers to<br />

take assets free of tax and labor liabilities. Previously<br />

asset sales could start only after liquidation proceedings<br />

ended, and they were subject to existing claims. Other<br />

reforms also help. One is allowing the administrator to<br />

rescind or compel performance on contracts. Another:<br />

letting the business obtain fresh loans that have priority<br />

for the lender—which could increase the chance of survival<br />

from 22% to 38%. And yet another: allowing management<br />

to dismiss employees during the bankruptcy<br />

process to help keep the company going. Many jobs will<br />

be saved if a viable business can continue operating. The<br />

benefits are large. Countries that keep viable firms alive<br />

have recovery averaging 59 cents on the dollar. Those<br />

that don’t, 21 cents.<br />

Set up creditors’ committees<br />

Finland’s reforms gave creditors the right to set up a<br />

creditors’ committee that advises the administrator. This<br />

is obligatory for large estates. Six of the other 8 reformers<br />

expanded the powers of creditors. Doing so is associated<br />

with higher recovery rates (figure 11.4). The reason<br />

is that such reforms align the incentives of creditors with<br />

reorganizing viable firms and closing down unviable<br />

ones. When creditors participate in decisions, proceedings<br />

tend to maximize recovery. And when creditors<br />

have the right to choose which bankruptcy procedure<br />

to follow—reorganization or liquidation—they opt for<br />

reorganization only when the chances of successful recovery<br />

are high.<br />

Other countries are recognizing the benefits<br />

of involving creditors. Chile’s reforms in May 2005<br />

authorized creditors—rather than the courts—to appoint<br />

the trustee. Slovakia’s upcoming bankruptcy law<br />

does the same. Indonesia’s reform gives secured creditors<br />

the right to vote in reorganization. And Brazil’s also<br />

brings secured creditors into the voting on reorganization<br />

proceedings.<br />

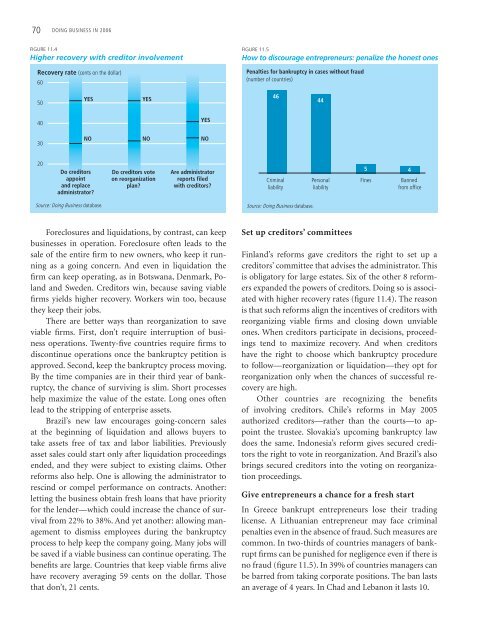

Give entrepreneurs a chance for a fresh start<br />

In Greece bankrupt entrepreneurs lose their trading<br />

license. A Lithuanian entrepreneur may face criminal<br />

penalties even in the absence of fraud. Such measures are<br />

common. In two-thirds of countries managers of bankrupt<br />

firms can be punished for negligence even if there is<br />

no fraud (figure 11.5). In 39% of countries managers can<br />

be barred from taking corporate positions. The ban lasts<br />

an average of 4 years. In Chad and Lebanon it lasts 10.